Loan Refinancing Commercial Mortgage, No Income Cash Out Miami, Florida

Gelt offers to finance to real estate investors and commercial property owners with programs that include no income verification mortgages, Bank turn downs, and credit problems welcomed, bridge mortgages, foreclosure buy out mortgages, foreign national programs.

Purchase, Refinance, Storied Loans Bridge Financing, Debtor in possession, Joint Ventures, Equity / Mezzanine, Foreclosure/DPO, Partnership Buyouts, Subordinated Debt, Acquisition, Judgement Payoffs, Note Financing, Recapitalization, Rehab, and Value Added deals.

No Income verification and Light documentation, Blanket Loans, Foreign nationals, Non-Recourse programs, commercial Second mortgages, No seasoning programs, discount note purchasing financing, joint ventures, mezzanine, preferred equity and partnership programs, No minimum credit scores, 100% Gift funds, no look back on previous bankruptcies and foreclosures.

Miami, Florida, closing on free-standing school building used as a College, No income verification, Self-employed, $1,225,00.00 Cash out First mortgage is fast and flexible, deal directly with the decision-makers.

Miami, Florida, closing on free-standing school building used as a College, No income verification, Self-employed, $1,225,00.00 Cash out First mortgage is fast and flexible, deal directly with the decision-makers.

Contact us online at www.Geltfinancial.com or 561-221-0900

When your bank says No, We say Yes.

Private Money Lender – Related posts

NO Credit Checks For Residential-Investment Properties & Small-Balance Commercial Bridge Loans At Gelt Financial, we understand that traditional credit checks can sometimes limit your real estate investment opportunities. [...]

Gelt Financial, LLC just closed a no income verification commercial cash-out mortgage refinance with a 30-year amortization on this retail motorcycle dealership. This allowed the borrower to pay off their [...]

Gelt Financial, was pleased to provide 100% of the financing to a new investor who found a great deal on a single-family property in Coral Gables, Florida, in need of [...]

Closed $3,050,000.00 Bridge financing for a 28 unit apartment in Detroit. The sponsor will use the funds for additional investments as he continues to improve operations. The apartment building represents [...]

Gelt Financial, LLC just closed a commercial mortgage with a 30-year amortization. This borrower was unable to obtain traditional bank financing because of a personal IRS tax lien, With the [...]

Dip Lending, LLC is pleased to announce that it has just closed a commercial real estate loan first mortgage in New Jersey for a real estate investor in Chapter 11 [...]

Auto Body Shop in St Louis, Missouri, No income qualification with credit challenges for a 3-year term. Our No Income Qualification Refinance Options We are fast and flexible, deal directly [...]

Gelt Financial, LLC is pleased to sponsor and support SafeTALK a three-hour suicide alertness and prevention training, developed by Livingworks, which is an innovative workshop that provides participants with tools, [...]

Gelt Financial, LLC is pleased to announce and is now offering a second commercial mortgage program on some income producing properties where we are offering a first mortgage of [...]

Gelt Financial, LLC recently closed a blanket mortgage on three retail properties in foreclosure, though a series of bank mergers the latest bank put this paying loan in default [...]

The Definition of Bridge Loans If you’ve dabbled in real estate, have dipped your toes in homeownership for some time, or are just beginning your journey into the vast [...]

We just provided an experienced investor a cash-out refinance on Free standing Restaurant suburbs of Pittsburgh, established tenant, but the owner had a lot of credit challenges due to other [...]

Great news for our clients! We are excited to announce the successful closing of a $385K mortgage on an investment condo in West New York, New Jersey. This deal was [...]

About 18 months ago we received a referral from a workout attorney, he had a client who owned a multi-location small business. Their current lender a local bank had [...]

Just closed commercial mortgage, Purchase of a owners occupied day care in Florida, credit below 630, 25 year term, no balloon……….. We are always here to help our clients.

Rehab Refinance investment property in Baltimore, Maryland. Several investors owned the property and ran short of capital to fix up the property and complete the job. Gelt Financial, provided them [...]

First mortgage closed in Philadelphia on a mixed us property that the owner had purchased and needed to be fixed up. The Investor saw potential value, came to us and [...]

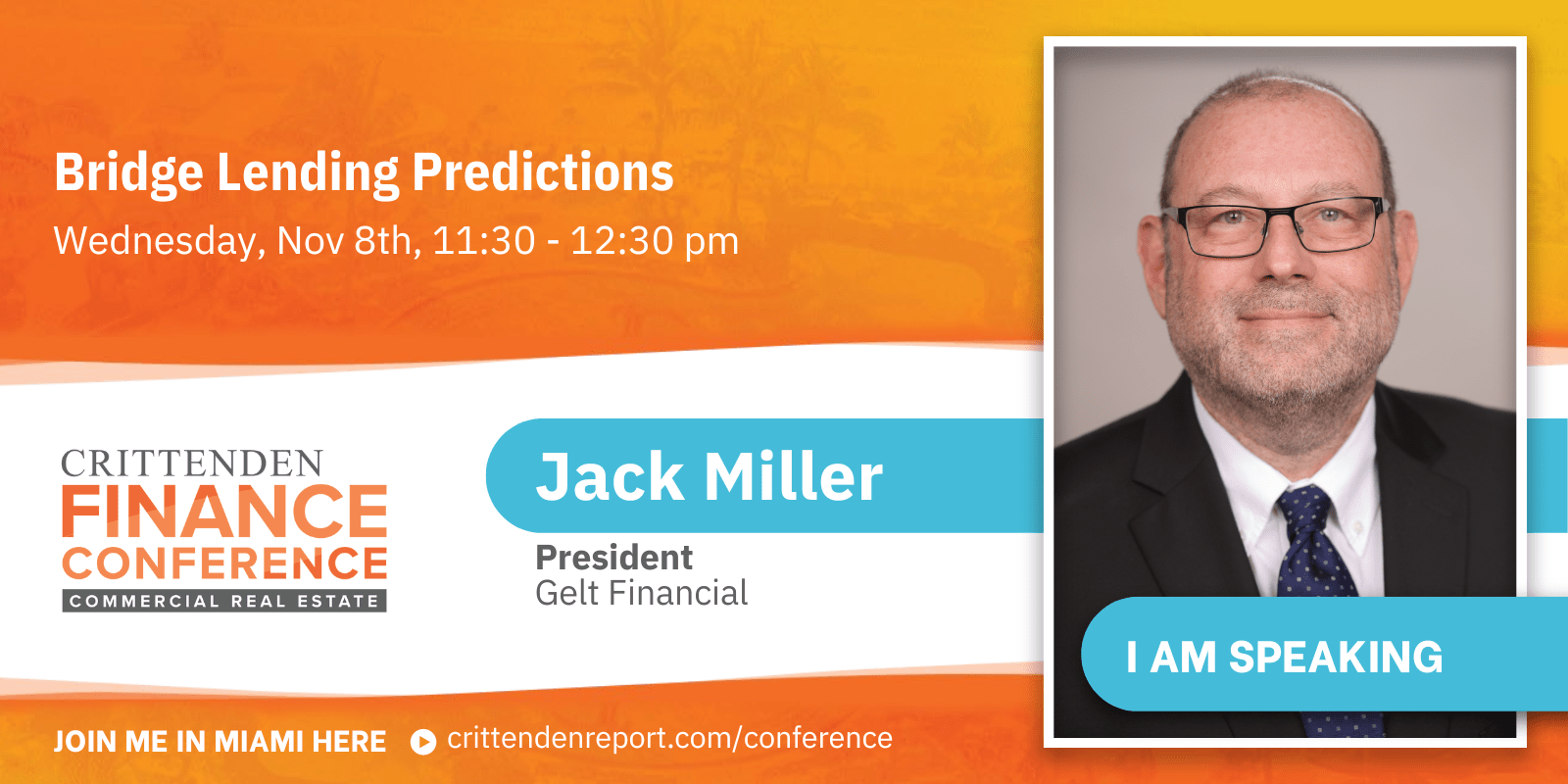

For 43 years, The Crittenden Real Estate Finance Conference has been the industry’s leading educational and networking event. This two-and-a-half-day conference caters to CRE professionals and featured nine hours of [...]

You are debating receiving your real estate loans from either a bank or a private lender. There’s been a lot of talks lately about private lenders like us here [...]

For 50 years, The Crittenden Real Estate Finance Conference has been the industry’s leading educational and networking event. This two-day conference caters to CRE professionals and features educational sessions and networking [...]

Gelt Financial recently arranged $9.8 million in commercial first mortgage financing for the real estate holding company of a large substance abuse recovery center. The company acquired three properties in [...]

Closed Loan: After being frustrated by other lenders we were pleased to help another real estate investor in Washington DC on the refinancing of his 4-unit multifamily property. We [...]

We have just closed another successful bridge loan for another happy client! We just closed a bridge loan on an office building in the Suburbs of Cleveland, Ohio. The property [...]

Here Are A Few Likes and Dislikes For Mortgage Brokers Dislikes Sorry we do not lend on land or development deals (it's not that we dislike these it's we don’t [...]

What is a LTV Loan to Value and how do we calculate it? This is not a cut and dry question. "Marcy: Hey Jack Jack: Hey Marcy, let's talk today about [...]

Jack Miller goes over the Mortgage Brokers' Commissions, Mortgage Broker Fee Income, and more

We made this for our borrowers and mortgage brokers, we all know in life things do not always go as planned or smoothly. We are here to help and work with [...]

Understand your deal and what types of deals your lenders do is important to being a successful mortgage broker.

In the video, Jack shares negotiation tips for property deals. He emphasizes the "Art of Negotiation is to Analyze" -- the importance of analyzing the situation, listening actively, and keeping one's [...]

Jack and Marcy talk about a 50k first mortgage Gelt Financial just closed on a Multi family property, There is almost no where for borrowers who want to borrower small amount [...]

We just provided an experienced real estate investor 100% financing on a new purchase by talking an additional property as collateral, our mortgages were on two single-family properties in two cities, Orlando [...]

Everyone has challenges at some point or another in their life; each of our challenges is different, but in today's times, a lot of people are falling behind on their mortgages [...]

Gelt is excited to partner with a local real estate investor. We provided 100% debt and equity in a deal where we purchased an office building and leased it out to [...]

Gelt closes collateral based first mortgage in San Antonio, Texas. Brought to us by a mortgage broker, closed very fast. "Jack: Okay, Marcy Berger, the angle is perfect. We're making this [...]

Gelt Financial provides mortgage debt on owner occupied business properties: "Jack: Okay, Marcy. Marcy: Hi! Jack: Yeah, we're here. Oh, remember, I always forget, like this, wherever you're seeing YouTube or [...]

Jack and Marcy talk about some of the differences between being a residential and commercial mortgage brokers. "Marcy: Hi, it's Jack and Marcy. What are we going to talk about today? [...]

Some tips for Mortgage Brokers from Jack Miller at Gelt Financial, LLC on how to be a more successful mortgage broker. Gelt has worked with brokers for over 30 years and is [...]

Gelt Financial helped an Auto Body Shop in St Louis, Missouri with credit challenges with a no-income qualification mortgage with a 3-year term. "Hello, this is Jack Miller of Gelt Financial. I [...]

In the video, Jack shares a valuable tip for investors: many people and businesses fail because they take on too much and lose focus. He advises caution, emphasizing the importance of [...]

Jack Miller and Marcy talk about a Mezzanine loan that just closed on a new state home in the North Shore of Long Island for a real estate investor. Mortgage broker [...]

Chicago Office Condo Mortgage Closed, No income Verification for owners of Business. "Chicago, Chicago, that title in town, that title in town. I love it. Bet your bottom dollar that you'll [...]

Gelt Financial provided a new first mortgage foreclosure bailout loan on a mixed use property ion Brooklyn, NY. The mortgage broker called us and we approved and close the loan without [...]

Jack Miller goes into detail on why real estate investing is the best inflation hedge and investment. He goes over it step by step. "Hello, this is Jack Miller. I hope [...]

Jack Miller gives an example of an interesting and creative deal. It was a TIC roll up where our borrower/partner made a lot of money using our money. "Hey Larry, this is [...]

Gelt financial closes a commercial office building in Atlanta Georgia for the owner of a new business in 4 working days after the bank said no at the 23rd hour. "Jack: [...]

This video presents a real estate investor who purchased an office building using tax liens. Gelt Financial provided collateral-based financing without personal income verification or appraisal. The deal was closed quickly, [...]

Gelt closed another Mobile Home Park Mortgage Closed in Indiana. Remember, when your bank says NO, we say YES! "Jack: Okay, Marcy Berger, we're here. Marcy: We're here. Hi, guess what? [...]

In Bridge Mortgage Loan Paid Us Off | Bridge Loans the video discusses a successful payoff of a bridge mortgage loan from Gelt Financial. The borrower owned three properties but had [...]