Commercial Mortgage Owner Occupied Business, Bank Turndown

If you need our help and want to talk to people who care about you call us at 561-221-0900 or visit us online at www.Geltfinancial.com.

Private Money Lender – Related posts

This month, Gelt Financial was featured in Scotsman Guide, the leading commercial real estate lending publication. See the featured article below: Let’s face it: The days of historically low interest rates, [...]

JUST CLOSED! Gelt Financial just funded a $750K purchase loan for a cannabis dispensary conversion in Marlton, NJ. With 34% LTV, the borrower, who holds a cannabis license, is [...]

The benefits of using a hard money lender versus a bank: There are several benefits to using a hard money lender, also known as [...]

Closed $3,050,000.00 Bridge financing for a 28 unit apartment in Detroit. The sponsor will use the funds for additional investments as he continues to improve operations. The apartment building represents [...]

Who is your lender, is as important as what deal you get... Since 1989. In the past week some examples of how we work with our borrowers. 1. One of [...]

We are happy to close a commercial mortgage loan for an experienced real estate investor in Pittsburgh, Pa on a blanket mortgage of 3 properties, 2 retail centers and 1 [...]

We were able to assist a borrower with cash-out refinance out on his 3 unit medical office building in Green Bay, WI with limited documentation. The building has 3 units [...]

Even though mortgage rates are reaching record lows, business owners and self-employed professionals are having difficulties participating in the financial opportunity. Leading news outlets are reporting that it is continuously [...]

CLOSED! 👊 Gelt Financial just closed on a $100k first mortgage on an office building in Greensboro, NC. To learn more about Gelt Financial’s lending capabilities and its advantages to [...]

DEAL CLOSED IN CHICAGO, ILLINOIS! Gelt Financial just closed on a $900k Bridge-to-Agency Loan in Chicago, IL. This professional investor could not close with traditional financing from Fannie/Freddie due [...]

Gelt Financial arranged to finance for clients that own a 34-unit multi-family apartment near Pittsburgh, PA. The loan enabled the client to pay off a higher-interest loan and receive [...]

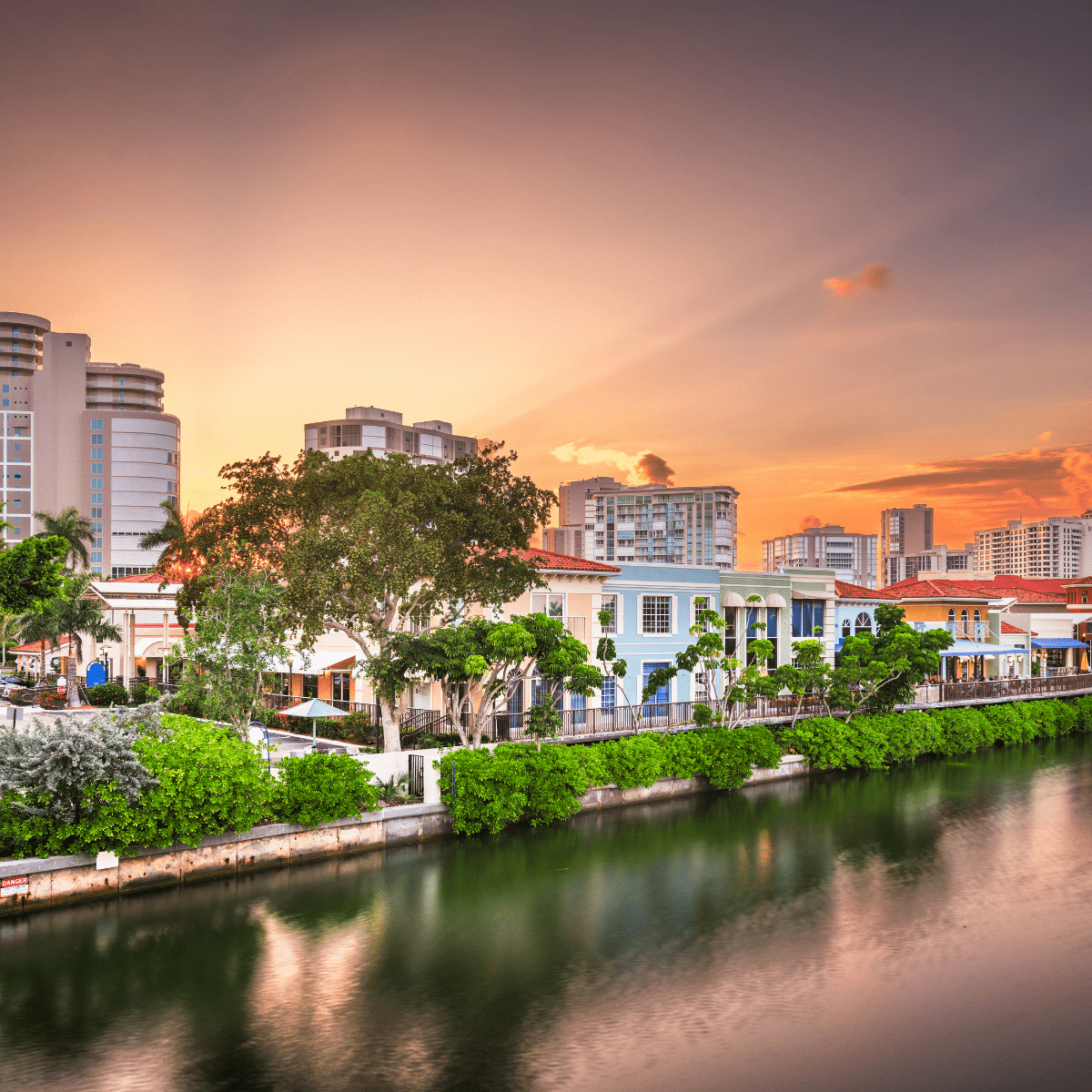

JUST CLOSED IN BOCA RATON, FLORIDA! Gelt Financial just closed on a $250K Second Mortgage in Boca Raton, FL. Using DIP financing, also known as Debtor In Possession Financing, [...]

Gelt Financial just closed a $125K refinance on a single-family home in Richmond, Virginia. The borrower wanted to do some light rehab before putting the property back on the [...]

JUST CLOSED IN METUCHEN, NEW JERSEY! Gelt Financial is excited to announce the closing of a $600k First Mortgage in Metuchen, NJ. This private mortgage was a refinance for [...]

DEAL CLOSED IN PHILADELPHIA, PENNSYLVANIA! Gelt Financial just closed on a $250K First Mortgage on a retail property in Philadelphia, PA. A borrower called up Gelt and needed a [...]

JUST CLOSED IN NEW YORK CITY, NEW YORK! Gelt Financial is proud to announce we just closed a $500K second mortgage on a 40+ unit apartment building in New [...]

Gelt Financial has provided a First Mortgage on a multifamily investment property in Brooklyn, NY. "Gelt is flexible with how we structure deals, giving us a real edge in providing [...]

ROOM FOR IMPROVEMENT Your hotel is financially distressed and the bank can come to collect. Fortunately, all is not lost. Getting the distressed property off your hands might make sense [...]

Gelt Financial just closed a $150K low-leverage cash out refinance on a renovated condo unit in Naples, Florida. The borrower inherited the unit, completed improvements, and is preparing to [...]

JUST CLOSED IN QUEENS, NEW YORK! Gelt Financial is excited to announce we closed a $300k First Mortgage on a Single Family Investment Property in Queens, NY. The borrower [...]

Gelt Financial, LLC a non-bank commercial portfolio mortgage lender who caters to commercial real estate owners and investor financing needs is pleased to launch its “Se Habla Español” campaign. According [...]

Here is what you can do DOWN BUT NOT OUT A distressed property is one that is one that is under foreclosure. Commercial properties such as self-storage centers stand [...]

Gelt Financial has provided a First Mortgage on a residential investment property in Wildwood, NJ. The property was a townhome, one block from the beach and Gelt was able to [...]

JUST CLOSED IN WARREN, OHIO! Gelt Financial is excited to announce we just closed a Dollar General in Warren, OH. This First Mortgage was for a repeat borrower and [...]

Jack Miller talks about what a Break up fee is and why and how it comes into play. "Hi, this is Jack Miller from Gelt Financial. I hope you're having a [...]

Jack Miller and Marcy talk about a Mezzanine loan that just closed on a new state home in the North Shore of Long Island for a real estate investor. Mortgage broker [...]

Just closed! Gelt Financial successfully secured a private loan for an auto body shop, a new commercial mortgage deal. No appraisal or income verification required. Watch the video to hear how [...]

In the video, Jack explains the concept of a co-tenancy clause in a lease, particularly in retail leasing. The clause allows one tenant to terminate or modify their lease if another tenant [...]

Gelt Financial provided $450,000 as a first mortgage on a Commercial building that was lost at a sheriff's sale and purchased back. No appraisal, no income, no credit, no recourse financing. [...]

Jack Miller and Marcy closed a very quick closing in Florida for a real estate investor on a single family investment property."Marcy: Hi Jack.Jack: Hey Marcy, how you doing? Our first video [...]

Gelt Financial closes a refinance on 2 auto related properties in Ohio, while the borrower was in Chapter 13. "Marcy: Hi, it's us again. Jack: It's us, this is Jack and [...]

Gelt closed on strong value add deal in a major city, providing 100% financing. The property was purchased at a foreclosure auction, leased back to the owners and sold for a [...]

Jack Miller asks whether you are cut out to be a commercial or residential mortgage broker. What skills do you need? Do you have them? "Hello, this is Jack Miller at [...]

A must-watch for everyone who wants to be a commercial mortgage broker or who is one. A simple, easy tool that everyone should have and is easy to get. What do you [...]

Gelt is excited to provide first mortgage financing for an owner of a day care center in Chicago. He is an experienced operator and this is a new business for him. [...]

Gelt Financial provides mortgage debt on owner occupied business properties: "Jack: Okay, Marcy. Marcy: Hi! Jack: Yeah, we're here. Oh, remember, I always forget, like this, wherever you're seeing YouTube or [...]

Jack Miller talks about what he leaned by making Toast? How good things take time and effort before you see the results. "Hey, this is Jack Miller. I hope you're having [...]

Gelt Financial closes a refinance on a new construction investment property in Texas. "Jack: This is Jack, this is Marcy at Gelt Financial. We just closed the loan in Manville, Texas, [...]

Charlotte, NC Residential Investment Property-Vacant, No income Verification or qualification, No seasoning, no appraisal same day approval; and 6 day closing.

Gelt Financial provides a First Mortgage on a Fire damaged Investment property in Baton Rough, LA.

Another deal closed! Gelt Financial discusses their recent closed loan on a 400k second mortgage in Tampa, FL. No appraisal, 85% debt. Interest only, short term, six month deal. We focused [...]

Gelt Financial provided a purchase mortgage first mortgage to a family business who is expending to Florida, when they wanted to purchase commercial real estate for their Business to operate in. [...]

In Bridge Mortgage Loan Paid Us Off | Bridge Loans the video discusses a successful payoff of a bridge mortgage loan from Gelt Financial. The borrower owned three properties but had [...]

Small Business Owner Occupied First Mortgage, provided by Gelt Financial. "Marcy: Hey Jack. Jack: Okay Marcy, so anyway, owner-occupied business, tell everyone about it. You know the details of this? Marcy: [...]

Gelt closes collateral based first mortgage in San Antonio, Texas. Brought to us by a mortgage broker, closed very fast. "Jack: Okay, Marcy Berger, the angle is perfect. We're making this [...]

We are here to help our borrowers through the financing process. When one of them was short $150,000.00 on a mixed-use property, we lent them the additional money. One of the many [...]

Gelt Financial just closed a commercial office bridge loan in Orlando, Florida in 4-5 working days, When Gparancy contacted us and told us this was a super rush deal, we did it. [...]

What is the culture at Gelt Financial? Go behind the scenes with Paul Barash. Every company has its own culture—and Gelt Financial is no different.