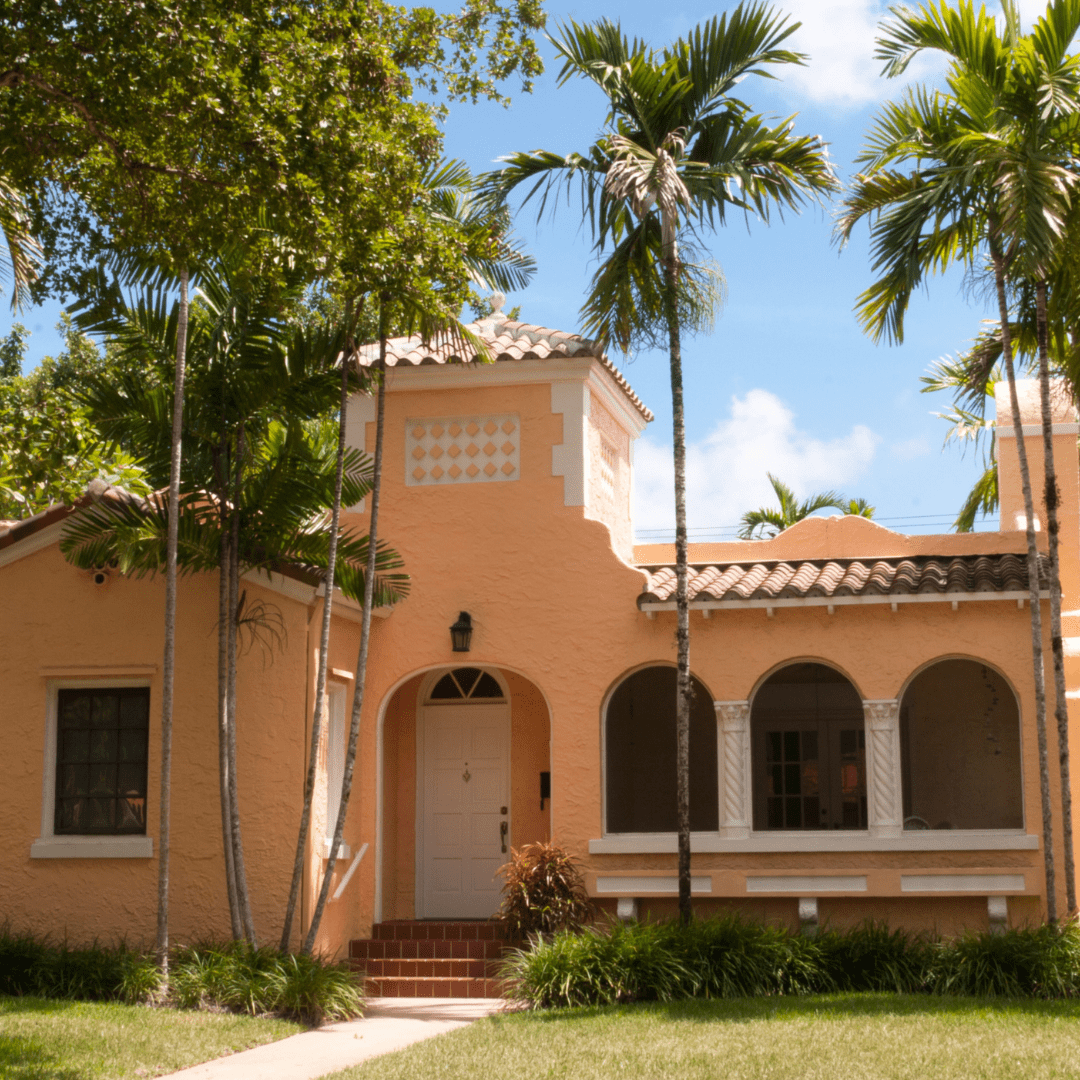

Closed: $218K Non-Performing Loan in Miami, FL

Gelt Financial just closed a $150K low-leverage cash out refinance on a renovated condo unit in Naples, Florida. The borrower inherited the unit, completed improvements, and is preparing to lease it out.

With no appraisal and no minimum credit requirement, this collateral-based mortage allowed the borrower to unlock liquidity quickly and efficiently. When your bank says NO, we say YES!

About Gelt Financial

Gelt Financial is a non-bank commercial real estate lender. We closed more than 10,000 loans totaling over $1 billion since 1989. Gelt focuses on providing debt to non-bank borrowers on all types of commercial real estate, including but not limited to multifamily, office, retail, warehouse, industrial, self-storage, and mixed-use.

For more info on how Gelt can help you with an investment property or on any of our other various products and services, look at what President Jack Miller does on Gelt’s YouTube channel, and for more info on our completed deals, check our Deals Done.

Private Money Lender – Related posts

Gelt Financial was able to arrange to finance for the hard-working owners of a business and commercial real estate a sports retailer using their commercial real estate as collateral [...]

After failed attempts with previous lenders, we were able to help borrowers attain financing for the acquisition of a mixed-use Investment building in Newark, NJ. This income-producing property is an [...]

JUST CLOSED! Gelt Financial is proud to have assisted a condo association in Hialeah, FL with securing $200K in financing for essential improvements. The 40-unit condo association needed immediate [...]

We were very pleased and excited to provide first mortgage purchase money financing to a hard working businessman who managed the business and got the opportunity to purchase it, using [...]

Condo Closed! Gelt just closed the first mortgage on an office condominium in Chicago for the owners of a small family business. When their bank said No, We said yes [...]

Just Closed! Gelt Financial just funded a $135K cash-out refinance for a single-family home in Baton Rouge, Louisiana! This deal came in at a 49% LTV — a strong, low-leverage, collateral-based loan with no income [...]

Just Closed! Gelt Financial just closed a $406K purchase loan for a heavy value add retail center in Cocoa Beach, FL. The loan was secured at 65% LTV for [...]

JUST CLOSED IN METUCHEN, NEW JERSEY! Gelt Financial is excited to announce the closing of a $600k First Mortgage in Metuchen, NJ. This private mortgage was a refinance for [...]

JUST CLOSED! Gelt Financial is excited to announce the closing of a $1,500,000 loan for a Miami, FL Condominium Association with over 160 units. Built in the 1970s, the [...]

Just closed! Gelt Financial delivered a $665K foreclosure bailout cash-out refinance secured by two mixed-use assets in Bound Brook, New Jersey. This low-leverage, collateral-based blanket mortage came in at [...]

Gelt Financial just closed a $195,000 cash-out refinance for a daycare center in Enfield, CT. The property is leased to a thriving daycare business and the real estate investor [...]

Gelt Financial is thrilled to announce that we have successfully closed a $230K first mortgage on a car wash purchase in Charleston, SC. This incredible deal was completed in [...]

We are excited to start lending on retail Cannabis and Hemp properties. We will offer the same flexible programs that we always have and are excited to enter this [...]

Gelt Financial is pleased to have H. Jack Miller take part in the Crittenden National Real Estate Conference in Miami, FL on October 25 to 27rd, 2017. Jack is very [...]

When a company is going bankrupt, there are things they can sell other than its assets. For one, they can also sell their debt. What is Distressed Debt? Distressed debt [...]

DEAL CLOSED IN CHICAGO, ILLINOIS! Gelt Financial just closed on a $900k Bridge-to-Agency Loan in Chicago, IL. This professional investor could not close with traditional financing from Fannie/Freddie due [...]

Gelt Financial just refinanced an operating Gas station and C store in Pleasantville, New Jersey. When the owner of this property found himself on the receiving end of a default [...]

Small business is the heart of America, so we jumped on the opportunity to provide first mortgage financing on a mixed use building in VA, when someone approached us saying [...]

JUST CLOSED IN FIVE BUSINESS DAYS! Gelt Financial is excited to announce we just closed an $840K First Mortgage on an office building in Orlando, FL. This project was [...]

Gelt Financial is pleased to announce we just closed a $1MM First Mortgage on a Wendy’s fast food restaurant in Johnson City, TN. This borrower reached out to us [...]

ANOTHER DEAL DONE! Gelt Financial recently closed on a purchase of a non-performing loan collateralized by a medical office building in Tampa, FL. The note was purchased at PAR [...]

Gelt Financial just closed and funded a first mortgage on a 7-unit condo Portfolio in Orlando, Florida. The buyer was a first-time investor who could not obtain financing through a [...]

Gelt Financial, LLC just closed a commercial mortgage with a 30-year amortization. This borrower was unable to obtain traditional bank financing because of a personal IRS tax lien, With the [...]

While 2019 comes to a close we reflect back on the work we have done in the area of Suicide Prevention, Mental Health awareness and education as well as recovery [...]

Part 2: Do you have what it takes to be a Mortgage Broker- Commercial or Residential? "Hello, this is Jack Miller from Gelt Financial again. I made a video the other [...]

What is a DSCR? (Debt Service Coverage Ratio). Why use it, and how is it calculated? Jack Miller of Gelt Financial LLC goes into the details and provides step-by-step detail. "Hello, [...]

Networking is a great source of business for mortgage brokers, Jack and Marcy at Gelt talk a little about it. "Jack: Okay, Marcy. So, like our YouTube channel or wherever you're [...]

Jack and Marcy talk about some of the differences between being a residential and commercial mortgage brokers. "Marcy: Hi, it's Jack and Marcy. What are we going to talk about today? [...]

Gelt has been helping commercial real estate and investment borrowers since 1989. When your bank says NO, we say YES! "Marcy: Hi, it's Marcy and Jack. Jack: Hey, we're Gelt Financial, [...]

Markets and the needs of borrowers are always changing, in order for a mortgage broker to survive and serve the needs of borrowers, they need to pivot. Foreclosure bailout loans and [...]

When the banks said no, Gelt Financial said YES! We just closed a loan for a South Florida condominium association after other lenders turned them down. Whether it's unique challenges or [...]

Commercial Mortgage Pawn Shop in Fort Lauderdale, FL "Marcy: Hi, Jack. Jack: Hey, Marcy. To tell people, I should, I say at the end, but I'm going to say at the [...]

In the video, Jack explains the concept of value add in commercial real estate. Value add refers to purchasing a property and making improvements or changes to increase its value. He [...]

Jack Miller and Marcy talk about a fast closing on a mixed use property in New Jersey that a residential mortgage broker brought to us when no one else could close [...]

Gelt is excited to provide first mortgage financing for an owner of a business who purchased a home for his employee's to live in. The buyer owned several restaurant business with [...]

Chicago Office Condo Mortgage Closed, No income Verification for owners of Business. "Chicago, Chicago, that title in town, that title in town. I love it. Bet your bottom dollar that you'll [...]

The video discusses how a small loan payoff of $65,000 made to an ethnic family who owned a bodega in Atlantic City. Despite not making much profit on the deal, Gelt [...]

Gelt has been helping commercial real estate and investment borrowers since 1989. When your bank says NO, we say YES! "Marcy: Hi. Jack: Hello, it's Marcy and Jack from Gelt Financial. [...]

Marcy and Jack talk about the eviction moratorium, non paying tenants and borrowing money in today's times. "Jack: Okay, we're live, Marcy. Marcy: All right, we're live. Jack: So let's continue [...]

Small Business Owner Occupied First Mortgage, provided by Gelt Financial. "Marcy: Hey Jack. Jack: Okay Marcy, so anyway, owner-occupied business, tell everyone about it. You know the details of this? Marcy: [...]

Gelt financial closes a commercial office building in Atlanta Georgia for the owner of a new business in 4 working days after the bank said no at the 23rd hour. "Jack: [...]

Gelt Financial can provide financing on inherited properties. We can supply the new owners the capital they need to payoff existing loans, fix the property up, or for other purposes to [...]

Jack and Marcy of Gelt Financial are back with another success story. We helped a client in Vineland, New Jersey with a joint venture equity loan and provided 100% of the [...]

Gelt Financial is a South Florida based Private lender and will provide financing for rehabs, construction and land in South Florida: "Marcy: Hi Jack. Jack: Hey Marcy. So, we want to [...]

Gelt Financial, LLC is pleased to announce and start to offer a second mortgage program on some income producing properties where we are offering a first mortgage on of 5% of [...]

In the video, Jack discusses JV equity in real estate investment, where partners provide the down payment and others find and manage the property. Gelt Financial offers JV equity to investors [...]

In C Store Commercial Mortgage Closed, Atlanta Georgia it discusses about a commercial mortgage deal for a convenience store (c-store) located near Atlanta, Georgia. It features the c-store owned by a [...]

Gelt closed another Mezzanine loan on 3 properties in 3 states with 3 tenants. this was a Collateral based loan. "Jack: I personally, I'm super excited. We just closed a mezzanine [...]