First Mortgage Rehab Closed Birmingham, Alabama

Gelt is pleased to provide a first mortgage rehab mortgage to an investor in Birmingham, Alabama. We have a very long history of providing rehab fix and flip and fix and hold mortgage financing to real estate investors and have closed on thousands of deals. In this case the borrower ran short on the financing to complete the project. When the real estate investor ran short on the capital to fix up the property Gelt stepped in and provided the real estate investor with the financing to complete the rehab of the property.

Gelt focuses on the deal and property and works with borrowers and investors with credit challenges.

When your bank says No, we say Yes.

Private Money Lender – Related posts

JUST CLOSED IN QUEENS, NEW YORK! Gelt Financial is excited to announce we closed a $300k First Mortgage on a Single Family Investment Property in Queens, NY. The borrower [...]

DEAL CLOSED IN MIAMI, FLORIDA! Gelt Financial just closed on a $300K First Mortgage on a single-family, investment property in Miami, FL. The non-owner-occupied home was bought vacant and [...]

JUST CLOSED! Gelt Financial is excited to announce we just closed a $135K First Mortgage on a 2,500 retail building in Newark, NJ. When your bank says NO, we say YES! [...]

Miami Preferred Equity MultiFamily: Gelt Financial, a leading commercial real estate lender, announced the closing of a preferred equity investment on a 16-unit Multifamily property in Miami, FL. Gelt [...]

JUST CLOSED IN LAKE WORTH, FLORIDA! Gelt Financial just closed a $700K First Mortgage on a 5-unit multifamily property in Lake Worth, FL. A local borrower came to us for [...]

JUST CLOSED IN ATLANTA, GEORGIA! Gelt Financial is excited to announce we just closed a First Mortgage on a gas station in Atlanta, GA. Our repeat borrower is a [...]

An experienced investor was able to put under agreement of sale an Industrial building with a large amount of ground at a very good price. The property was lost to [...]

Gelt Financial is excited to announce a new partnership to purchase investment real estate in South Florida. To date, this partnership has purchased 8 single family homes in Palm [...]

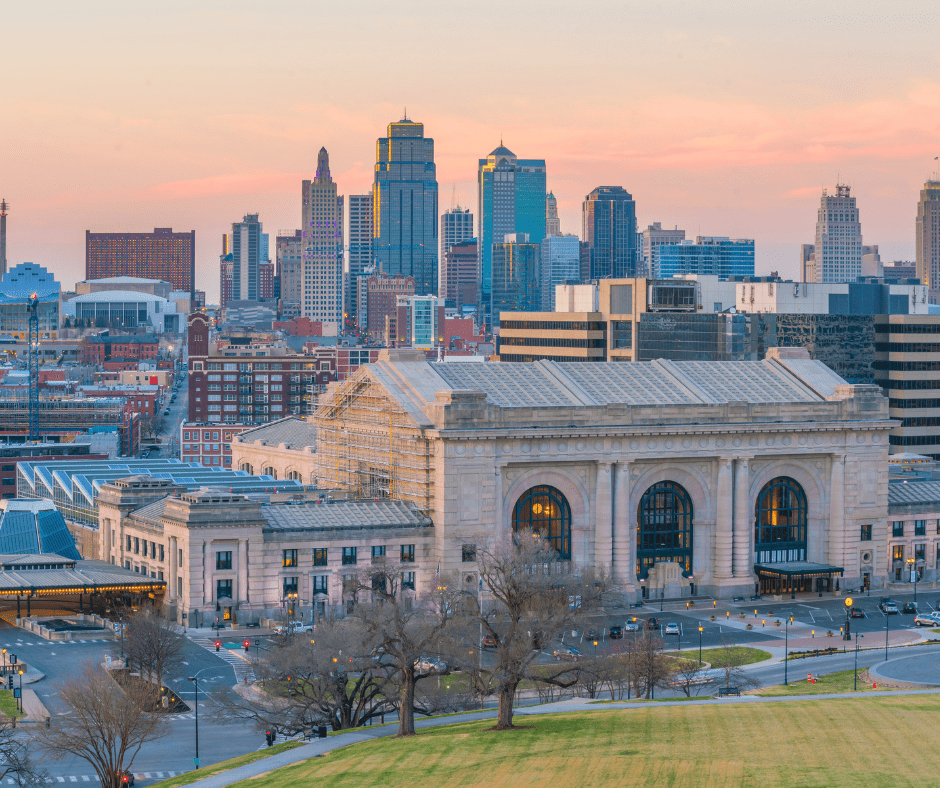

Gelt Financial is thrilled to announce the successful closing of a $200K deal on a Retail/Warehouse Portfolio in Kansas City. We are proud to have provided the financing for [...]

Gelt Financial is thrilled to announce that we have successfully closed a $273K loan for a commercial retail property in Albuquerque, NM. We partnered with a mortgage broker to [...]

Gelt Financial, LLC provided self-amortizing financing for a 19-unit, self managed condominium association. The association will be using the financing to make capital improvements. Most banks would not extend financing [...]

Gelt Financial, LLC was pleased to provide a $1,800,000.00 non-recourse first mortgage financing to a local non-profit owner of a retail shopping center in Philadelphia. The property is a neighborhood [...]

ANOTHER DEAL DONE IN FLORIDA! Gelt Financial just closed a $100K Distressed Debt Purchase on a single-family investment property in Fort Lauderdale.Gelt Financial purchases distressed debt, nonperforming loans, and sub-performing [...]

Commercial Mortgage Loan Closed Gelt Financial helped close a deal on a car wash in Lintoia, GA, the owner-operator chose Gelt Financial, LLC. We focus on providing financing to [...]

Gelt Financial just refinanced an operating Gas station and C store in Pleasantville, New Jersey. When the owner of this property found himself on the receiving end of a default [...]

First mortgage closed in Philadelphia on a mixed us property that the owner had purchased and needed to be fixed up. The Investor saw potential value, came to us and [...]

JUST CLOSED IN FOUR BUSINESS DAYS! Gelt Financial is excited to announce we just closed a $500K mortgage on a five-property Dollar General portfolio across multiple states. Gelt provided [...]

Granite City, IL- We did the loan solely on the property 24-month term. Mixed Use property refinance Non-U.S. resident credit Foreign national Lives and works overseas No credit No personal [...]

We just provided an experienced investor a cash-out refinance on Free standing Restaurant suburbs of Pittsburgh, established tenant, but the owner had a lot of credit challenges due to other [...]

ANOTHER DEAL DONE IN FLORIDA! Gelt Financial just closed a $60K First Mortgage on an investment condo in Fort Lauderdale, FL. Click here to view more closed Fort Lauderdale hard [...]

We are pleased to provide financing to a condominium Association that was in Chapter 11 Bankruptcy, in the Atlanta, GA area. The funding we provided them allowed them to exit [...]

JUST CLOSED IN NASHVILLE, TENNESSEE -- ATLANTA, GEORGIA -- NORTHAMPTON, MASSACHUSETTS! Gelt Financial is pleased to announce we just closed a $3.55MM First Mortgage on a NNN Portfolio. The [...]

JUST CLOSED IN NEW YORK CITY, NEW YORK! Gelt Financial is proud to announce we just closed a $500K second mortgage on a 40+ unit apartment building in New [...]

JUST CLOSED IN CITRUS SPRINGS, FLORIDA! Gelt Financial just closed a $225K First Mortgage on an owner-occupied restaurant in Citrus Springs, FL. Our borrower bought both the restaurant and [...]

In the video, Jack shares a valuable tip for investors: many people and businesses fail because they take on too much and lose focus. He advises caution, emphasizing the importance of [...]

In the video, Jack explains the concept of a co-tenancy clause in a lease, particularly in retail leasing. The clause allows one tenant to terminate or modify their lease if another tenant [...]

How do we dig in and use real life math and market data to determine the market value of a real; estate investment property at Gelt Financial. "Jack: Jack and Michael [...]

Gelt is excited to provide first mortgage financing for the owners of a multi family property in Brooklyn, NY. This property was inherited with a balloon loan that was in default. [...]

In this video, Jack discusses a closed deal in Chesapeake, Virginia. Wherein $220,000 is provided, first mortgage on a mixed-use property to a real estate investor with poor credit. The borrower [...]

Jack Miller speaks to mortgage brokers and talks about doing business together and some things to know.

Gelt Financial closes a refinance on investment condominium in Jersey City, NJ. "Jack: Hello, this is Jack and Marcy again, here to tell you about a loan. A loan we just [...]

Gelt Financial provides non QM mortgages on residential investment properties. Hear more from Jack and Michael on how to get started. When your bank says NO, we say YES! "Jack: Michael, [...]

Marcy and Jack talk a little bit about the increasing interest rate environment and what it means for commercial mortgage brokers and borrowers, and how to take advantage of it. "Marcy: [...]

Gelt Closed a first mortgage on a single family investment property. "Jack: Hi, this is Jack, and this is Marcy. We're social distancing at Gelt Financial. I hope everyone is having [...]

Gelt Financial closes a refinance on 2 small multi family properties in CT. "Jack: Hello, this is Jack and Marcy at Gelt Financial again, super excited. We're always excited here, but [...]

Jack Miller gives his opinion on if its wise to pay down a home mortgages faster then the term calls for? Its all comes down to the person you are. "Hi, [...]

Mortgage and Real Estate Professional Tip: If you have a corporate entity like an LLC or Corporation, get your documents in order prior to trying to refinance or sell a property, [...]

Mobile Home Park closes, in Long Island, NY Gelt has been helping commercial real estate and investment borrowers since 1989. When your bank says NO, we say YES! "Jack: This is [...]

Term sheet signed Black Friday, deal ready to close Wednesday. Broker contacted us when bank did not close and needed a very quick close. We did it! "Jack: Hi, Jack and [...]

We made this for our borrowers and mortgage brokers, we all know in life things do not always go as planned or smoothly. We are here to help and work with [...]

Jack Miller gives a little background on what a Loan Loss reserve or an Allowance for a loan loss reserve is in lending. "Hi, this is Jack Miller. I want to [...]

Gelt Financial closes a refinance on 2 auto related properties in Ohio, while the borrower was in Chapter 13. "Marcy: Hi, it's us again. Jack: It's us, this is Jack and [...]

Learn to say NO more, and you will be more focused and productive in achieving the results you want. "Jack: Okay, Jack and Marcy at Gelt Financial here. So, we want [...]

Gelt Financial, LLC is pleased to announce and start to offer a second mortgage program on some income producing properties where we are offering a first mortgage on of 5% of [...]

Why use a private lender? When to use a Private lender? "Marcy: Hi! Mortgage tip of the day! Jack: Mortgage tip of the day! Jack and Marcy at Gelt Financial. First, like [...]

In the video, Jack shares an interesting story about closing a 100% loan-to-value deal on land in Ohio. Despite not typically offering land loans, Gelt made an exception due to the [...]

Gelt closed on strong value add deal in a major city, providing 100% financing. The property was purchased at a foreclosure auction, leased back to the owners and sold for a [...]

Jack Miller gives explains what is a Cap rate and how do I use it in Commercial Real Estate. "Hello, I hope you're having a great day. This is Jack Miller [...]