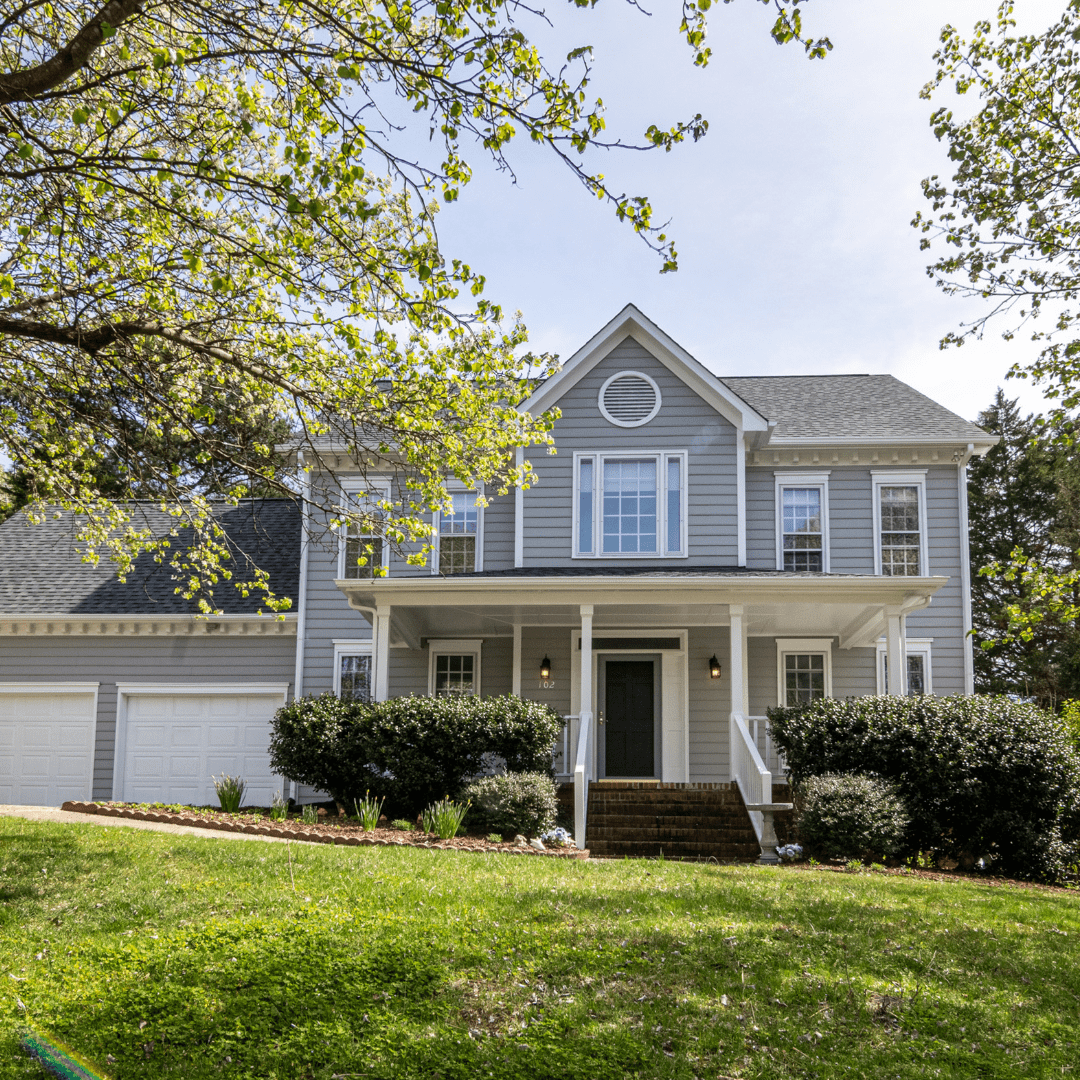

Closed $274,000 First Mortgage Purchase in Suffolk, Virginia

Virginia First Mortgage Purchase: Gelt Financial Announces Funding of $273,000.00 office Building in Virginia

Gelt Financial, a leading commercial real estate direct lender, today announced the closing of a $273,000.00 first mortgage on an office building in Suffolk, Virginia. This was brought to Gelt by a mortgage broker who needed a two week closing, which Gelt was able to do. Gelt provided a purchase money mortgage on this office building, with a term of two years.

Gelt Financial, a leading commercial real estate direct lender, today announced the closing of a $273,000.00 first mortgage on an office building in Suffolk, Virginia. This was brought to Gelt by a mortgage broker who needed a two week closing, which Gelt was able to do. Gelt provided a purchase money mortgage on this office building, with a term of two years.

“Gelt Financial is strategically deploying capital for transactions in the $100K-$5MM range, a market that is increasingly being overlooked during the pandemic,” said Jack Miller, of Gelt Financial. “this was purchased by the owner of a small business to use for their office space. We believe in this business and will continue to be at the forefront of lending in the space.”

About Gelt Financial

Gelt Financial is a non-bank commercial real estate lender, which has closed more than 10,000 loans totaling over $1 billion, since its founding in 1989. Gelt focuses on providing debt to non-bank borrowers on all types of commercial real estate, including but not limited to multifamily, office, retail, warehouse, industrial, self-storage, and mixed-use.

To learn more about Gelt Financial’s lending capabilities and the advantages it offers to commercial real estate owners and investors across the U.S., please contact us at 561-221-0900.

For more info on how Gelt can fight for you as a client to get your deal closed in the best way possible, take a look at what President Jack Miller on Gelt’s YouTube channel and for more info on our completed deals, check our Deals Done.

Private Money Lender – Related posts

Exciting news from Gelt Financial! We recently closed a $450K sale leaseback deal for a Residential Investment Property in New Jersey. The best part is, we made it happen [...]

We just provided an experienced investor a cash-out refinance on Free standing Restaurant suburbs of Pittsburgh, established tenant, but the owner had a lot of credit challenges due to other [...]

Gelt Financial just closed a $250K cash-out refi for a Strip Center in North Tonawanda, NY. The purchase was conveniently located near Niagara Falls and featured a large parking [...]

Gelt Financial Announces Funding of $3,000,000 Multifamily Bridge Loan Company Debuts in Columbus Ohio, Announces Aggressive Q4 Growth Plans Across the U.S. DELRAY BEACH, FL (Sept. 9, 2020) – Gelt [...]

Gelt Financial has provided a First Mortgage on a residential investment property in Wildwood, NJ. The property was a townhome, one block from the beach and Gelt was able to [...]

JUST CLOSED IN MIAMI, FLORIDA! We are pleased to announce we just closed a $242,500 First Mortgage on an investment property collateralized by a condo in Brickell, the heart [...]

Gelt closed a first mortgage for an investor with the purchase of 6 condominiums all located in the same community. Instead of buying each unit individually, we were able to [...]

Rehab Fix and Hold Gelt is pleased to have closed a mortgage to a local real estate investors in Haverstraw, Part of Rockland County, New York. We provided the investor [...]

DEAL CLOSED IN ATLANTA, GEORGIA IN FOUR BUSINESS DAYS! Gelt Financial closed on a $1.2MM First Mortgage in Atlanta, GA. This office building was in a highly desired location, [...]

Gelt Financial just closed a $125K refinance on a single-family home in Richmond, Virginia. The borrower wanted to do some light rehab before putting the property back on the [...]

JUST CLOSED IN FOUR BUSINESS DAYS! Gelt Financial is excited to announce we just closed a $500K mortgage on a five-property Dollar General portfolio across multiple states. Gelt provided [...]

Just Closed! Gelt Financial just funded a $135K cash-out refinance for a single-family home in Baton Rouge, Louisiana! This deal came in at a 49% LTV — a strong, low-leverage, collateral-based loan with no income [...]

Hotel Mortgage Financing Missouri: Gelt Financial Announces Funding of $800,000.00 Hospitality Bridge Loan in Branson. DELRAY BEACH, FL (Dec. 30, 2020) – Gelt Financial, a leading commercial real estate direct [...]

JUST CLOSED IN NEW JERSEY! Gelt Financial just closed an $800K First Mortgage on a cannabis dispensary in New Jersey. We provided cash-out refinancing to fund the borrower's rehab [...]

JUST CLOSED IN SEVEN BUSINESS DAYS! Gelt Financial just closed a $750K First Mortgage on a retail building in Fort Lauderdale, FL. This loan needed to close FAST, and we [...]

Gelt Financial has successfully closed a $400K purchase loan for a beautiful one-bedroom, one-bathroom condominium unit in Miami, FL. This property, valued at $665K, is primed to become a [...]

Fill Gaps in the Capital Stack Alternative financing options for small-balance investors are gaining traction Written By Noah Miller, Vice President of Gelt Financial LLC Featured article in Scotsman Guide [...]

Another successful closing by Gelt Financial, your trusted private lender. We just closed on a $400K foreclosure bailout for a retail building in Battle Creek, MI. This well-maintained property, [...]

Gelt Financial buying distressed debt on commercial real estate between the loan sizes of $100,000 and $5MM Are you a lender looking to sell your distressed commercial real estate debt? [...]

ANOTHER DEAL DONE IN FLORIDA! Gelt Financial just closed a $100K Distressed Debt Purchase on a single-family investment property in Fort Lauderdale.Gelt Financial purchases distressed debt, nonperforming loans, and sub-performing [...]

JUST CLOSED IN METUCHEN, NEW JERSEY! Gelt Financial is excited to announce the closing of a $600k First Mortgage in Metuchen, NJ. This private mortgage was a refinance for [...]

JUST CLOSED! Gelt Financial is excited to announce the closing of a $1,500,000 loan for a Miami, FL Condominium Association with over 160 units. Built in the 1970s, the [...]

Gelt Financial, LLC was pleased to close on a Blanket Mortgage, two auto-related properties in Ohio for a borrower in Chapter 13.

DEAL CLOSED IN MIAMI, FLORIDA! Gelt Financial just closed on a $300K First Mortgage on a single-family, investment property in Miami, FL. The non-owner-occupied home was bought vacant and [...]

Gelt Financial can provide financing on inherited properties. We can supply the new owners the capital they need to payoff existing loans, fix the property up, or for other purposes to [...]

Gelt Closed a first mortgage on a single family investment property. "Jack: Hi, this is Jack, and this is Marcy. We're social distancing at Gelt Financial. I hope everyone is having [...]

Gelt closes on a first mortgage cash out refinancing for $300,000.00 on a strip of stores in Detroit. "Jack: Hello, everyone. This is Marcy and Jack. Marcy, what deal are we [...]

Jack Miller talks about 4 easy and tried and true ways to get 100% financing on commercial and or investment real estate. "Hi, this is Jack Miller from Gelt Financial. I [...]

Jack Miller and Marcy talk about a Mezzanine loan that just closed on a new state home in the North Shore of Long Island for a real estate investor. Mortgage broker [...]

We completed a mixed-use property first mortgage refinance for a non-U.S. resident who is a foreign national and lives and works overseas. He has no credit or no personal income. We did [...]

Gelt closed another Mobile Home Park Mortgage Closed in Indiana. Remember, when your bank says NO, we say YES! "Jack: Okay, Marcy Berger, we're here. Marcy: We're here. Hi, guess what? [...]

Understand your deal and what types of deals your lenders do is important to being a successful mortgage broker.

Gelt Financial provides a First Mortgage on a Fire damaged Investment property in Baton Rough, LA.

In this video, Jack and Marcy provide tips for successfully closing a private or hard money loan, emphasizing the importance of preparation and transparency for both brokers and borrowers. Key tips [...]

Gelt closes collateral based first mortgage in San Antonio, Texas. Brought to us by a mortgage broker, closed very fast. "Jack: Okay, Marcy Berger, the angle is perfect. We're making this [...]

In our latest YouTube video, Michael explains what a mortgage broker or borrower should send to Gelt Financial—or any lender—for a deal to be reviewed for approval. When your bank says [...]

Gelt Financial closes a cash out, mixed use, no income verification mortgage in Indianapolis, IN. "Marcy: Hi. Jack: Hi, this is Jack and Marcy at Gelt. Marcy: How are you? Jack: [...]

The video titled "Pro Guide To Commercial Mortgage Rates with Some Key Factors" by Gelt Financial, LLC discusses the factors involved in pricing a loan in the private lending space. It [...]

Marcy Berger is Retiring from Gelt Financial. She will be greatly missed.

Gelt Financial loves working with Mortgage Brokers, and a very common question is how they get paid. This very short video answers that question. "Jack: Michael, how do Brokers get paid? [...]

Gelt Financial just closed two fix and hold JV equity Mortgages, were we provided 100% Financing to our partner.

Jack Miller of Gelt Financial addresses a common misconception on why some businesses file Chapter 11 Bankruptcy. Gelt Financial is a bankruptcy DIP and Exit lender.

Jack Miller gives some tips to commercial mortgage brokers in challenging times.

Real estate investors can make a lot of money with fix-and-flip rehab investing, but they also can lose a lot of money. Jack and Marcy talk about their experience of doing [...]

Jack Miller advises mortgage brokers on everything they should have ready and provide to lenders to get their loans closed FASTER.

Jack Miller talks about what he leaned by making Toast? How good things take time and effort before you see the results. "Hey, this is Jack Miller. I hope you're having [...]

Gelt has been helping commercial real estate and investment borrowers since 1989. When your bank says NO, we say YES! "Marcy: Hi, it's Marcy and Jack. Jack: Hey, we're Gelt Financial, [...]

Gelt provides Condo and HOA Association Financing when banks won't. Typically banks wont deal with small associations, high delinquency, low reserves or high investor condensations as well as other reasons and [...]