Closed: $400K Refinance Loan for Medical Office Building in Odessa, TX

Gelt Financial just closed a $400K refinance loan for a medical office building in Odessa, TX. The property sits in a fantastic location with excellent parking, and the borrower came to us with strong business financials.

With a low 49% LTV, this deal was a great fit for our flexible lending approach. When traditional lenders say NO, we say YES!

About Gelt Financial

Gelt Financial is a non-bank commercial real estate lender. We closed more than 10,000 loans totaling over $1 billion since 1989. Gelt focuses on providing debt to non-bank borrowers on all types of commercial real estate, including but not limited to multifamily, office, retail, warehouse, industrial, self-storage, and mixed-use.

For more info on how Gelt can help you with an investment property or on any of our other various products and services, look at what President Jack Miller does on Gelt’s YouTube channel, and for more info on our completed deals, check our Deals Done.

Private Money Lender – Related posts

JUST CLOSED IN PETERSBURG, VIRGINIA! Gelt Financial is excited to announce the closing of a $150k First Mortgage in Petersburg, VA. The non-recourse loan was secured by a cash-flowing, [...]

JUST CLOSED IN CITRUS SPRINGS, FLORIDA! Gelt Financial just closed a $225K First Mortgage on an owner-occupied restaurant in Citrus Springs, FL. Our borrower bought both the restaurant and [...]

JUST CLOSED! Gelt Financial just funded a $750K purchase loan for a cannabis dispensary conversion in Marlton, NJ. With 34% LTV, the borrower, who holds a cannabis license, is [...]

Just Closed! We just closed a $300K refinance for an owner-occupied commercial condominium in Philadelphia, PA—home to a local dance studio. The borrower’s previous loan was in forbearance, but we stepped in and [...]

Written by Vice President of Gelt Financial, Noah Miller, and featured on Commercial Property Executive Gone are the days of Wall Street investors staking claim to all the assets, argues [...]

We are pleased to be able to sponsor some of the marketing behind “Synagogue Security Tool Kit” put out by Herut North American Zionist Organization. “We are each other’s brothers/sister’s [...]

JUST CLOSED IN DETROIT, MICHIGAN! Gelt Financial just closed a $225K First Mortgage on a commercial property in Detroit, Michigan. The borrower needed a short-term refinance to pay off [...]

As the world faces an unpredictable crisis we on the Gelt Financial team are preparing for the worst and hoping and praying for the best. We are reaching out to [...]

Gelt is pleased to provide a first mortgage rehab mortgage to an investor in Birmingham, Alabama. We have a very long history of providing rehab fix and flip and fix [...]

Gelt Financial Closes $650K Loan on Jack in the Box Property in Texas — Rush Closing in Just 10 Days

Gelt Financial, LLC, a nationwide private commercial real estate lender, has announced the successful closing of a $650,000 loan secured by a Jack in the Box property in Texas. [...]

It is not the critic who counts: not the man who points out how the strong man stumbles or where the doer of deeds could have done better. The credit [...]

The real estate industry has been on the rise for almost a decade now, and it continues to grow thanks to the booming economy. But [...]

Closed loan- We were able to help this borrower obtain a cash-out refinance on his mixed-use building in Philadelphia PA. The borrower was able to pay off his higher interest [...]

When submitting loan requests to a private lender, it is important to provide as much information as you can to get a quick response and ensure that your deal [...]

Gelt Financial is excited to announce we just closed on a $1.6MM mezzanine loan on a 60k SF office building in Houston, TX. The capital provided by Gelt will [...]

Gelt Financial recently arranged $9.8 million in commercial first mortgage financing for the real estate holding company of a large substance abuse recovery center. The company acquired three properties in [...]

Gelt Financial has successfully closed a $400K purchase loan for a beautiful one-bedroom, one-bathroom condominium unit in Miami, FL. This property, valued at $665K, is primed to become a [...]

Purchasing distressed debt, also known as buying non-performing loans, can be a profitable investment strategy for those willing to take on the risk. Distressed debt refers to loans that [...]

Commercial Mortgage Loan Closed Gelt Financial helped close a deal on a car wash in Lintoia, GA, the owner-operator chose Gelt Financial, LLC. We focus on providing financing to [...]

Another successful deal closed by Gelt Financial! We are thrilled to have closed a $900K purchase loan for a daycare located in the suburban area of Atlanta. Our team [...]

Gelt Financial was recently featured in MSN Money's article, "Should You Buy a House During a Recession?" In this piece, H. Jack Miller, President & CEO of Gelt Financial, [...]

FORT LAUDERDALE, Fla., April 14, 2015 - With widespread criticism citing the demand for greater liquidity for minority interest owners in real estate partnerships and real estate crowdfunding positions, QuickLiquidity [...]

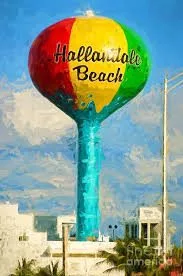

Gelt Financial Announces Funding of $150,000 retail property in Hallandale Beach, Florida. Gelt Financial, a leading commercial real estate direct lender, announced the closing of a $150,000 cash-out refinance [...]

Gelt Financial president H. Jack Miller was recently featured as a real estate expert in the Benzinga article "How Many Months of Bank Statements for a Mortgage Are Needed?" [...]

Jack Miller gives an example of an interesting and creative deal. It was a TIC roll up where our borrower/partner made a lot of money using our money. "Hey Larry, this is [...]

Gelt Financial helped an Auto Body Shop in St Louis, Missouri with credit challenges with a no-income qualification mortgage with a 3-year term. "Hello, this is Jack Miller of Gelt Financial. I [...]

How do we dig in and use real life math and market data to determine the market value of a real; estate investment property at Gelt Financial. "Jack: Jack and Michael [...]

Just closed! Gelt Financial successfully secured a private loan for an auto body shop, a new commercial mortgage deal. No appraisal or income verification required. Watch the video to hear how [...]

Jack talks about the difference between an Exclusive versus Non-Exclusive Fee Agreement for Mortgage Brokers. "Hello, this is Jack Miller at Gelt Financial. Hope you're having a fantastic day. I want [...]

Jack Miller gives a little explanation on why lenders charge prepayment penalties, the different types of them and some tips on how to analyze and negotiate the best one for your [...]

Gelt is excited to provide first mortgage financing for an local real estate investor in Idaho on a single family dwelling. This was done under as a very limited documentation mortgage [...]

Gelt Financial provided a purchase mortgage first mortgage on Mixed Use Property in Brooklyn New York. No income qualification When your bank says No, we say Yes. "Marcy: Hi, all right. [...]

Gelt Financial, LLC focuses on DIP Lending, also known as Debtor-in-Possession Financing and exit financing for Chapter 11 bankruptcy cases. Jack Miller gives a little history and overview of DIP financing [...]

In the video, Jack shares an interesting story about closing a 100% loan-to-value deal on land in Ohio. Despite not typically offering land loans, Gelt made an exception due to the [...]

Jack and Marcy of Gelt Financial are back with another success story. We helped a client in Vineland, New Jersey with a joint venture equity loan and provided 100% of the [...]

Charlotte, NC Residential Investment Property-Vacant, No income Verification or qualification, No seasoning, no appraisal same day approval; and 6 day closing.

Mobile Home Park closes, in Long Island, NY Gelt has been helping commercial real estate and investment borrowers since 1989. When your bank says NO, we say YES! "Jack: This is [...]

In this video, H. Jack Miller shares common mistakes he has seen people make in real estate investing, especially with fix-and-flip projects. To succeed, you need to excel in three key [...]

Jack and Marcy share some real-life tips for commercial Mortgage Brokers: "Jack: Okay, we're starting; we're improvising here. Marcy: Yes, because we have had mechanical problems this morning. Jack: I'm embarrassed [...]

Gelt Closed a first mortgages on 7 residential Investment condo's in Orlando, FL, No appraisal and a cash out on a commercial building in Des Moine, Iowa. Both deals came from [...]

Gelt Closed a first mortgage on a single family investment property. "Jack: Hi, this is Jack, and this is Marcy. We're social distancing at Gelt Financial. I hope everyone is having [...]

Gelt Financial closes a refinance on investment condominium in Jersey City, NJ. "Jack: Hello, this is Jack and Marcy again, here to tell you about a loan. A loan we just [...]

The video explains the definition of Note on Note Financing. It is the practice of buying and selling notes, typically related to mortgages and debts. Investors look for discounts and consider [...]

Gelt is excited to provide first mortgage financing for an owner of a day care center in Chicago. He is an experienced operator and this is a new business for him. [...]

Gelt Financial closes a rehab mortgage to finish a property in Birmingham, Alabama. "Jack: Hello, this is Jack and Marcy at Gelt. Anyway, okay, new closing property in Birmingham, Alabama. Tell [...]

Jack Miller and Marcy talk a little about marketing basics for commercial mortgage brokers.

Marcy Berger is Retiring from Gelt Financial. She will be greatly missed.

Gelt Financial provided $500,000 as a first mortgage on an office Condominium in Orlando Florida, No appraisal, No income, No Credit, No Recourse financing. fast approval and closing. Gelt has been [...]