Financing for 19-Unit Condominium Association in Seattle, WA

Gelt Financial, LLC provided self-amortizing financing for a 19-unit, self managed condominium association. The association will be using the financing to make capital improvements.

Most banks would not extend financing to the association because of the size and the fact that it was self managed. This opportunity was brought to Gelt Financial by a broker and Gelt was able to approve the request on the same day it was brought to them and closed just a few weeks later.

“Gelt is flexible with how we structure deals and that gives us a real edge in providing capital. As part of our robust national growth strategy, we will continue to lend and provide capital to business, real estate investors and condominium and HOA Associations when banks are not” said Jack Miller, founder of Gelt Financial.

To learn more about Gelt Financial’s lending capabilities and the advantages it offers to commercial real estate owners and investors across the U.S., please visit www.Geltfinancial.com.

About Gelt Financial

Gelt Financial is a non-bank commercial real estate lender. We closed more than 10,000 loans totaling over $1 billion since 1989. Gelt focuses on providing debt to non-bank borrowers on all types of commercial real estate, including but not limited to multifamily, office, retail, warehouse, industrial, self-storage, and mixed-use.

Private Money Lender – Related posts

Chicago suburbs, the mixed-use property being purchased by an attorney at a discount price. We provided the first mortgage under our no income qualification program. Gelt Financial, is a private [...]

Just Closed! Gelt Financial just funded a $135K cash-out refinance for a single-family home in Baton Rouge, Louisiana! This deal came in at a 49% LTV — a strong, low-leverage, collateral-based loan with no income [...]

We were excited to close the first mortgage on a value add property in Jackson, MS. This was brought to us by a mortgage broker, the property was partially [...]

Another successful deal was closed by Gelt Financial! We’re excited to announce the closing of a $300K cash-out refinance for a medical office in Baton Rouge, LA. This property, [...]

Gelt Financial just closed and funded a first mortgage on a 7-unit condo Portfolio in Orlando, Florida. The buyer was a first-time investor who could not obtain financing through a [...]

We are happy to close a commercial mortgage loan for an experienced real estate investor in Pittsburgh, Pa on a blanket mortgage of 3 properties, 2 retail centers and 1 [...]

JUST CLOSED! Congratulations to our client on securing $328,250 for a Sale-Leaseback transaction on a ready-to-rent townhome in Atlanta, GA. The loan was structured at 65% LTV, providing the [...]

Gelt Financial Announces Funding of $200,000.00 Office Building in Ohio Gelt Financial, a leading commercial real estate direct lender, today announced the closing of a $200,000 first purchase money [...]

LOAN CLOSED IN JUST FOUR BUSINESS DAYS! Gelt Financial just closed a $185K Cash Out First Mortgage in West New York, NJ on an investment condominium. The buyer needed [...]

Gelt Financial is pleased to announce we just closed a $1MM First Mortgage on a Wendy’s fast food restaurant in Johnson City, TN. This borrower reached out to us [...]

Gelt Financial is pleased to announce we just closed a $4.3MM First Mortgage on a NNN Portfolio. The 1031 transaction included three properties in Chattanooga, TN, Macon, GA and [...]

Gelt Financial just provided a first mortgage cash-out refinance on a commercial property in Des Moine, Iowa. The property was recently converted from a church to multi-unit commercial. In providing [...]

ANOTHER DEAL DONE IN FLORIDA! Gelt Financial just closed a $100K Distressed Debt Purchase on a single-family investment property in Fort Lauderdale.Gelt Financial purchases distressed debt, nonperforming loans, and sub-performing [...]

DEAL CLOSED IN LAKE WORTH, FLORIDA! Gelt Financial is excited to announce we just closed on a $900K First Mortgage on a retail strip center in South Florida. The [...]

Just Closed! We just closed a $300K refinance for an owner-occupied commercial condominium in Philadelphia, PA—home to a local dance studio. The borrower’s previous loan was in forbearance, but we stepped in and [...]

Gelt Financial has provided a First Mortgage on a Single Family Investment Property in Boise, ID. "Gelt is flexible with how we structure deals and that gives us a real [...]

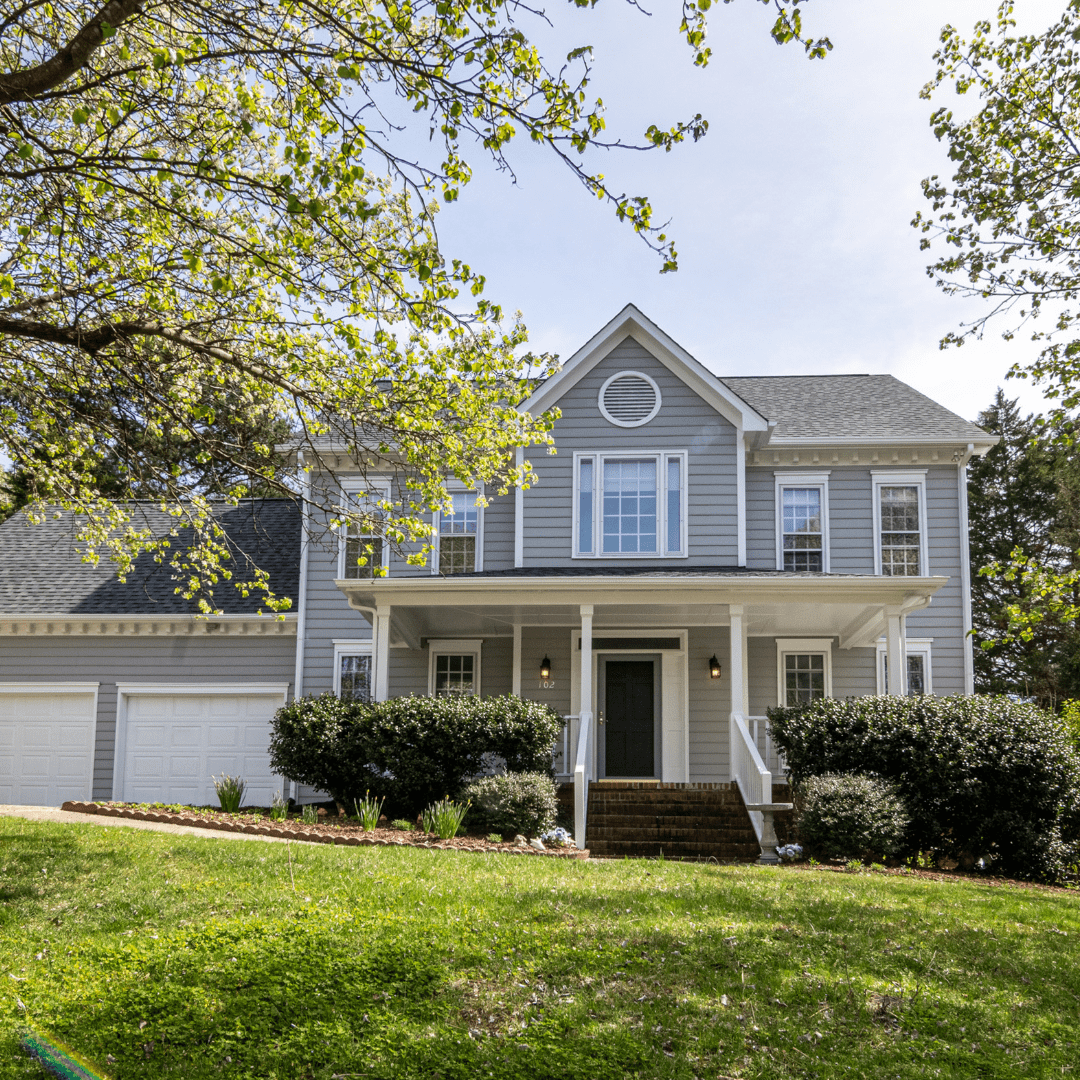

Gelt Financial just closed a $125K refinance on a single-family home in Richmond, Virginia. The borrower wanted to do some light rehab before putting the property back on the [...]

Virginia First Mortgage Purchase: Gelt Financial Announces Funding of $273,000.00 office Building in Virginia Gelt Financial, a leading commercial real estate direct lender, today announced the closing of a $273,000.00 [...]

JUST CLOSED IN FORT LAUDERDALE, FLORIDA! Gelt Financial just closed a $600K First Mortgage on a retail building in Fort Lauderdale, FL. The borrower was having trouble finding a [...]

JUST CLOSED IN QUEENS, NEW YORK! Gelt Financial is excited to announce we closed a $300k First Mortgage on a Single Family Investment Property in Queens, NY. The borrower [...]

Small business is the heart of America, so we jumped on the opportunity to provide first mortgage financing on a mixed use building in VA, when someone approached us saying [...]

JUST CLOSED IN FOUR BUSINESS DAYS! Gelt Financial is excited to announce we just closed a $500K mortgage on a five-property Dollar General portfolio across multiple states. Gelt provided [...]

JUST CLOSED! Gelt Financial is pleased to announce we just closed a $325K First Mortgage on an Industrial Property in Pueblo, CO. This was structured as a cash-out refinance [...]

JUST CLOSED IN SEVEN BUSINESS DAYS! Gelt Financial just closed a $750K First Mortgage on a retail building in Fort Lauderdale, FL. This loan needed to close FAST, and we [...]

Gelt Financial closes a cash out, mixed use, no income verification mortgage in Indianapolis, IN. "Marcy: Hi. Jack: Hi, this is Jack and Marcy at Gelt. Marcy: How are you? Jack: [...]

Gelt Financial provides First Mortgages on Single or Multi family residential Investment Properties that are being purchased to flip or to fix up and lease out. Gelt usually closes them very [...]

Jack and Marcy talk to Mortgage Brokers and give tips on closing more deals. "Jack: Jack and Marcy at Gelt Financial. Marcy: How are you guys today? Jack: Hopefully, you're having [...]

Gelt is excited to provide first mortgage financing for an owner of a business who purchased a home for his employee's to live in. The buyer owned several restaurant business with [...]

In the video, Jack explains the concept of a co-tenancy clause in a lease, particularly in retail leasing. The clause allows one tenant to terminate or modify their lease if another tenant [...]

Jack Miller gives some tips to commercial mortgage brokers in challenging times.

In the video, Jack explains the secondary mortgage market, where loans are bought and sold as assets. He discusses how loans, including mortgages, can be sold by originators and owners in [...]

In the video, Jack shares a valuable tip for investors: many people and businesses fail because they take on too much and lose focus. He advises caution, emphasizing the importance of [...]

Gelt Financial closes a refinance on investment condominium in Jersey City, NJ. "Jack: Hello, this is Jack and Marcy again, here to tell you about a loan. A loan we just [...]

Gelt is excited to partner with a local real estate investor. We provided 100% debt and equity in a deal where we purchased an office building and leased it out to [...]

Some commonsense mortgage broker tips. Remember, when your bank says NO, we say YES! "Marcy: Hi, it's Marcy, and Jack from Gelt Financial. Jack: So our tip of the day for [...]

Gelt Financial, LLC focuses on DIP Lending, also known as Debtor-in-Possession Financing and exit financing for Chapter 11 bankruptcy cases. Jack Miller gives a little history and overview of DIP financing [...]

Gelt just closed on a Debtor in Possession for a nonprofit in Chapter 11 Bankruptcy in Boca Raton, Florida. Hear how it all went down from our expert team! "Marcy: Hi, [...]

Jack Miller advises mortgage brokers on everything they should have ready and provide to lenders to get their loans closed FASTER.

In the video, Jack shares valuable tips on the importance of paying attention to the details when investing in real estate. He emphasizes the need for personal involvement in conducting due [...]

Gelt provides Condo and HOA Association Financing when banks won't. Typically banks wont deal with small associations, high delinquency, low reserves or high investor condensations as well as other reasons and [...]

First Mortgage Commercial Mortgages on an owner occupied restaurant in Illinois. No income verification. "Video Title: First Mortgage Financing on Owner Occupied Restaurant in Illinois Speaker: Jack Miller and Marcy Berger [...]

Gelt Financial just closed a commercial office bridge loan in Orlando, Florida in 4-5 working days, When Gparancy contacted us and told us this was a super rush deal, we did it. [...]

In this video, Michael discusses how Gelt Financial handles prepayment penalties on commercial mortgages. They offer a creative solution by negotiating an exit fee that allows clients to avoid paying minimum [...]

Jack Miller of Gelt Financial addresses a common misconception on why some businesses file Chapter 11 Bankruptcy. Gelt Financial is a bankruptcy DIP and Exit lender.

In the video, Jack discusses JV equity in real estate investment, where partners provide the down payment and others find and manage the property. Gelt Financial offers JV equity to investors [...]

Jack Miller, being in the lending business for over 35 years, tells commercial mortgage brokers the number one thing they need to know and do to succeed. "Hello, this is Jack [...]

In this video, H. Jack Miller shares his passion for helping real estate investors and small business owners secure financing, particularly when traditional banks decline. With over 35 years in the [...]

Gelt Financial closed a 1st mortgage rehab loan in Virginia for a cash out refinance to fix up the property, no appraisal or income verification.