Gelt Offers Lines of Credit to Existing Borrowers

Gelt Financial, is pleased to announce that it recently started to offer lines of credit to existing borrowers. According to H. Jack Miller, the company founder, we are always looking for ways to solve the needs of our borrowers and customers who are business owners and real estate investors. By extending to them an offer of lines of credit, it seemed like a natural fit for their needs.

Often times real estate investors and business owners need cash and working capital for unexpected reasons or have opportunities that they can increase profits if they had more liquidity. Gelt Financial wants to solve those needs!

Contact Us today for all your non-bank commercial mortgage needs.

Private Money Lender – Related posts

As prices in several markets dip for the year 2019, a lot of people are reminded about companies going bankrupt. Consumers are not the only ones affected by this - [...]

We are pleased to help another small business owner and provide them with a cash-out refinance the mortgage on a liquor store they owned in Dearborn, Michigan, they came to [...]

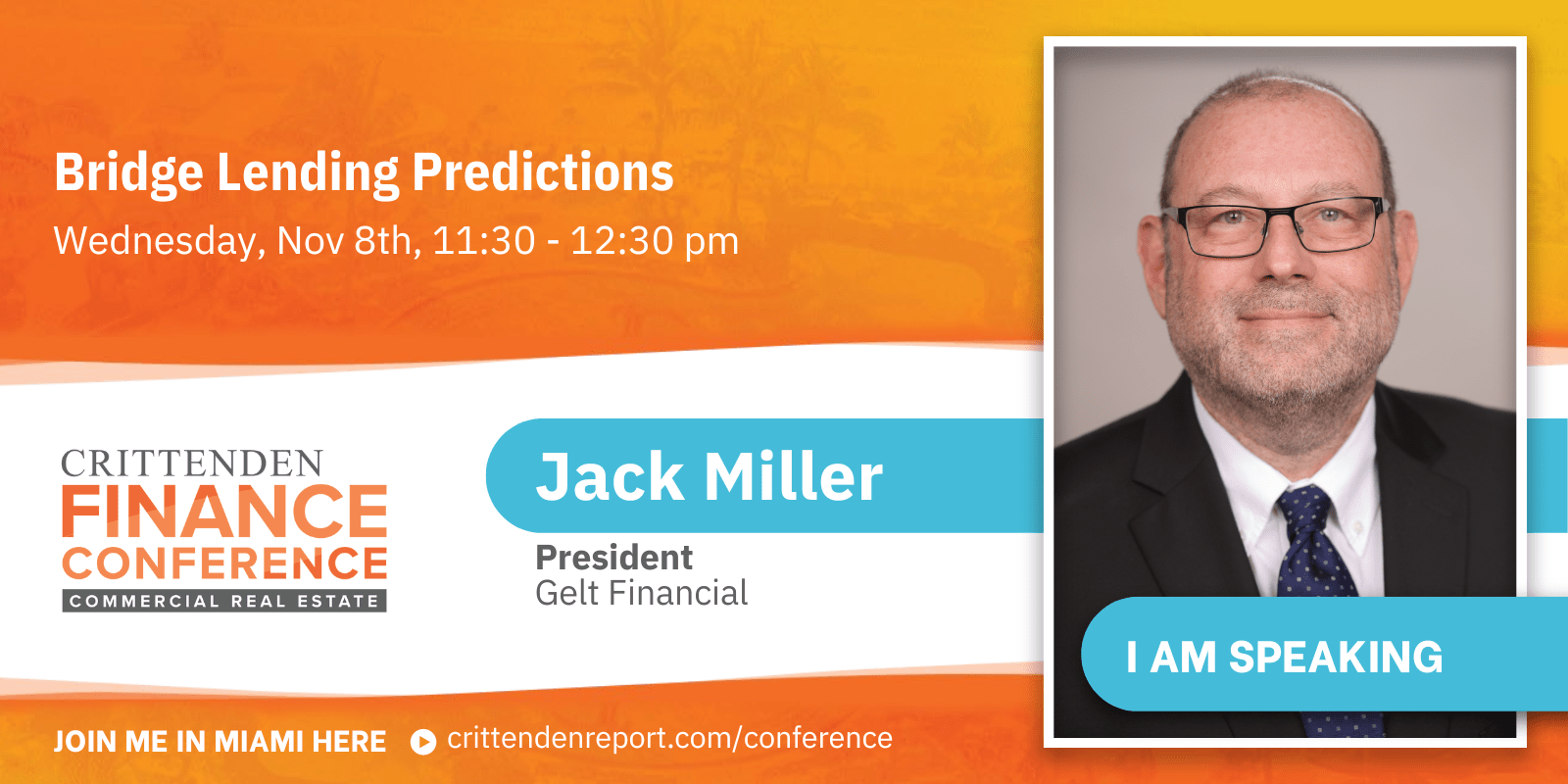

For 43 years, The Crittenden Real Estate Finance Conference has been the industry’s leading educational and networking event. This two-and-a-half-day conference caters to CRE professionals and featured nine hours of [...]

Gelt Financial, LLC is pleased to sponsor and support SafeTALK a three-hour suicide alertness and prevention training, developed by Livingworks, which is an innovative workshop that provides participants with tools, [...]

Fill Gaps in the Capital Stack Alternative financing options for small-balance investors are gaining traction Written By Noah Miller, Vice President of Gelt Financial LLC Featured article in Scotsman Guide [...]

We are excited to once again step in and help those who banks won’t. In this case, it was owners of a mixed use property in New Jersey which we [...]

Thinking about a mortgage loan from a big-name bank or a private mortgage lender, but you aren’t sure which one to choose? Think again—the differences will [...]

Even though mortgage rates are reaching record lows, business owners and self-employed professionals are having difficulties participating in the financial opportunity. Leading news outlets are reporting that it is continuously [...]

Auto Body Shop in St Louis, Missouri, No income qualification with credit challenges for a 3-year term. Our No Income Qualification Refinance Options We are fast and flexible, deal directly [...]

Gelt Financial, LLC recently closed a blanket mortgage on three retail properties in foreclosure, though a series of bank mergers the latest bank put this paying loan in default [...]

Here Are A Few Likes and Dislikes For Mortgage Brokers Dislikes Sorry we do not lend on land or development deals (it's not that we dislike these it's we don’t [...]

This borrower’s seller-financed mortgage came due to his commercial condo space. Gelt Financial, LLC was able to assist the borrower in refinancing his commercial property from which he runs his [...]

Granite City, IL- We did the loan solely on the property 24-month term. Mixed Use property refinance Non-U.S. resident credit Foreign national Lives and works overseas No credit No personal [...]

There’s something about non-bank commercial lenders that’s got everyone jumping for joy in the financial world, but what gives—why are these lenders in such hot demand🔥 as opposed to [...]

Small business is the heart of America, so we jumped on the opportunity to provide first mortgage financing on a mixed use building in VA, when someone approached us saying [...]

Jack attended the Crittenden Financing Conference in Miami, Fl September of 2018 and was there meeting with industry leaders, people speaking about the latest trends, challenges, and opportunities with his [...]

For 50 years, The Crittenden Real Estate Finance Conference has been the industry’s leading educational and networking event. This two-day conference caters to CRE professionals and features educational sessions and networking [...]

A closed first mortgage in Atlantic City, New Jersey, Mixed-use, no income verification mortgage. Self-employed business owner. When your bank says No, we say Yes. Contact us on 561-221-0900 or [...]

Gelt Financial Announces Funding of $150,000 retail property in Hallandale Beach, Florida. Gelt Financial, a leading commercial real estate direct lender, announced the closing of a $150,000 cash-out refinance [...]

Gelt Financial Announces Funding of $200,000.00 Office Building in Ohio Gelt Financial, a leading commercial real estate direct lender, today announced the closing of a $200,000 first purchase money [...]

About 18 months ago we received a referral from a workout attorney, he had a client who owned a multi-location small business. Their current lender a local bank had [...]

Gelt offers to finance to real estate investors and commercial property owners with programs that include no income verification mortgages, Bank turn downs, and credit problems welcomed, bridge mortgages, [...]

In this video, Michael discusses how Gelt Financial handles prepayment penalties on commercial mortgages. They offer a creative solution by negotiating an exit fee that allows clients to avoid paying minimum [...]

In the video, Jack shares an interesting story about closing a 100% loan-to-value deal on land in Ohio. Despite not typically offering land loans, Gelt made an exception due to the [...]

Marcy and Jack talked about a bridge Mortgage loan that just closed on a single-tenant Humana Healthcare leased property while doing some social distancing. "Jack: Hello! this is Jack, (*Hi! *) that's [...]

Gelt Financial provides first mortgage financing on a medical office building in Ohio for a service business. "Jack: Hello, this is Jack, and Marcy... you know what, Marcy, during a little [...]

Jack Miller and Marcy talk about a $500,000.00 loan we provided an CRE investors securing a 11% minority non liquid ownership interest in a Multi Family Partnership. Marcy: Hi Jack. Jack: [...]

Gelt Financial just closed a commercial office bridge loan in Orlando, Florida in 4-5 working days, When Gparancy contacted us and told us this was a super rush deal, we did it. [...]

Gelt closed another Mobile Home Park Mortgage Closed in Indiana. Remember, when your bank says NO, we say YES! "Jack: Okay, Marcy Berger, we're here. Marcy: We're here. Hi, guess what? [...]

Jack and Marcy go into detail on how to get 100% financing on Commercial and investment real estate. There is a lot of talk about this, but we drill down and [...]

In the video, Jack explains the secondary mortgage market, where loans are bought and sold as assets. He discusses how loans, including mortgages, can be sold by originators and owners in [...]

Some tips for Mortgage Brokers from Jack Miller at Gelt Financial, LLC on how to be a more successful mortgage broker. Gelt has worked with brokers for over 30 years and is [...]

Gelt has been helping commercial real estate and investment borrowers since 1989. When your bank says NO, we say YES. "Jack: So, what— a little interview. Marcy: Sure. Jack: A little [...]

Jack Miller speaks to mortgage brokers and talks about doing business together and some things to know.

In Foreclosure Bail Out, commercial Property in Brooklyn NY, it discusses Gelt Financial's provision of foreclosure bailout loans for commercial properties in Brooklyn, New York. It emphasizes our ability to quickly [...]

Gelt is now lending on Cannabis properties."Marcy: Hi, it's Marcy.Mario: It's Mario.Jack: It's Jack from Gelt Financial.Marcy: We're doing a shoutout today for cannabis.Mario: Oh, yay, cannabis. So, we're now supporting all [...]

In the video, Jack discusses JV equity in real estate investment, where partners provide the down payment and others find and manage the property. Gelt Financial offers JV equity to investors [...]

In the video, Jack explains the difference between recourse and non-recourse loans. Recourse loans involve personal guarantees, making the borrower liable if the property can't cover the debt. Non-recourse loans, on [...]

What is a LTV Loan to Value and how do we calculate it? This is not a cut and dry question. "Marcy: Hey Jack Jack: Hey Marcy, let's talk today about [...]

Jack Miller and Marcy talk about a fast closing on a mixed use property in New Jersey that a residential mortgage broker brought to us when no one else could close [...]

Networking is a great source of business for mortgage brokers, Jack and Marcy at Gelt talk a little about it. "Jack: Okay, Marcy. So, like our YouTube channel or wherever you're [...]

Jack and Marcy share some real-life tips for commercial Mortgage Brokers: "Jack: Okay, we're starting; we're improvising here. Marcy: Yes, because we have had mechanical problems this morning. Jack: I'm embarrassed [...]

Gelt Financial closes a rehab mortgage to finish a property in Birmingham, Alabama. "Jack: Hello, this is Jack and Marcy at Gelt. Anyway, okay, new closing property in Birmingham, Alabama. Tell [...]

Gelt closes on a first mortgage cash out refinancing for $300,000.00 on a strip of stores in Detroit. "Jack: Hello, everyone. This is Marcy and Jack. Marcy, what deal are we [...]

The video explains the definition of Note on Note Financing. It is the practice of buying and selling notes, typically related to mortgages and debts. Investors look for discounts and consider [...]

Jack Miller goes into detail on why real estate investing is the best inflation hedge and investment. He goes over it step by step. "Hello, this is Jack Miller. I hope [...]