Closed First Mortgage Atlantic City, New Jersey, Mixed use, No income Verification Mortgage

A closed first mortgage in Atlantic City, New Jersey, Mixed-use, no income verification mortgage. Self-employed business owner. When your bank says No, we say Yes. Contact us on 561-221-0900 or www.Geltfinancial.com

We are fast and flexible, deal directly with the decision-makers. When your bank says No, We say Yes. 561-221-0900 or www.Geltfinancial.com

Gelt offers to finance to real estate investors and commercial property owners with programs that include no income verification mortgages, Bank turndowns, and credit problems welcomed, bridge mortgages, foreclosure buy out mortgages, foreign national programs, Contact us online at www.Geltfinancial.com or 561-221-0900

Purchase, Refinance, Storied Loans Bridge Financing, Debtor in possession, Joint Ventures, Equity / Mezzanine, Foreclosure/DPO, Partnership Buyouts, Subordinated Debt, Acquisition, Judgement Payoffs, Note Financing, Recapitalization, Rehab, and Value Added deals.

No Income verification and Light documentation, Blanket Loans, Foreign nationals, Non-Recourse programs, commercial Second mortgages, No seasoning programs, discount note purchasing financing, joint ventures, mezzanine, preferred equity and partnership programs, No minimum credit scores, 100% Gift funds, no look back on previous bankruptcies and foreclosures.

Private Money Lender – Related posts

Gelt Financial, LLC is pleased to announce that is has purchased the debt of two Multi Family mortgages that are in Chapter 11 Bankruptcy. According to Jack Miller, Gelt’s president, [...]

Gelt Financial, LLC is pleased to provide financing for an owner of a 6 unit multi-family investment property in Cincinnati, Ohio. This was No income verification cash-out refinance with a [...]

JUST CLOSED! Congratulations to our client on securing $328,250 for a Sale-Leaseback transaction on a ready-to-rent townhome in Atlanta, GA. The loan was structured at 65% LTV, providing the [...]

Whether you’re a one or two-person shop or a large, correspondent lender that lends across the state or across the country, you know there are times when you get a [...]

Gelt Financial assisted the owner of a 35 unit apartment building in North Huntingdon, PA in arranging a cash-out refinance using the Freddie Mac Small Balance Loan program. The Borrower [...]

Gelt Financial has successfully closed a $400K purchase loan for a beautiful one-bedroom, one-bathroom condominium unit in Miami, FL. This property, valued at $665K, is primed to become a [...]

Georgia Retail First Mortgage: Gelt Financial LLC has provided a First Mortgage loan on a 15,000 SF retail strip center in Augusta, GA. Gelt is flexible with how we structure [...]

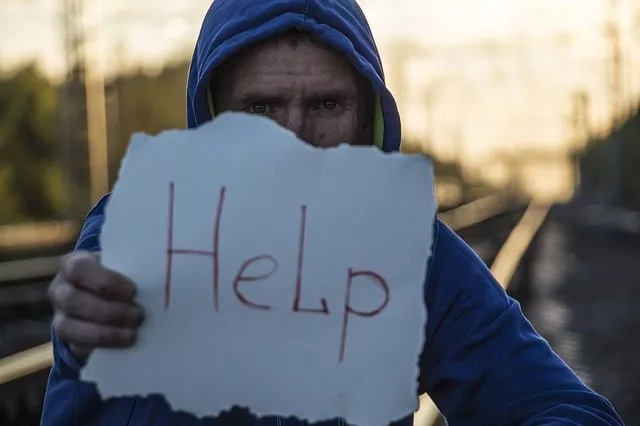

Gelt Financial, LLC is pleased to sponsor and support SafeTALK a three-hour suicide alertness and prevention training, developed by Livingworks, which is an innovative workshop that provides participants with tools, [...]

Closed Loan, Philadelphia the home of the Super Bowl Champion Eagles, vacant Mixed-use property, the buyer was purchasing to fix up and rent out. When your bank says No, we [...]

When submitting loan requests to a private lender, it is important to provide as much information as you can to get a quick response and ensure that your deal is funded. [...]

Gelt Financial has closed a First Mortgage Refinance on a convenience store in Charleston, SC. The property has been owned by a successful operator and they needed to refinance out [...]

We are pleased to provide financing to a condominium Association that was in Chapter 11 Bankruptcy, in the Atlanta, GA area. The funding we provided them allowed them to exit [...]

Just Closed! Gelt Financial just funded a $360K refinance for a single-family home in Bonita Springs, Florida—a market that continues to grow and appreciate. This loan came together [...]

Gelt Financial recently arranged $9.8 million in commercial first mortgage financing for the real estate holding company of a large substance abuse recovery center. The company acquired three properties in [...]

We are excited to once again step in and help those who banks won’t. In this case, it was owners of a mixed use property in New Jersey which we [...]

JUST CLOSED! Gelt Financial just funded a $130K Note-on-Note financing deal for a warehouse in Oakhurst, NJ . The borrower already held the 1st mortgage, making it the perfect [...]

JUST CLOSED IN BROOKLYN, NEW YORK! Gelt Financial is proud to announce we just closed a $450K First Mortgage on a mixed-use property in Brooklyn, NY. The building was [...]

For 43 years, The Crittenden Real Estate Finance Conference has been the industry’s leading educational and networking event. This two-and-a-half-day conference caters to CRE professionals and featured nine hours of [...]

Just Closed! Gelt Financial has successfully closed a $715,000 blanket refinance for three single-family homes in Vero Beach, FL. The properties, all located in the same neighborhood, were refinanced at [...]

CLOSED! 👊 Gelt Financial just closed on a $100k first mortgage on an office building in Greensboro, NC. To learn more about Gelt Financial’s lending capabilities and its advantages to [...]

JUST CLOSED IN ATLANTA, GEORGIA! Gelt Financial is excited to announce we just closed a First Mortgage on a gas station in Atlanta, GA. Our repeat borrower is a [...]

We are excited to announce a closing under our new Small First Mortgage Lending Program of a $75,000 first mortgage on a day care center in the suburbs of Philadelphia. [...]

Private money lenders are the secret weapon among commercial real estate investors and the reason behind the thriving commercial mortgage industry. Bridge loans and bridge mortgages play a critical [...]

JUST CLOSED IN SEVEN BUSINESS DAYS! Gelt Financial just closed a $750K First Mortgage on a retail building in Fort Lauderdale, FL. This loan needed to close FAST, and we [...]

Jack Miller gives some tips for mortgage brokers. Gelt has been helping commercial real estate and investment borrowers since 1989. When your bank says NO, we say YES! "Hey, hope you're [...]

Gelt is now lending on Cannabis properties."Marcy: Hi, it's Marcy.Mario: It's Mario.Jack: It's Jack from Gelt Financial.Marcy: We're doing a shoutout today for cannabis.Mario: Oh, yay, cannabis. So, we're now supporting all [...]

In this video, H. Jack Miller shares his passion for helping real estate investors and small business owners secure financing, particularly when traditional banks decline. With over 35 years in the [...]

Mobile Home Park closes, in Long Island, NY Gelt has been helping commercial real estate and investment borrowers since 1989. When your bank says NO, we say YES! "Jack: This is [...]

Gelt Financial provides a First Mortgage on a Fire damaged Investment property in Baton Rough, LA.

In the video, Jack explains the concept of a blanket or cross-collateralization mortgage. It involves combining multiple properties into one mortgage, allowing borrowers to tap into equity in one property to [...]

Gelt closed on strong value add deal in a major city, providing 100% financing. The property was purchased at a foreclosure auction, leased back to the owners and sold for a [...]

Jack and Marcy go into details and talk about Whats needed to have a 4 day closing on a investment or commercial mortgage. It happens all of the time, but all [...]

Real estate investors, DON'T depend on anyone else when doing your background or due diligence for your real estate projects. This can backfire on you or cause complications. "Hey, this is [...]

Gelt Financial loves working with Mortgage Brokers, and a very common question is how they get paid. This very short video answers that question. "Jack: Michael, how do Brokers get paid? [...]

Gelt Financial provided a new first mortgage foreclosure bailout loan on a mixed use property ion Brooklyn, NY. The mortgage broker called us and we approved and close the loan without [...]

Gelt has been helping commercial real estate and investment borrowers since 1989. When your bank says NO, we say YES! "Marcy: Hi, Jack. Jack: Hey, Michael and Marcy. I'm on the side [...]

In the video, Jack shares valuable tips on the importance of paying attention to the details when investing in real estate. He emphasizes the need for personal involvement in conducting due [...]

In the video, Jack shares negotiation tips for property deals. He emphasizes the "Art of Negotiation is to Analyze" -- the importance of analyzing the situation, listening actively, and keeping one's [...]

Another deal closed! Gelt Financial discusses their recent closed loan on a 400k second mortgage in Tampa, FL. No appraisal, 85% debt. Interest only, short term, six month deal. We focused [...]

Markets and the needs of borrowers are always changing, in order for a mortgage broker to survive and serve the needs of borrowers, they need to pivot. Foreclosure bailout loans and [...]

Jack Miller and Marcy closed a very quick closing in Florida for a real estate investor on a single family investment property."Marcy: Hi Jack.Jack: Hey Marcy, how you doing? Our first video [...]

Gelt just provided a experienced real estate investors and repeat borrower of Gelt's financing on land in Miami, Florida that's zoned for 9 units. "Jack: We're on. Marcy: Hi, how are [...]

Gelt Financial just closed two fix and hold JV equity Mortgages, were we provided 100% Financing to our partner. Gelt has been helping commercial real estate and investment borrowers since 1989. [...]

Jack Miller talks about surviving a down term. How he survived numerous downturns and reinvested the company. What he learned along the way. "Well, this is Jack Miller. I hope this [...]

Gelt Financial offers financing to HOA and Condo associations. There are plenty of associations who don't have time or cant go to a bank. What's when Gelt steps in and privies [...]

Term sheet signed Black Friday, deal ready to close Wednesday. Broker contacted us when bank did not close and needed a very quick close. We did it! "Jack: Hi, Jack and [...]

Jack Miller speaks to mortgage brokers and talks about doing business together and some things to know.

When a borrower ran short of capital to complete the repairs and their current lender would not lend them more money, Gelt step up and approved a second mortgage. "Jack: Hey, [...]