Dr. George Selgin, Director of Monetary policy at CATO Institute with Jack Miller 10-3-18

Jack Miller, President of Gelt Financial, LLC talks to Professor George Selgin, Director of the Cato Institute’s Center for Monetary and Financial Alternatives. Author and world-known economics expert join us to discuss the great recession, the governments actions, and how those actions worked or did not work, to big to fail, the government take over of banks and FNMA and Freddie Mac. The moral hazards and lines crossed during the recession as well he tells us what he thinks of the economy now and what lessons should be learned from the past. Did we fix the problem? twitter.com/catocmfa https://www.facebook.com/CatoCMFA/

Private Money Lender – Related posts

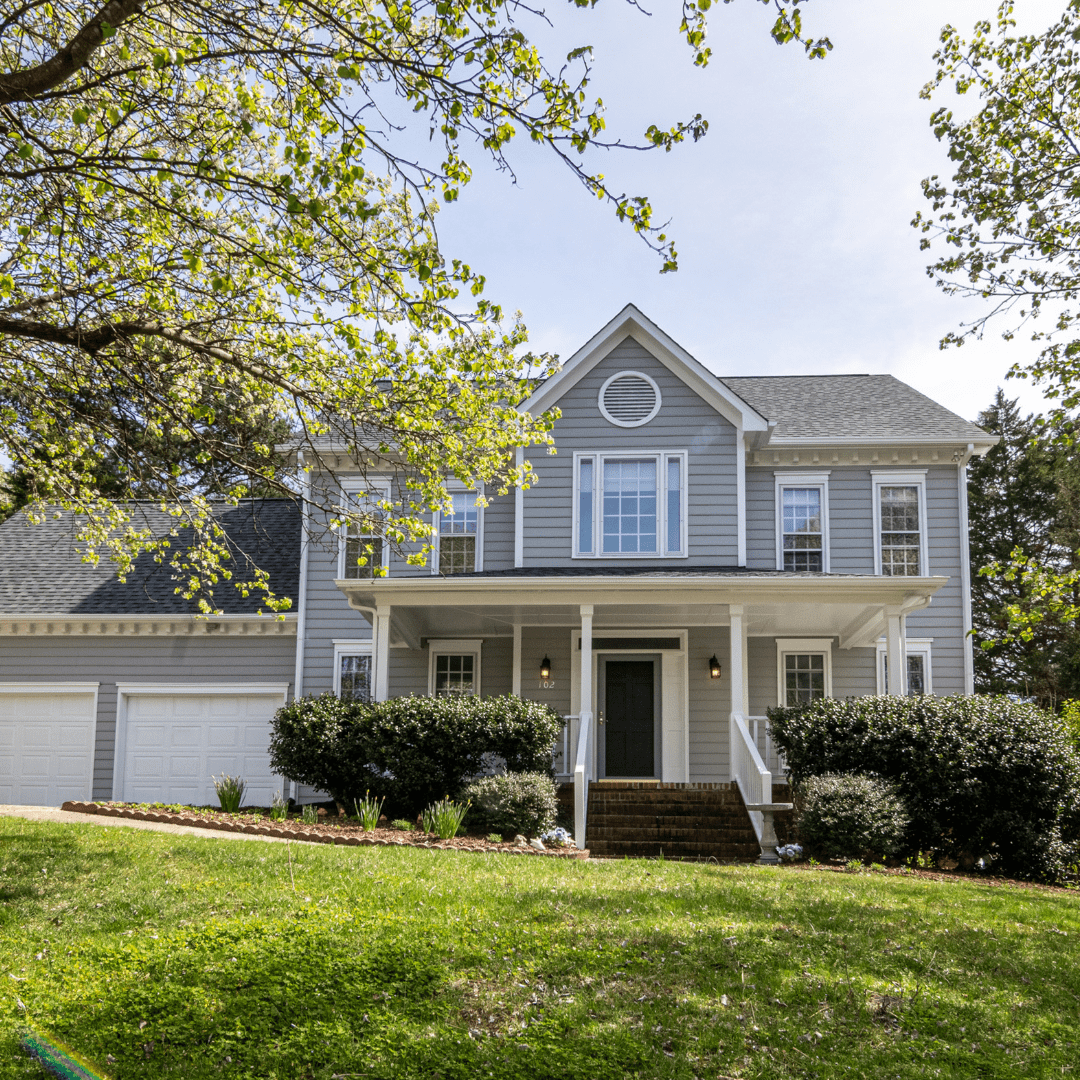

Gelt Financial just funded a $450,000 refinance loan for a single-family home in beautiful Charleston, SC. The borrower plans to renovate the property and turn it into a rental. With a 64% LTV and no income verification required, this deal highlights the flexibility we bring to real estate investors. Looking for creative financing? We can help. When your bank says NO, we say YES! About Gelt Financial Gelt Financial is a [...]

Gelt Financial president H. Jack Miller was recently featured as a real estate expert in the BiggerPockets article "Everything Around It is Collapsing, But This One Last Property Type Remains [...]

Gelt is pleased to have relocated its offices to 5300 Atlantic Ave, Suite 205, Delray Beach, Fl 33484, We are very excited about this move it will give us the [...]

Just Closed! Gelt Financial just funded a $135K cash-out refinance for a single-family home in Baton Rouge, Louisiana! This deal came in at a 49% LTV — a strong, low-leverage, collateral-based loan with no income [...]

JUST CLOSED IN CHATTANOOGA, TENNESSEE + MACON, GEORGIA + DANVILLE, ILLINOIS! Gelt Financial is pleased to announce that they recently closed a $4.3MM First Mortgage on a NNN Portfolio [...]

Small business is the heart of America, so we jumped on the opportunity to provide first mortgage financing on a mixed use building in VA, when someone approached us saying [...]

We are pleased to have secured asset-based financing for a telecommunications and IT company in Chapter 11 Bankruptcy providing them with an accounts receivable line of credit. Prior to contacting [...]

Gelt Financial has closed a First Mortgage on the purchase of an auto body shop in Winter Haven FL. This was a purchase by and operator, who is following his [...]

Granite City, IL- We did the loan solely on the property 24-month term. Mixed Use property refinance Non-U.S. resident credit Foreign national Lives and works overseas No credit No personal [...]

Closed Loan, Gelt was able to assist this borrower obtain financing for her vacant Single-Family investment property in upstate NY. The property has been vacant for some while and with [...]

Are you wondering about what your options are for commercial mortgages? The good news is that you aren’t limited—you’ll come to discover the terminology of hard [...]

JUST CLOSED IN FORT LAUDERDALE, FLORIDA! Gelt Financial just closed a $600K First Mortgage on a retail building in Fort Lauderdale, FL. The borrower was having trouble finding a [...]

Even though mortgage rates are reaching record lows, business owners and self-employed professionals are having difficulties participating in the financial opportunity. Leading news outlets are reporting that it is continuously [...]

Just Closed in Willingboro, NJ! Gelt Financial just funded a $670K refinance for a unique project—a former bank being converted into a cannabis dispensary. Traditional banks wouldn’t touch the deal [...]

Dip Lending, LLC is pleased to announce that it has just closed a commercial real estate loan first mortgage in New Jersey for a real estate investor in Chapter 11 [...]

JUST CLOSED IN ATLANTIC CITY, NEW JERSEY! We have a story for you. An American Dream come true. Last week we received a $65k payoff from a family who [...]

Noah Miller, Vice President of Gelt Financial LLC, was featured on Bloomberg Radio with host Matt Miller and Paul Sweeney. Miller discussed the health of the real estate market and [...]

Thinking about a mortgage loan from a big-name bank or a private mortgage lender, but you aren’t sure which one to choose? Think again—the differences will [...]

About 18 months ago we received a referral from a workout attorney, he had a client who owned a multi-location small business. Their current lender a local bank had [...]

Written by Beth Mattson-Teig of WealthManagement.com contributing expert Gelt Financial The increased capital flowing to the preferred equity space far outweighs the volume of available deals. Real estate investors looking [...]

Gelt Financial, LLC is pleased to provide financing for an owner of a 6 unit multi-family investment property in Cincinnati, Ohio. This was No income verification cash-out refinance with a [...]

We want to earn your business, until the end of April, there is no appraisal cost on some new loans, No income verification, and Foreign national mortgages. call us today [...]

Gelt Financial has provided a First Mortgage on a Single Family Investment Property in Boise, ID. "Gelt is flexible with how we structure deals and that gives us a real [...]

We are pleased to help another small business owner and provide them with a cash-out refinance the mortgage on a liquor store they owned in Dearborn, Michigan, they came to [...]

Jack Miller goes over why commercial banks will call in or default on a commercial mortgage loan even when the loan holder is on-time with the payments. "Hi, this is Jack [...]

Networking is a great source of business for mortgage brokers, Jack and Marcy at Gelt talk a little about it. "Jack: Okay, Marcy. So, like our YouTube channel or wherever you're [...]

Gelt Financial closes a rehab mortgage to finish a property in Birmingham, Alabama. "Jack: Hello, this is Jack and Marcy at Gelt. Anyway, okay, new closing property in Birmingham, Alabama. Tell [...]

Jack Miller gives a little background on what a Loan Loss reserve or an Allowance for a loan loss reserve is in lending. "Hi, this is Jack Miller. I want to [...]

In the video Jack explains the concept of phantom income in real estate investing. Phantom income refers to situations where investors may not receive cash distributions despite owning a share of [...]

Gelt Financial, LLC just closed a $50,000.00 first mortgage on an office building in Kansas City, for a real estate investor. Gelt focuses on closing small commerical and investment mortgages. "Jack: [...]

Gelt Financial is a South Florida based Private lender and will provide financing for rehabs, construction and land in South Florida: "Marcy: Hi Jack. Jack: Hey Marcy. So, we want to [...]

Gelt Financial loves providing Real Estate Investors and Small Business owners the small balance mortgage financing they need. We Finance Cannabis Retail locations, contact us to learn more. [...]

Gelt Financial just closed a collateral-only first mortgage on a commercial property in Fort Lauderdale, FL, within 10 days. "Marcy: Hi, this is Marcy and Michael, and we're going to talk [...]

Gelt Financial loves Chicago! We love to do business in Chicago. When your bank says no, we say YES! #privatelending #commercialrealestate #Chicago "Marcy: hi. Jack: hey, it's Jack and Marcy at Gelt [...]

Listen and uplift people. Commercial Mortgage Broker Tip of the Day and Advice for Commercial Mortgage Brokers. "Jack: Marcy and Jack, so we want to make our mortgage broker tip of [...]

Gelt Financial just closed two fix and hold JV equity Mortgages, were we provided 100% Financing to our partner.

In this video, Jack discusses a closed deal in Chesapeake, Virginia. Wherein $220,000 is provided, first mortgage on a mixed-use property to a real estate investor with poor credit. The borrower [...]

In the video, Jack shares an interesting story about closing a 100% loan-to-value deal on land in Ohio. Despite not typically offering land loans, Gelt made an exception due to the [...]

Gelt Financial provides first mortgage financing on a medical office building in Ohio for a service business. "Jack: Hello, this is Jack, and Marcy... you know what, Marcy, during a little [...]

Gelt Financial closes a cash out, mixed use, no income verification mortgage in Indianapolis, IN. "Marcy: Hi. Jack: Hi, this is Jack and Marcy at Gelt. Marcy: How are you? Jack: [...]

Gelt Financial provides mortgage debt on owner occupied business properties: "Jack: Okay, Marcy. Marcy: Hi! Jack: Yeah, we're here. Oh, remember, I always forget, like this, wherever you're seeing YouTube or [...]

Jack and Marcy share some real-life tips for commercial Mortgage Brokers: "Jack: Okay, we're starting; we're improvising here. Marcy: Yes, because we have had mechanical problems this morning. Jack: I'm embarrassed [...]

Gelt closes on a first mortgage cash out refinancing for $300,000.00 on a strip of stores in Detroit. "Jack: Hello, everyone. This is Marcy and Jack. Marcy, what deal are we [...]

In Bridge Mortgage Loan Paid Us Off | Bridge Loans the video discusses a successful payoff of a bridge mortgage loan from Gelt Financial. The borrower owned three properties but had [...]

Gelt Financial does the processing for mortgage brokers. Gelt has been helping commercial real estate and investment borrowers since 1989. When your bank says NO, we say YES!

Gelt Financial focuses on Small Balance- Business Purpose, Investment and Commercial Private Mortgages. We love loans under 1 Million. Private Lending without any red tape and log delays of banks. Gelt [...]

Gelt just closed on a Bridge to Agency short term mortgage solution on Multi Family in Chicago, we were called to private quick financing when it was clear the the permeant [...]

What’s needed for a fast and smooth mortage closing at Gelt Financial? And what can cause delays? Go behind the scenes with Jack Miller and Marcy Berger at Gelt Financial to [...]