Jack Miller discusses financing and buying real estate at auctions. He advises caution, emphasizing the need for thorough planning, due diligence, and having financing in place. He also mentions that auctions can present profitable opportunities if approached with caution. He provides examples of successful deals that Gelt Financial has been involved in, highlighting the importance of having a reliable lender who understands auction dynamics:

Hi, this is Jack Miller. I hope you are having a good day. I wanted to talk to you about financing commercial real estate, really could be residential real estate, at auctions. So, the short answer is yes, you can, and our company, Gelt Financial, provides that financing. But like everything else, the devil’s always in the details. But the quick answer is yes.

So, first of all, I want to go into how most of it works. Auctions typically have no financing contingencies, and you have to do all of your due diligence upfront. Once you put your deposit down, it’s hard, which means if you don’t close, you’re going to lose your deposit. So, you have to be very sure that you want the property for the price you pay, under the conditions that the property is in, and you have the financing and the is money lined up. That’s critical. Most auctions, in fact, none that I know, frankly, have any financing contingencies.

You know, the reality is you can, some people can make a lot of money buying properties at auctions, but it’s not for the faint of heart. And my personal advice would be, it’s not for most people unless you already have the money and/or you’re highly sophisticated. That’s a disclaimer. So, I would be highly careful about it. Don’t just jump in thinking, “Oh, I’ll bid it up, I’ll get a great deal,” and then if you don’t have the money lined up or if you don’t have all your due diligence lined up, you’re in trouble.

You know, the reality is, in the auction’s world, that you have to look and bid on a lot of auctions, and you have to do a lot of due diligence upfront to get very few. So, you may have to bid, you know, do the due diligence on 10 or 20 or 30 deals, or whatever the number is, have the money lined up, and most of them you’re not going to get. Maybe you’ll get 1 in 10, 1 in 20, and 1 in 30. I don’t know what the number is, but either way, it’s a lot of work, a lot of risk, a lot of time, a lot of money. But let me go on.

So, I think the key thing is planning. I don’t want to be a naysayer because at the end, I’m going to give you some examples that we’ve recently participated in that worked out very well for our borrowers, investors, our partners, and for us. The key is planning, again, as I said, most due diligence, the deposits are hard, which means if you don’t close, you lose it. Depending on the auction, some of them give you 28 days to close, some of them, believe it or not, require you to close within 24 hours. So be careful, be careful, be careful.

A couple other things: you need to be 100% sure that you have the financing and the money lined up. Again, there’s no mortgage contingency. Ideally, you have to have either the money yourself, the money raised, or a relationship with the right lender who knows what’s going on and is auction-friendly. I’ll get into a little bit more in detail.

Make sure you do all the due diligence up front. Remember, as I’ve said a hundred times on these YouTube videos and probably millions of times in my life, people only tell you what they want you to know. I’m not saying they’re deceiving or they’re hiding, but you need to dig around and do the proper due diligence. Don’t just go through it and say, “Oh, okay, it looks good.” The realtor said; “Oh, I can rent it out for X” or “It sold.” You know, the other day we looked at a deal in a pretty big city, and the potential borrower gave me some comps. I said, “Where’d you get the comps?” He said, “The realtor.” I said, “Did you check him out?” He goes, “No”. We did our own comps, and of course the realtor gives you comps. No offense to realtors, but the realtor gives you comps that he wants you to see. And when we did our own comps, we realized that the sale prices weren’t what they gave us. They gave us the top-of-the-line sale prices. There were plenty of lower sale prices. So, understand that there are plenty of lower rental prices. So, do your own research and make sure you know what you’re getting.

Another piece of advice I have for you is a lot of people get caught up emotionally. I’ve learned when you’re bidding at an auction, and they’re online. Write down on a piece of paper your high bid. Don’t go over that high bid. Be very careful because a lot of people, including me, I’ve got caught up on it. You know, you get so caught up in the excitement of an auction. You know, “Oh, what’s another?” If it’s worth X, it’s worth X plus whatever. It would have been a hundred thousand, I’ll bid a hundred and one thousand. Or, you know, it can get out of control really quick. So, be very disciplined in the price you get.

Auction deals, as much as I’m being a naysayer on, are really perfect deals for bridge lenders and companies like Gelt Financial because you can usually, at an auction, you need to stabilize the property. It’s opportunistic. So, with the bridge loan, you could borrow the money, you can stabilize it, you could usually build in the LC (leasing commissions), the TI (tenant improvements), the CAPEX money because we’re asset-based lenders.

On the Gelt side, we also financed sometimes equity, not only the debt on it. I’ll give an example where we offered to do the equity, but they turned us down. Know your lender, it’s critical. Make sure everything is lined up in advance. Make sure they have the capital, make sure they can close in that time frame. Make sure they’re auction-friendly because what’ll happen is if they can’t close, you’re going to lose your money, and that’s a serious thing. You’re putting down big money on this, you don’t want to lose it. Remember, risk and reward. When you’re buying in an auction, they’re much more risky for all the reasons I’ve identified, but the reward can be higher. You just have to make sure you really understand the risks, and most people, in my experience, they look at the rewards and they ignore the risks. Don’t ignore them, again, know what you’re doing.

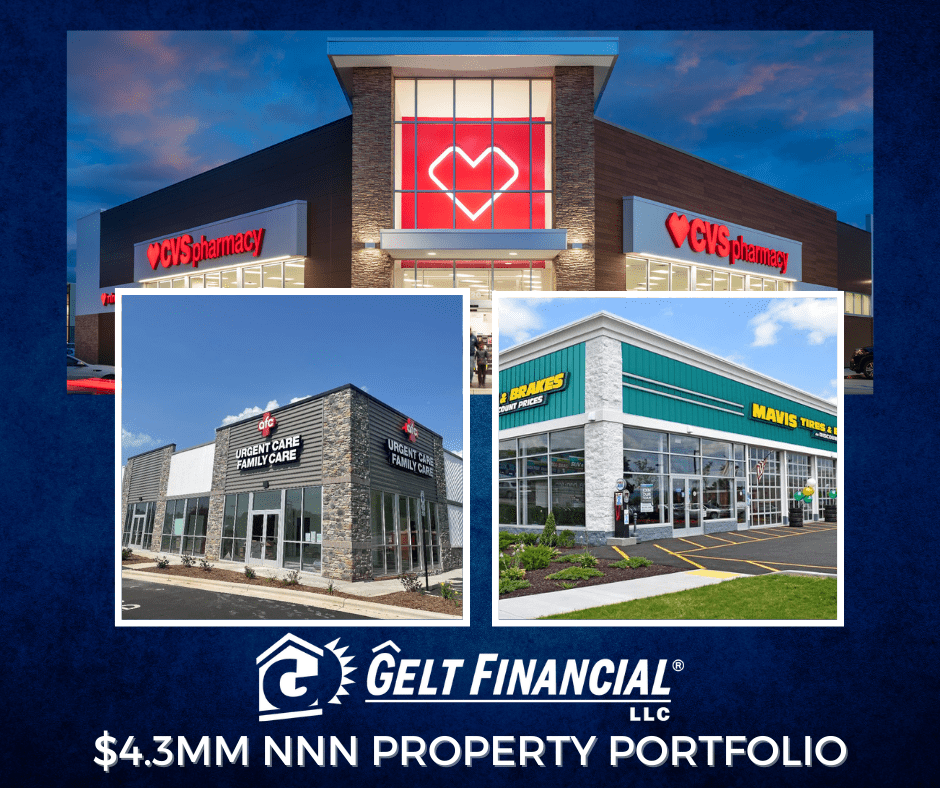

So, a couple examples of deals that we’ve closed in auction that worked out very well for us. One deal was, we got a call, I believe it was like the day before Christmas or maybe even Christmas day, from a couple guys who were buying a shopping center. I don’t remember the exact square feet, but let’s say it was 34,000 square feet. We thought, and by the way, they had to close by the end of the year. They went to another lender who promised them they would do it, the lender dropped it at the last minute, and what happened was, they called us in a panic. We got together, we all fast forward, we closed. But I want to tell you about the deal. They were buying a shopping center; I believe it was for like 30 bucks a square foot.

Really, almost no due diligence. When you looked at it, it looked run down, looked like it needed work, and it looked like about 50% of it was occupied. We looked at the market comps and we said, you know, if this was stabilized, we’d think it would be worth between 125 to 150 square foot, and we think rents would be, you know, 12.50, 15 bucks, somewhere around that triple net per square foot. Even though there were really no histories of tenants, no records, really nothing. We looked and said, you know, for 30 bucks a foot, even if you have to throw all the tenants out, even if no one’s paying, even if you have to start from scratch, and I think we ballparked it, put in 20, 30, 40 a foot in capex, LC, negative cash flow, all this, you’re still way under the market. We financed that. In that case, we lent them, I believe it was 90% of the purchase price and a certain amount of money, I forget the amount, for capex, TI, and LC. In that case, it worked out for them. A side note, I was personally involved in that deal, and I actually offered to put up the equity. We wanted to be their equity partners because they got a fantastic deal. They suffered

with the property for a long time, to be candid with you. There was negative cash flow, tenants didn’t rent, there were more problems than they thought. But ultimately, that will be a home run for them. Now, these were sophisticated guys. They had a good amount of cash on their own. But, again, they were panicked at the end because unless we came through, they might not have been able to close it.

So, that’s one positive example, and it was a fantastic example. And to be candid with you, I wish I would have bought that property. I wish they would have taken me up on the equity because they bought the property so cheap that it covered up a lot of the problems. You know, I have an expression in real estate: if you buy it cheap enough, it covers up all the mistakes that you’re going to have. It won’t matter if you buy it cheap enough. But the problem is, in auctions and in the market, the market’s priced to perfection, and auctions are priced to perfection. So, a lot of times, you’re not buying it cheap. But anyway, that’s one example.

Another example of a positive one was a couple guys approached me. They wanted to buy properties through county sheriff’s sales. In this particular county, you needed to have the deposit in advance of the sale, I think four or five days. And when you had the sale, if you wanted or were the successful bidder at the sale, you had to fund it by the next day, let’s say one or two o’clock. You know, how many people can fund the deed? They have to have a deposit in advance. Maybe you’re going to win, maybe you’re not. And then you have to fund it in advance. Also, there’s no time for title insurance, and you can’t get in to see the properties. You know, who’s going to buy a property without title insurance? You need the money within 24 hours. You can’t see it.

We did a deal with them. They happened to have some cash. And what we worked out was a partnership where they provided the first $300,000 to the partnership as what I call a first loss position. We provided five million dollars in financing, and they bought properties, and we funded them. And we felt comfortable that $300,000 was a safety cushion. I’m giving you, they did certain things to protect the title. They did mortgage and judgment bring downs. They looked for properties that were on the market or were recently on the market, so they had pictures. So, they did certain things in advance to do their due diligence. So, that worked out. I think they wound up doing like 17 or 18 or 19 deals with us or something like that. And then whatever, I think they got a cheaper cost of capital or something happening. But whatever, the bottom line is we can do financing, and you can make a lot of money. But proceed with extreme caution.

So ultimately, the answer is yes, we can do financing, and other lenders can do financing. It can be a vehicle. But go with proceed extreme caution when you’re buying a property at auction, okay? Check us out, remember to like the YouTube, ask questions. We certainly answer them, and we’re here to provide your finance. Remember, check us out at geltfinancial.com and “When your bank says no, We say yes.” Have a great day!

Category: Borrowers