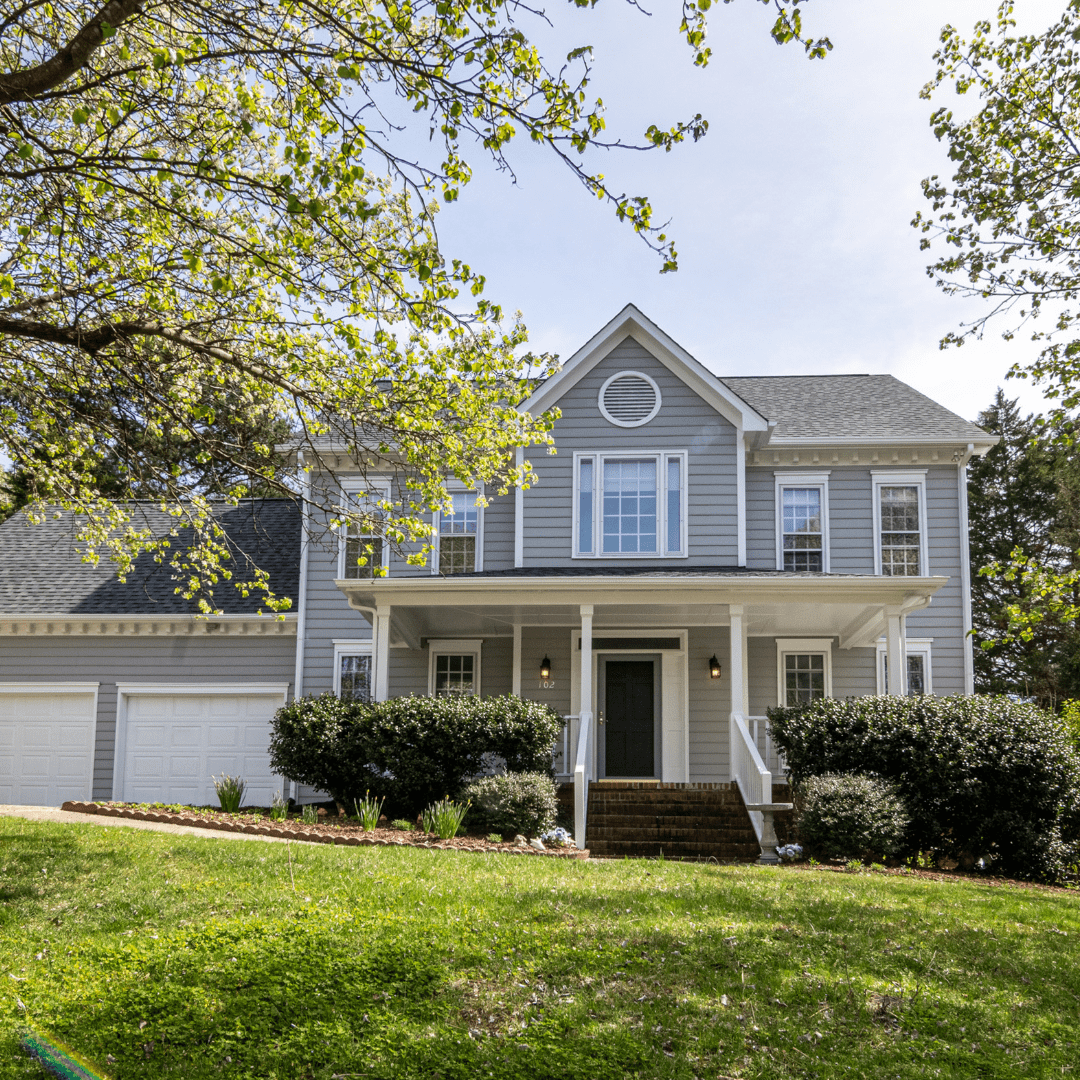

Closed: $250K Second Mortgage Boca Raton, FL

JUST CLOSED IN BOCA RATON, FLORIDA!

Gelt Financial just closed on a $250K Second Mortgage in Boca Raton, FL. Using DIP financing, also known as Debtor In Possession Financing, we provided short-term financing and closed QUICK. An attorney approached Gelt and requested distressed financing for a local borrower in bankruptcy. COVID-19 took its toll and this particular investor needed our help. No income and limited docs.

When your bank says NO, we say YES!

About Gelt Financial

Gelt Financial is a non-bank commercial real estate lender. We have closed more than 10,000 loans totaling over $1 billion since 1989. Gelt focuses on providing debt to non-bank borrowers on all types of commercial real estate, including but not limited to multifamily, office, retail, warehouse, industrial, self-storage, and mixed-use. We offer a wide array of mortgage products including bridge loans, no income verification programs, foreclosure buy-out programs, DIP, JV Equity, and subordinate debt.

Deal directly with the decision-makers. For more info on how Gelt can help you with an investment property or on any of our other various products and services, take a look at what President Jack Miller does on Gelt’s YouTube channel and for more info on our completed deals, check our Deals Done.

Private Money Lender – Related posts

You are debating receiving your real estate loans from either a bank or a private lender. There’s been a lot of talks lately about private lenders like us here [...]

Gelt Financial, LLC was pleased to close on a Blanket Mortgage, two auto-related properties in Ohio for a borrower in Chapter 13.

Noah Miller, Vice President of Gelt Financial LLC, was featured on Bloomberg Radio with host Matt Miller and Paul Sweeney. Miller discussed the health of the real estate market and [...]

Just closed! Another win for an experienced investor. Gelt Financial closed a $300K cash out refinance on a single-family home in Charlotte where the borrower needed funds for light [...]

In this Realtor.com article, real estate experts, including Gelt Financial, weigh in on the lasting lessons from the 2008 housing market crash. Gelt Financial President Jack Miller shares insights [...]

Gelt Financial president H. Jack Miller was recently featured as a real estate expert in the feature “What Happens to My Mortgage If My Lender Goes Bankrupt?” on U.S. News [...]

Purchasing distressed debt, also known as buying non-performing loans, can be a profitable investment strategy for those willing to take on the risk. Distressed debt refers to loans that [...]

DEAL CLOSED IN CHICAGO, ILLINOIS! Gelt Financial just closed on a $900k Bridge-to-Agency Loan in Chicago, IL. This professional investor could not close with traditional financing from Fannie/Freddie due [...]

JUST CLOSED! Gelt Financial is pleased to announce we just closed a $65k loan for a single-family investment property in Augusta, Georgia. With our streamlined process, there was no [...]

JUST CLOSED IN BROOKLYN, NEW YORK! Gelt Financial is excited to announce the closing of a $800K first mortgage in Brooklyn, NY. The investment property was a retail building [...]

Closed loan in 9 days, residential vacant property in New York for sale, no appraisal all cash-out, no income verification. When your bank says no we say Yes. 561-221-0900 or [...]

Just Closed! Gelt Financial just funded a $135K cash-out refinance for a single-family home in Baton Rouge, Louisiana! This deal came in at a 49% LTV — a strong, low-leverage, collateral-based loan with no income [...]

JUST CLOSED! Gelt Financial is excited to announce the closing of a $1,500,000 loan for a Miami, FL Condominium Association with over 160 units. Built in the 1970s, the [...]

Gelt Financial Closes $650K Loan on Jack in the Box Property in Texas — Rush Closing in Just 10 Days

Gelt Financial, LLC, a nationwide private commercial real estate lender, has announced the successful closing of a $650,000 loan secured by a Jack in the Box property in Texas. [...]

Gelt Financial is excited to announce we just closed on a $225k first mortgage on a condo in Miami, FL. Talk about a breathtaking property! Discover more closed commercial [...]

ANOTHER DEAL DONE! Gelt Financial recently closed a $185K First Mortgage in Cleveland, OH, on an owner-occupied warehouse. Gelt does not shy away from complicated financing situations. We work [...]

JUST CLOSED IN TOLEDO, OHIO! Gelt Financial is excited to announce the closing of a $1.7MM First Mortgage in Toledo, OH. This stunning 80k square-foot office/retail building was highly [...]

As the world faces an unpredictable crisis we on the Gelt Financial team are preparing for the worst and hoping and praying for the best. We are reaching out to [...]

If your bank can't help you, we can. We specialize in mortgages that banks won't do. We use commonsense underwriting and offer flexible terms. Quick approvals and closing. [...]

Jack Miller is pleased to speak and take part in a panel discussion “Critical Capital Markets Updates and Office Market Strategies" at the 3rd Annual New Jersey Office Summit Iselin, New [...]

We closed the first mortgage for an experienced fix and flip investor cash out on a newly rehabbed SFR in New Orleans LA. Borrower completed a full rehab on the [...]

Gelt Financial president H. Jack Miller was recently featured as a real estate expert in the Materials Market article "40 Financial Experts Reveal If Investing In Real Estate is Worth [...]

Just Closed! We just funded a $240K cash-out refinance for two single-family homes in Marmora and Westville, New Jersey! This deal was a blanket mortgage with a 43% LTV — a solid, low-leverage, collateral-based loan. [...]

We offer no income verification mortgages on commercial and residential investment properties, 30 year amortizations with no balloons, loans up to 5 Million.

Chicago Office Condo Mortgage Closed, No income Verification for owners of Business. "Chicago, Chicago, that title in town, that title in town. I love it. Bet your bottom dollar that you'll [...]

In this video, Jack discusses a closed deal in Chesapeake, Virginia. Wherein $220,000 is provided, first mortgage on a mixed-use property to a real estate investor with poor credit. The borrower [...]

Jack Miller and Marcy talk about a $500,000.00 loan we provided an CRE investors securing a 11% minority non liquid ownership interest in a Multi Family Partnership. Marcy: Hi Jack. Jack: [...]

Jack Miller Gelt Financial's founder talks about how to become a commercial mortgage broker. Gelt has been helping commercial real estate and investment borrowers since 1989. When your bank says NO, we [...]

Jack Miller and Marcy talk about how to value commercial and investment real estate. Gelt has been helping commercial real estate and investment borrowers since 1989. When your bank says NO, [...]

Gelt closed another Mezzanine loan on 3 properties in 3 states with 3 tenants. this was a Collateral based loan. "Jack: I personally, I'm super excited. We just closed a mezzanine [...]

Gelt Financial loves providing Real Estate Investors and Small Business owners the small balance mortgage financing they need. We Finance Cannabis Retail locations, contact us to learn more. [...]

Jack Miller and Marcy talk about a fast closing on a mixed use property in New Jersey that a residential mortgage broker brought to us when no one else could close [...]

4 Day Commercial Investment Mortgage Closing on an Investment condominium, asset based loan, mortgage broker, no appraisal. Jack: Okay, Michael, tell everyone about the deal that we just closed. Give everyone [...]

Gelt Financial provided a purchase mortgage first mortgage to a family business who is expending to Florida, when they wanted to purchase commercial real estate for their Business to operate in. [...]

Gelt provides Condo and HOA Association Financing when banks won't. Typically banks wont deal with small associations, high delinquency, low reserves or high investor condensations as well as other reasons and [...]

Gelt Financial closes a cash out, mixed use, no income verification mortgage in Indianapolis, IN. "Marcy: Hi. Jack: Hi, this is Jack and Marcy at Gelt. Marcy: How are you? Jack: [...]

Gelt is excited to provide first mortgage financing for the owners of a multi family property in Brooklyn, NY. This property was inherited with a balloon loan that was in default. [...]

Jack Miller goes over why commercial banks will call in or default on a commercial mortgage loan even when the loan holder is on-time with the payments. "Hi, this is Jack [...]

Gelt Financial closes a purchase of a Gas station/ C store in Ohio. "Jack: This is Jack, and Marcy, new socially distanced closing, a gas station in Ohio—Steubenville. I've actually been [...]

Gelt has been helping commercial real estate and investment borrowers since 1989. When your bank says NO, we say YES. "Jack: So, what— a little interview. Marcy: Sure. Jack: A little [...]

JUST CLOSED! Gelt just closed on a non arms length foreclosure bail out mortgage in a Suburb's of Philadelphia. Pa Hear how it all went down from our expert team! "Jack: Michael [...]

Gelt Financial just closed two fix and hold JV equity Mortgages, were we provided 100% Financing to our partner.

Super Rush Closing to save the day. "Jack: Okay, Michael Kelman, tell everyone exactly what happened. Don't spare anything in the last 10 minutes. Michael: We have a broker who has [...]

Jack Miller and Marcy talk a little about marketing basics for commercial mortgage brokers.

Jack and Marcy discuss the current market and share their observations, including the types of deals Gelt is currently closing and not closing, and the reasons behind these decisions. They outline [...]

In the video, Jack shares real estate investing tips. His main advice is to not get too attached to any deal and be prepared to walk away. He emphasizes the importance [...]

Gelt Financial just closed two fix and hold JV equity Mortgages, were we provided 100% Financing to our partner. Gelt has been helping commercial real estate and investment borrowers since 1989. [...]

A Mortgage broker bought us an Office Condo financing request for a business owner who occupied the property and could not verify income and did not quality for bank financing due [...]