Cash Out Refinance for Owner of Liquor Store to expand

We are pleased to help another small business owner and provide them with a cash-out refinance the mortgage on a liquor store they owned in Dearborn, Michigan, they came to us wanting to purchase the adjoining the next door property and expand their business. We provided them with 30-year amortization cash-out refinance mortgage. We love helping investors and business owners and supply them with the capital they need when others are saying no, we say yes.

Private Money Lender – Related posts

After failed attempts with previous lenders, we were able to help borrowers attain financing for the acquisition of a mixed-use Investment building in Newark, NJ. This income-producing property is an [...]

Gelt Financial, a leader in non-bank commercial real estate financing, today announced that it is relocating from Fort Lauderdale, Florida to Boca Raton, Florida. Beginning January 21th, 2016 Gelt Financial’ [...]

This borrower’s seller-financed mortgage came due to his commercial condo space. Gelt Financial, LLC was able to assist the borrower in refinancing his commercial property from which he runs his [...]

Gelt Financial just closed a $400K refinance loan for a medical office building in Odessa, TX. The property sits in a fantastic location with excellent parking, and the borrower came to us with strong business financials. With a low 49% LTV, this deal was a great fit for our flexible lending approach. When traditional lenders say NO, we say YES! About Gelt Financial Gelt Financial is a non-bank commercial [...]

We are pleased to have secured asset-based financing for a telecommunications and IT company in Chapter 11 Bankruptcy providing them with an accounts receivable line of credit. Prior to contacting [...]

Just Closed in Rochester, NH! This borrower came to us in a tough spot—extremely low credit, missed payments, and no time for the usual red tape. We stepped in and [...]

Gelt Financial, LLC is pleased to announce that it has continued its sponsorship and underwriting of the costs involved with the Minhag recovery program in Boca Raton, Fl. When one [...]

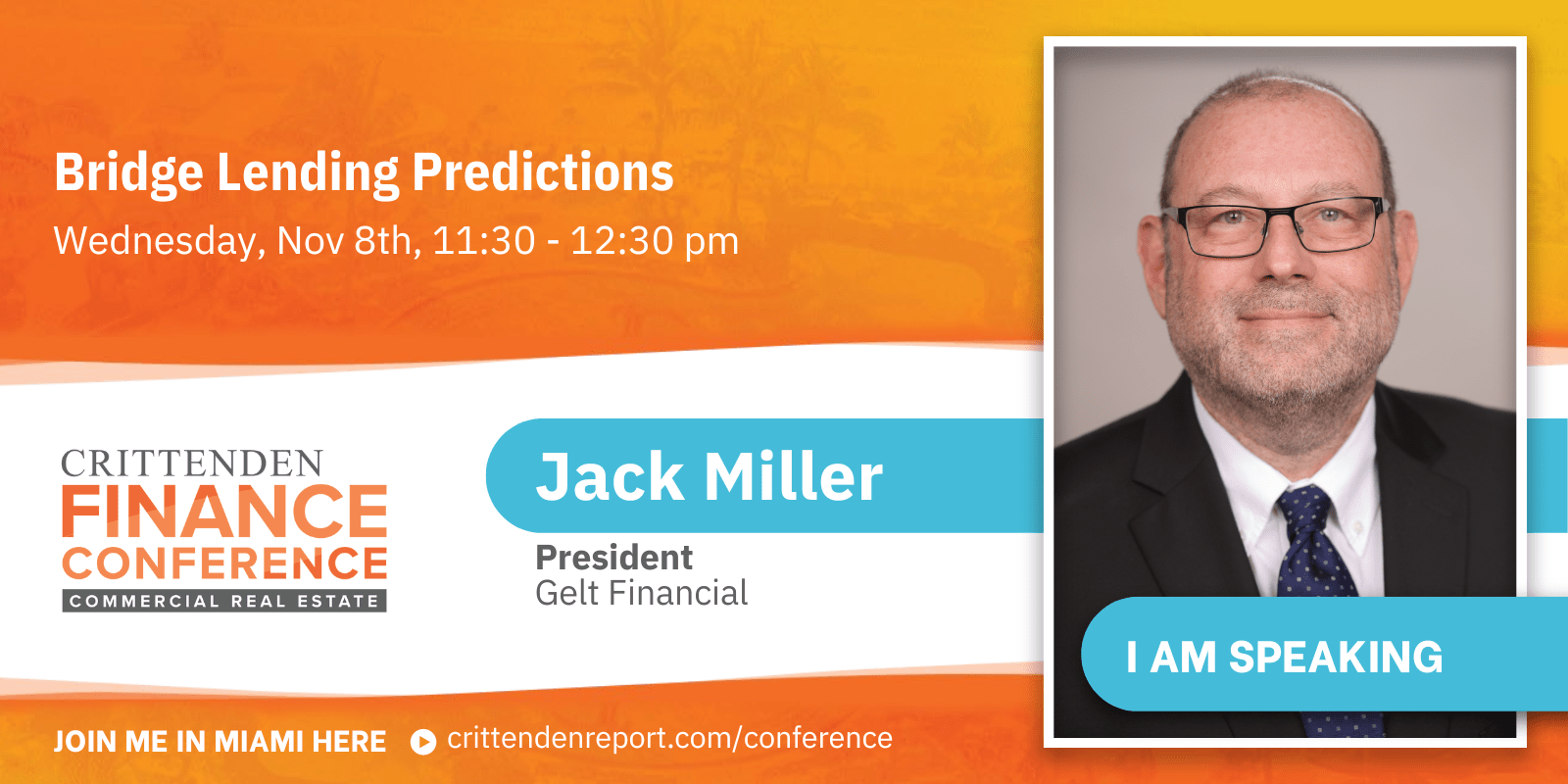

In this Realtor.com article, real estate experts, including Gelt Financial, weigh in on the lasting lessons from the 2008 housing market crash. Gelt Financial President Jack Miller shares insights [...]

Gelt Financial, LLC is pleased to sponsor and support SafeTALK a three-hour suicide alertness and prevention training, developed by Livingworks, which is an innovative workshop that provides participants with tools, [...]

Gelt Financial president H. Jack Miller was recently featured as a real estate expert in the feature "13 Best Ways How To Find Foreclosures to Get a List of [...]

When submitting loan requests to a private lender, it is important to provide as much information as you can to get a quick response and ensure that your deal [...]

TL;DR: What Insurance Do I Need for a Hard Money Loan? • Property insurance (hazard): Covers the physical structure against fire, wind, theft, and damage • Liability coverage: Protects [...]

Borrower cashed out $230k on a 2-bedroom luxury condominium in the heart of downtown Miami, FL. We paid off his first mortgage and gave them a new mortgage of $603k, [...]

Purchasing distressed debt, also known as buying non-performing loans, can be a profitable investment strategy for those willing to take on the risk. Distressed debt refers to loans that [...]

Closed Loan: After being frustrated by other lenders we were pleased to help another real estate investor in Washington DC on the refinancing of his 4-unit multifamily property. We [...]

Gelt Financial arranged a cash-out refinance for a client that owns a single-family investment property. The loan amount was $130,000.00 with a 30-year amortization and no balloon. It was done [...]

Gelt Financial arranged to finance for clients that own a 34-unit multi-family apartment near Pittsburgh, PA. The loan enabled the client to pay off a higher-interest loan and receive [...]

Gelt Financial recently arranged $9.8 million in commercial first mortgage financing for the real estate holding company of a large substance abuse recovery center. The company acquired three properties in [...]

First mortgage closed in Philadelphia on a mixed us property that the owner had purchased and needed to be fixed up. The Investor saw potential value, came to us and [...]

We provided the financing for hard-working self-employed businesswomen to purchase a used car lot and repair center in Philadelphia, PA, under our No income documentation business owner programs. The loan [...]

We are pleased to announce a loan closing on an office building in the suburbs of Philadelphia. Our loan paid off a bridge loan with a 30 year fixed rate [...]

Private money lenders are the secret weapon among commercial real estate investors and the reason behind the thriving commercial mortgage industry. Bridge loans and bridge mortgages play a critical [...]

For 50 years, The Crittenden Real Estate Finance Conference has been the industry’s leading educational and networking event. This two-day conference caters to CRE professionals and features educational sessions and networking [...]

JUST CLOSED IN FIVE BUSINESS DAYS! Gelt Financial is excited to announce we just closed an $840K First Mortgage on an office building in Orlando, FL. This project was [...]

In the video, Jack shares his top 11 reasons to be in the mortgage business. These include no formal education requirement, a consistent demand for mortgage services, high income potential, and [...]

Gelt Provided 100% financing of the sales price on an office Building In Illinois. No appraisal, quick close deal. No appraisal, rush deals, bank and other lender turndowns, and much more [...]

Jack Miller talks about what he leaned by making Toast? How good things take time and effort before you see the results. "Hey, this is Jack Miller. I hope you're having [...]

Gelt is excited to partner with a local real estate investor. We provided 100% debt and equity in a deal where we purchased an office building and leased it out to [...]

Is Gelt Financial a Hard Money Lender or a Private Lender? Whats the difference? What is a subprime lender? "Hi, I hope you're having a good day. I want to make [...]

Gelt Financial closed a 1st mortgage rehab loan in Virginia for a cash out refinance to fix up the property, no appraisal or income verification.

Commercial Mortgage Pawn Shop in Fort Lauderdale, FL "Marcy: Hi, Jack. Jack: Hey, Marcy. To tell people, I should, I say at the end, but I'm going to say at the [...]

Jack Miller Gelt Financial's founder talks about how to become a commercial mortgage broker. Gelt has been helping commercial real estate and investment borrowers since 1989. When your bank says NO, we [...]

Jack and Marcy talk about what is a re trade in commercial and investment real estate? Why and when does this happen? What does it mean to you? "Marcy: Hi, we're [...]

In this video, Jack discusses a closed deal in Chesapeake, Virginia. Wherein $220,000 is provided, first mortgage on a mixed-use property to a real estate investor with poor credit. The borrower [...]

Gelt just closed on a Debtor in Possession for a nonprofit in Chapter 11 Bankruptcy in Boca Raton, Florida. Hear how it all went down from our expert team! "Marcy: Hi, [...]

In C Store Commercial Mortgage Closed, Atlanta Georgia it discusses about a commercial mortgage deal for a convenience store (c-store) located near Atlanta, Georgia. It features the c-store owned by a [...]

In the video Jack explains the concept of phantom income in real estate investing. Phantom income refers to situations where investors may not receive cash distributions despite owning a share of [...]

Jack Miller goes into detail on why real estate investing is the best inflation hedge and investment. He goes over it step by step. "Hello, this is Jack Miller. I hope [...]

Gelt Financial just closed a commercial office bridge loan in Orlando, Florida in 4-5 working days, When Gparancy contacted us and told us this was a super rush deal, we did it. [...]

Marcy and Jack talk a little bit about the increasing interest rate environment and what it means for commercial mortgage brokers and borrowers, and how to take advantage of it. "Marcy: [...]

Jack Miller speaks to mortgage brokers and talks about doing business together and some things to know.

Gelt Financial loves providing Real Estate Investors and Small Business owners the small balance mortgage financing they need. Gelt has been helping commercial real estate and investment borrowers since 1989. When [...]

Gelt financial closes a commercial office building in Atlanta Georgia for the owner of a new business in 4 working days after the bank said no at the 23rd hour. "Jack: [...]

We completed a mixed-use property first mortgage refinance for a non-U.S. resident who is a foreign national and lives and works overseas. He has no credit or no personal income. We did [...]

Gelt is excited to provide first mortgage financing for an owner of a day care center in Chicago. He is an experienced operator and this is a new business for him. [...]

Everyone has challenges at some point or another in their life; each of our challenges is different, but in today's times, a lot of people are falling behind on their mortgages [...]

Jack Miller gives a little background on what a Loan Loss reserve or an Allowance for a loan loss reserve is in lending. "Hi, this is Jack Miller. I want to [...]

Some tips on how a commercial mortgage broker can earn 400k annually."Video Title: Tips on how a Commercial Mortgage Broker can make 400k annually.Speaker: Jack Miller and Michael KelmanTranscript:Jack: Michael, I want [...]