No Income Qualification Refinance of 31 Condominium Units Palm Bay, Florida

We are pleased to close a no income qualification refinance of the first mortgage on this non-owner occupied condominium that the owner has purchased at discounted prices over time. The owner had worked very hard to accumulate these, but his credit score was too low for traditional banks and they did not verify enough income to qualify for a standard bank mortgage.

We are pleased to close a no income qualification refinance of the first mortgage on this non-owner occupied condominium that the owner has purchased at discounted prices over time. The owner had worked very hard to accumulate these, but his credit score was too low for traditional banks and they did not verify enough income to qualify for a standard bank mortgage.

Our No Income Qualification Refinance Options

We are fast and flexible, deal directly with the decision makers.

Gelt Financial offers private financing to real estate investors and commercial property owners with programs that include:

- No income verification mortgages

- Bank turndowns and credit problems welcomed

- Bridge Mortgages

- Foreclosure buy out mortgages

- Foreign national programs

- Hard money loans

- Purchase

- Refinance

- Storied Loans

- Bridge Financing

- Debtor in Possession

- Joint Ventures

- Equity/Mezzanine

- Foreclosure/DPO

- Partnership Buyouts

- Subordinated Debt

- Acquisition,

- Judgment Payoffs

- Note Financing

- Recapitalization

- Rehab and Value Added deals

- No Income verification

- Light documentation

- Blanket Loans

- Foreign nationals

- Non-Recourse programs

- Commercial Second Mortgages

- No seasoning programs

- Discount note purchasing financing,

- Joint ventures

- Mezzanine

- Preferred equity and partnership programs

- No minimum credit scores

- 100% Gift Funds

- No look back on previous bankruptcies and foreclosures

When your bank says No, we say Yes!

Gelt Financial is one of the top hard money lenders in Florida. Contact us at 561-221-0900.

Private Money Lender – Related posts

JUST CLOSED IN QUEENS, NEW YORK! Gelt Financial is excited to announce we closed a $300k First Mortgage on a Single Family Investment Property in Queens, NY. The borrower [...]

Gelt Financial has closed a First Mortgage Refinance on a convenience store in Charleston, SC. The property has been owned by a successful operator and they needed to refinance out [...]

Miami Preferred Equity MultiFamily: Gelt Financial, a leading commercial real estate lender, announced the closing of a preferred equity investment on a 16-unit Multifamily property in Miami, FL. Gelt [...]

Rehab Refinance investment property in Baltimore, Maryland. Several investors owned the property and ran short of capital to fix up the property and complete the job. Gelt Financial, provided them [...]

Deal done! Gelt Financial just funded a $240K sale leaseback for a single-family home in Port Charlotte, FL. No appraisal. No income verification. Super-fast closing. Flexible documentation. This new [...]

JUST CLOSED IN DELAWARE! Gelt Financial, LLC and QuickLiquidity provided $500,000 in bridge financing to a highly experienced developer & investor on a 192-unit multifamily property in Delaware. The [...]

JUST CLOSED Cash-Out Refinance in Ramsey, New Jersey! Gelt Financial just closed on a $500k First Mortgage on an office building in Ramsey, NJ, a suburb of New York [...]

Gelt Financial has provided a First Mortgage on a residential investment property in Wildwood, NJ. The property was a townhome, one block from the beach and Gelt was able to [...]

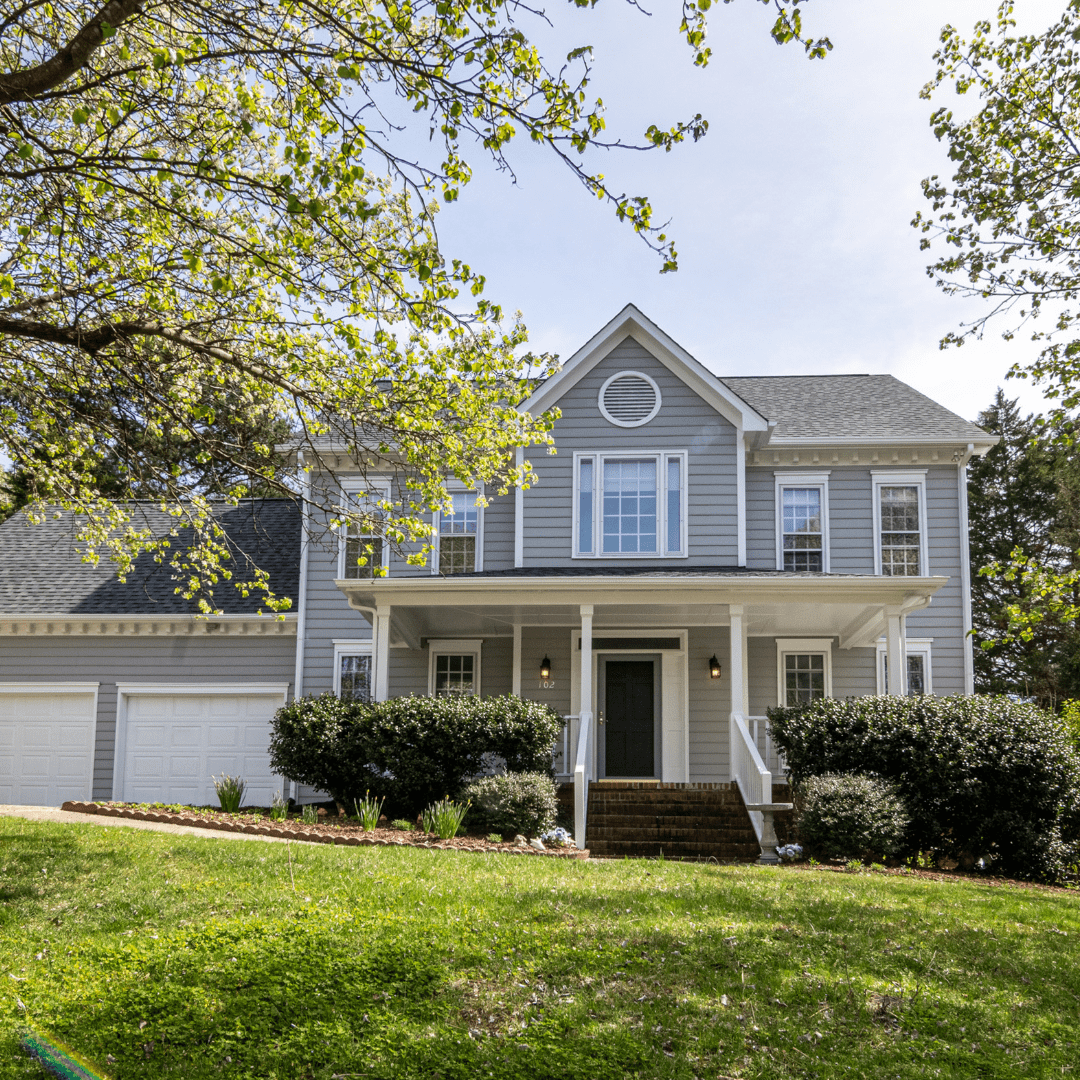

Just closed! Another win for an experienced investor. Gelt Financial closed a $300K cash out refinance on a single-family home in Charlotte where the borrower needed funds for light [...]

ANOTHER DEAL DONE! Gelt Financial recently closed a $185K First Mortgage in Cleveland, OH, on an owner-occupied warehouse. Gelt does not shy away from complicated financing situations. We work [...]

JUST CLOSED IN FORT LAUDERDALE, FLORIDA! Gelt Financial just closed a $600K First Mortgage on a retail building in Fort Lauderdale, FL. The borrower was having trouble finding a [...]

A closed first mortgage in Atlantic City, New Jersey, Mixed-use, no income verification mortgage. Self-employed business owner. When your bank says No, we say Yes. Contact us on 561-221-0900 or [...]

JUST CLOSED! Gelt Financial is proud to have assisted a condo association in Hialeah, FL with securing $200K in financing for essential improvements. The 40-unit condo association needed immediate [...]

Gelt is pleased to provide a first mortgage rehab mortgage to an investor in Birmingham, Alabama. We have a very long history of providing rehab fix and flip and fix [...]

Virginia First Retail Mortgage: Gelt Financial, LLC is pleased to have provided a 1st mortgage and a Line of credit 2nd mortgage on an auto repair and sales center in [...]

Chicago suburbs, the mixed-use property being purchased by an attorney at a discount price. We provided the first mortgage under our no income qualification program. Gelt Financial, is a private [...]

First mortgage closed in Philadelphia on a mixed us property that the owner had purchased and needed to be fixed up. The Investor saw potential value, came to us and [...]

JUST CLOSED! Gelt Financial is excited to announce we just closed a $135K First Mortgage on a 2,500 retail building in Newark, NJ. When your bank says NO, we say YES! [...]

Just Closed! Gelt Financial just funded a $135K cash-out refinance for a single-family home in Baton Rouge, Louisiana! This deal came in at a 49% LTV — a strong, low-leverage, collateral-based loan with no income [...]

Gelt Financial has just closed a blanket loan on owner-occupied gas stations and C-stores in New Jersey. The current Bank called the loan due and put them in foreclosure and [...]

Gelt Financial was pleased to provide an investor group with first mortgage financing on a value-add retail center in Chicago that the buyers were the successful bidder through a national [...]

We are happy to close a commercial mortgage loan for an experienced real estate investor in Pittsburgh, Pa on a blanket mortgage of 3 properties, 2 retail centers and 1 [...]

CLOSED! Gelt Financial is excited to announce the closing of a $500,000 loan for a Pheonix, AZ 99-unit Co-Op association to replace all the property's air conditioning units. After [...]

Another successful deal was closed by Gelt Financial! We’re excited to announce the closing of a $300K cash-out refinance for a medical office in Baton Rouge, LA. This property, [...]

A Mortgage broker emailed us and asked us about marketing to banks for turndowns. Lots of opportunities out there for those willing to work at it. Watch the video to learn [...]

Gelt closed another Mobile Home Park Mortgage Closed in Indiana. Remember, when your bank says NO, we say YES! "Jack: Okay, Marcy Berger, we're here. Marcy: We're here. Hi, guess what? [...]

Gelt Financial just closed a collateral-only first mortgage on a commercial property in Fort Lauderdale, FL, within 10 days. "Marcy: Hi, this is Marcy and Michael, and we're going to talk [...]

Gelt has been helping commercial real estate and investment borrowers since 1989. When your bank says NO, we say YES. "Jack: So, what— a little interview. Marcy: Sure. Jack: A little [...]

Gelt Financial, LLC just closed a $50,000.00 first mortgage on an office building in Kansas City, for a real estate investor. Gelt focuses on closing small commerical and investment mortgages. "Jack: [...]

What’s needed for a fast and smooth mortage closing at Gelt Financial? And what can cause delays? Go behind the scenes with Jack Miller and Marcy Berger at Gelt Financial to [...]

Gelt Financial focuses on Small Balance- Business Purpose, Investment and Commercial Private Mortgages. We love loans under 1 Million. Private Lending without any red tape and log delays of banks. Gelt [...]

Jack Miller gives his opinion on leaving your job and becoming a full time real estate investor. What has he seen over the years: "How you doing? This is Jack Miller. [...]

We buy commercial real estate debt. That includes Performing, Non-Performing, and Sub-Performing commercial debt. Jack Miller goes over the types of commercial debt that Gelt Financial buys. Gelt has been helping [...]

Jack Miller gives a explanation on what an exit fee is. "Hello, this is Jack Miller at Gelt Financial. Hope you're having a fantastic day. We get a question a lot, and [...]

Small Business Owner Occupied First Mortgage, provided by Gelt Financial. "Marcy: Hey Jack. Jack: Okay Marcy, so anyway, owner-occupied business, tell everyone about it. You know the details of this? Marcy: [...]

Some tips on how a commercial mortgage broker can earn 400k annually."Video Title: Tips on how a Commercial Mortgage Broker can make 400k annually.Speaker: Jack Miller and Michael KelmanTranscript:Jack: Michael, I want [...]

4 Day Investment Property Closing, Gelt Financial moves very fast-Commercial & Investment mortgages.

4 Day Investment Property Closing, Gelt Financial moves very fast-Commercial & Investment mortgages."Marcy: Hi Jack.Jack: Marcy, we just closed a couple of deals, but one, in particular, closed in. It came in [...]

Gelt provides Condo and HOA Association Financing when banks won't. Typically banks wont deal with small associations, high delinquency, low reserves or high investor condensations as well as other reasons and [...]

Gelt is excited to provide first mortgage financing for an owner of a business who purchased a home for his employee's to live in. The buyer owned several restaurant business with [...]

Gelt Financial just closed two fix and hold JV equity Mortgages, were we provided 100% Financing to our partner. Gelt has been helping commercial real estate and investment borrowers since 1989. [...]

Some tips for Mortgage Brokers from Jack Miller at Gelt Financial, LLC on how to be a more successful mortgage broker. Gelt has worked with brokers for over 30 years and is [...]

Jack Miller gives explains what is a Cap rate and how do I use it in Commercial Real Estate. "Hello, I hope you're having a great day. This is Jack Miller [...]

Gelt just closed on a Bridge to Agency short term mortgage solution on Multi Family in Chicago, we were called to private quick financing when it was clear the the permeant [...]

The video titled "Pro Guide To Commercial Mortgage Rates with Some Key Factors" by Gelt Financial, LLC discusses the factors involved in pricing a loan in the private lending space. It [...]

Foreclosure Bailouts: Blanket Loan on 2 Mixed-Use Properties in New Jersey — Property-Only Qualification. Gelt Financial. No personal income, no credit, no appraisal. Same-day approval and fast closing. [...]

Jack Miller gives an example of an interesting and creative deal. It was a TIC roll up where our borrower/partner made a lot of money using our money. "Hey Larry, this is [...]

In the video, Jack shares a valuable tip for investors: many people and businesses fail because they take on too much and lose focus. He advises caution, emphasizing the importance of [...]

The video explains the definition of Note on Note Financing. It is the practice of buying and selling notes, typically related to mortgages and debts. Investors look for discounts and consider [...]