Gelt Financial Co-sponsors Workshops & High Holiday Services For Those In Recovery

We are pleased to co-sponsor recovery workshops and Jewish High Holiday service for those in recovery and their families in or around Boca Raton, FL hosted by Congregation Shaarei Kodesh.

We are pleased to co-sponsor recovery workshops and Jewish High Holiday service for those in recovery and their families in or around Boca Raton, FL hosted by Congregation Shaarei Kodesh.

Recovery Help in Boca Raton

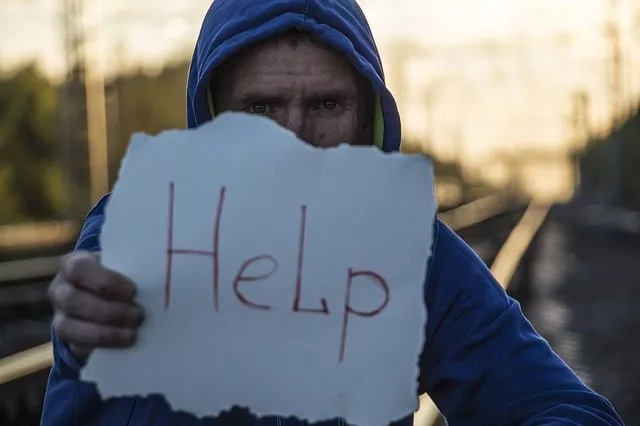

A new interactive workshop/series for people “Jewish by bagel” who are in recovery or have a friend or family member who is affected by substance use disorder or any other process disorder. No previous knowledge of Judaism necessary. It is an open and confidential group in a safe and non-judgmental environment. This series will connect you to other Jewish people who understand the cultural stigma of addiction. You will gain the tools to further your healing process through the lens of Jewish thought and text study with the goal of deepening your spiritual context.

This Minhag program will have a series of workshops every Sunday leading up to the Jewish High Holidays, where there will be a High Holiday service lead by Rabbi Mark Rotenberg.

According to H. Jack Miller, Gelt’s Founder and President, “we need to uplift people and not hold them down, now is the time to step up and help. We cannot wait for the government or look to someone else. There is a large segment of our population that’s suffering from addictions, depression, and mental health issues and we want to direct what attention and resources to helping those in need. Jack went on to say that communities should be helping there own people and its or hope that these type of programs will spread. We want to help people.”

Private Money Lender – Related posts

Jack Miller is pleased to speak and take part in a panel discussion “Alternative Financing Solutions for Real Estate Deals” at the 2nd Annual Mid-Atlantic Real Estate Capital Markets Conference [...]

Gelt Financial, LLC is pleased to sponsor and support SafeTALK a three-hour suicide alertness and prevention training, developed by Livingworks, which is an innovative workshop that provides participants with tools, [...]

“Jack. Good afternoon. Thanks for getting right back to me – you are still the most responsive person I deal with and I hope we can get a deal done together [...]

If your bank can't help you, we can. We specialize in mortgages that banks won't do. We use commonsense underwriting and offer flexible terms. Quick approvals and closing. [...]

Gelt Financial providing loans to HOAs for required repairs and reserves between $100,000 and $3MM Gelt Financial is a leading provider of loans to homeowner’s associations (HOAs) for required repairs and [...]

Gelt Financial, LLC and Gelt Charitable Foundation Partner with Hate Ends Now to Combat Antisemitism and Hate Ends Now with Interest-Free Loan for Powerful Holocaust Exhibit Boca Raton, FL [...]

Gelt Financial president H. Jack Miller was recently featured as a real estate expert in the Bankrate article "What Is A Private Mortgage Lender?" What Is A Private Mortgage [...]

At Gelt Financial, LLC, we believe in making a difference—not just in the world of finance, but in the communities we serve. That’s why we are proud to sponsor [...]

GFCIB and Advisors, LLC is pleased to have H. Jack Miller speak and take part in a panel discussion “Utilizing Bridge Capital in a Rising Real Estate Market” at the [...]

Gelt Financial was recently featured in Consumer Affairs' article, "How many people can be on a mortgage?" In this article, H. Jack Miller, President & CEO of Gelt Financial, [...]

Gelt Financial was recently featured in the article, The Biggest Financial Mistakes People Are Carrying Into 2026. In this article, H. Jack Miller, President & CEO of Gelt Financial, [...]

Gelt Financial, LLC a non-bank commercial portfolio mortgage lender who caters to commercial real estate owners and investor financing needs is pleased to launch its “Se Habla Español” campaign. According [...]

Gelt Financial's Vice President Noah Miller will be a featured panelist next week at the 6th Annual NPL, Notes & Default Servicing Forum (East) in Orlando on Monday, March 20. [...]

Gelt Financial president H. Jack Miller was recently featured as a real estate expert in the Benzinga article "How Many Months of Bank Statements for a Mortgage Are Needed?" [...]

Who is your lender, is as important as what deal you get... Since 1989. In the past week some examples of how we work with our borrowers. 1. One of [...]

Gelt Financial is a leading provider of DIP loans, also known as debtor-in-possession loans. We offer DIP loans between $100,000 and $3,000,000 to help businesses continue operations and achieve financial stability [...]

Gelt Financial, a leader in non-bank commercial real estate financing, today announced that it is relocating from Fort Lauderdale, Florida to Boca Raton, Florida. Beginning January 21th, 2016 Gelt Financial’ [...]

Gelt Financial president H. Jack Miller was recently featured as a real estate expert in the feature “This Private Commercial Real Estate Lender Cuts Through the Clutter To Produce [...]

Gelt Financial president H. Jack Miller was featured on Yahoo! Finance Should you buy a house during a recession? By AJ Dellinger In 2022, as inflation grew and gross [...]

Gelt Financial now makes its bridge and opportunity loans available throughout the mortgage brokering community. We offer bridge loans up to $20,000,000 in all major MSAs. We have common [...]

Gelt Financial was recently featured in Realtor.com's article, "What to Do If You Can't Pay Your Mortgage". In this piece, H. Jack Miller, President & CEO of Gelt Financial, [...]

It is not the critic who counts: not the man who points out how the strong man stumbles or where the doer of deeds could have done better. The credit [...]

Loan amounts $50,000,00 and above Commercial Properties or Investment Real Estate Commonsense Underwriting- Deal with decision-makers Customized terms to meet the borrower’s needs (we can be flexible) Purchase, refinance, storied [...]

Gelt Financial, LLC is pleased to be back in Scotsman Guide. Gelt and its management have been lending to small commercial property owners and investors since 1989. Gelt offers commercial [...]

In C Store Commercial Mortgage Closed, Atlanta Georgia it discusses about a commercial mortgage deal for a convenience store (c-store) located near Atlanta, Georgia. It features the c-store owned by a [...]

Jack Miller and Marcy talk a little about marketing basics for commercial mortgage brokers.

Gelt Financial just closed a fast and easy mortgage for a cannabis retail property in New Jersey. If you’re looking for reliable financing for your cannabis real estate investment, we’ve got [...]

In the video, Jack shares his top 11 reasons to be in the mortgage business. These include no formal education requirement, a consistent demand for mortgage services, high income potential, and [...]

Some tips for Mortgage Brokers from Jack Miller at Gelt Financial, LLC on how to be a more successful mortgage broker. Gelt has worked with brokers for over 30 years and is [...]

Jack Miller talks about what he leaned by making Toast? How good things take time and effort before you see the results. "Hey, this is Jack Miller. I hope you're having [...]

Gelt Financial just closed two fix and hold JV equity Mortgages, were we provided 100% Financing to our partner. Gelt has been helping commercial real estate and investment borrowers since 1989. [...]

Very high LTV, new construction, Florida almost nothings down. property only qualification. When your bank says NO, we say YES!

Gelt has been helping commercial real estate and investment borrowers since 1989. When your bank says NO, we say YES! "Marcy: Hi, it's Marcy and Jack. Jack: Hey, we're Gelt Financial, [...]

Commercial Mortgage Pawn Shop in Fort Lauderdale, FL "Marcy: Hi, Jack. Jack: Hey, Marcy. To tell people, I should, I say at the end, but I'm going to say at the [...]

Understand your deal and what types of deals your lenders do is important to being a successful mortgage broker.

Jack Miller and Marcy closed a very quick closing in Florida for a real estate investor on a single family investment property."Marcy: Hi Jack.Jack: Hey Marcy, how you doing? Our first video [...]

Jack and Marcy of Gelt Financial are back with another success story. We helped a client in Vineland, New Jersey with a joint venture equity loan and provided 100% of the [...]

Gelt Provided 100% financing of the sales price on an office Building In Illinois. No appraisal, quick close deal. No appraisal, rush deals, bank and other lender turndowns, and much more [...]

In this video, H. Jack Miller shares his passion for helping real estate investors and small business owners secure financing, particularly when traditional banks decline. With over 35 years in the [...]

In some situations, Gelt Financial does not require a credit report on residential investment property financing and small commercial Mortgage Financing. Gelt has been helping commercial real estate and investment borrowers [...]

Gelt closes collateral based first mortgage in San Antonio, Texas. Brought to us by a mortgage broker, closed very fast. "Jack: Okay, Marcy Berger, the angle is perfect. We're making this [...]

Jack and Marcy discuss the current market and share their observations, including the types of deals Gelt is currently closing and not closing, and the reasons behind these decisions. They outline [...]

Gelt Financial just closed a commercial office bridge loan in Orlando, Florida in 4-5 working days, When Gparancy contacted us and told us this was a super rush deal, we did it. [...]

Construction First Mortgage closed on investment property spec home in Boca Raton, Fl. "Marcy: Hey Jack. Jack: Hey Marcy, let's tell everyone we just closed something. We normally don't do a [...]

Jack talks about the difference between an Exclusive versus Non-Exclusive Fee Agreement for Mortgage Brokers. "Hello, this is Jack Miller at Gelt Financial. Hope you're having a fantastic day. I want [...]

Is Gelt Financial a Hard Money Lender or a Private Lender? Whats the difference? What is a subprime lender? "Hi, I hope you're having a good day. I want to make [...]

In our latest YouTube video, Michael explains what a mortgage broker or borrower should send to Gelt Financial—or any lender—for a deal to be reviewed for approval. When your bank says [...]

What’s needed for a fast and smooth mortage closing at Gelt Financial? And what can cause delays? Go behind the scenes with Jack Miller and Marcy Berger at Gelt Financial to [...]