Bridge and Opportunity Loans now being offered thought Mortgage Brokers

Gelt Financial now makes its bridge and opportunity loans available throughout the mortgage brokering community.

For more information, visit our mortgage brokers page or contact us.

Private Money Lender – Related posts

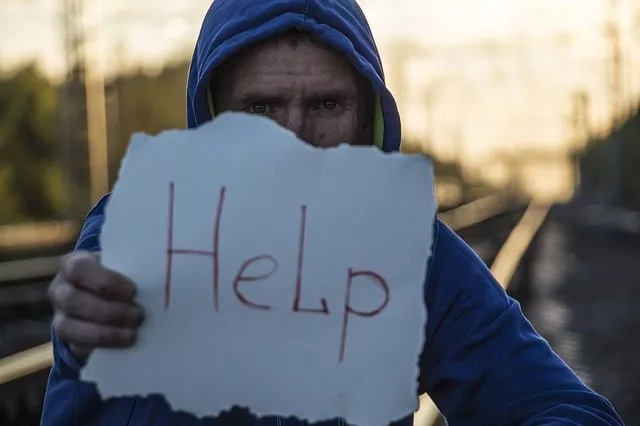

Gelt Financial, LLC is pleased to sponsor and support SafeTALK a three-hour suicide alertness and prevention training, developed by Livingworks, which is an innovative workshop that provides participants with tools, [...]

DELRAY BEACH, FL (Dec. 16, 2020) – Gelt Financial, a leading commercial real estate direct lender, has announced that they have donated 5,000 Square Feet of office space to [...]

Gelt Financial's Vice President Noah Miller will be a featured panelist next week at the 6th Annual NPL, Notes & Default Servicing Forum (East) in Orlando on Monday, March 20. [...]

Gelt Financial, LLC was pleased to provide a $1,800,000.00 non-recourse first mortgage financing to a local non-profit owner of a retail shopping center in Philadelphia. The property is a neighborhood [...]

Some Reasons To Deal with Gelt Financial For Your Commercial or Real Estate Investment Mortgage We have a long history and were founded on February 1, 1989 Experience: We [...]

There’s something about non-bank commercial lenders that’s got everyone jumping for joy in the financial world, but what gives—why are these lenders in such hot demand🔥 as opposed to [...]

If your bank can't help you, we can. We specialize in mortgages that banks won't do. We use commonsense underwriting and offer flexible terms. Quick approvals and closing. [...]

You are debating receiving your real estate loans from either a bank or a private lender. There’s been a lot of talks lately about private lenders like us here [...]

We just provided an experienced investor a cash-out refinance on Free standing Restaurant suburbs of Pittsburgh, established tenant, but the owner had a lot of credit challenges due to other [...]

A closed first mortgage in Atlantic City, New Jersey, Mixed-use, no income verification mortgage. Self-employed business owner. When your bank says No, we say Yes. Contact us on 561-221-0900 or [...]

Gelt Financial president H. Jack Miller was recently featured as a real estate expert in the BiggerPockets article "Everything Around It is Collapsing, But This One Last Property Type Remains [...]

When it comes to saving money through real estate, leverage is an important aspect. We have worked with a number of real estate investors who fix or flip residential non-owned [...]

An experienced investor was able to put under agreement of sale an Industrial building with a large amount of ground at a very good price. The property was lost to [...]

Gelt Financial, was pleased to provide 100% of the financing to a new investor who found a great deal on a single-family property in Coral Gables, Florida, in need of [...]

Gelt Financial president H. Jack Miller was recently featured as a real estate expert in the feature "13 Best Ways How To Find Foreclosures to Get a List of [...]

Gelt Financial, LLC approved a “DIP” Debtor in Possession first mortgage on a health care facility in New England. Over the years Gelt has developed a specialty in helping owners [...]

When you’re short of cash but you know that you’ll get financing in a few weeks’ time, you could be looking for a loan that can sustain you for [...]

Closed loan- We were able to help this borrower obtain a cash-out refinance on his mixed-use building in Philadelphia PA. The borrower was able to pay off his higher interest [...]

Gelt Financial is a leading provider of DIP loans, also known as debtor-in-possession loans. We offer DIP loans between $100,000 and $3,000,000 to help businesses continue operations and achieve financial stability [...]

Jack Miller of Gelt Financial, LLC announces its “Better than Bank Commercial Mortgages without the aggravation new loan programs” Gelt recognizes that commercial real estate owners and investors are increasingly [...]

Who is your lender, is as important as what deal you get... Since 1989. In the past week some examples of how we work with our borrowers. 1. One of [...]

Gelt Financial buying distressed debt on commercial real estate between the loan sizes of $100,000 and $5MM Are you a lender looking to sell your distressed commercial real estate debt? [...]

It is not the critic who counts: not the man who points out how the strong man stumbles or where the doer of deeds could have done better. The credit [...]

Here is what you can do DOWN BUT NOT OUT A distressed property is one that is one that is under foreclosure. Commercial properties such as self-storage centers stand [...]

Gelt Financial closes a refinance on 2 auto related properties in Ohio, while the borrower was in Chapter 13. "Marcy: Hi, it's us again. Jack: It's us, this is Jack and [...]

Real estate investors, DON'T depend on anyone else when doing your background or due diligence for your real estate projects. This can backfire on you or cause complications. "Hey, this is [...]

Listen and uplift people. Commercial Mortgage Broker Tip of the Day and Advice for Commercial Mortgage Brokers. "Jack: Marcy and Jack, so we want to make our mortgage broker tip of [...]

In the video, Jack shares negotiation tips for property deals. He emphasizes the "Art of Negotiation is to Analyze" -- the importance of analyzing the situation, listening actively, and keeping one's [...]

Markets and the needs of borrowers are always changing, in order for a mortgage broker to survive and serve the needs of borrowers, they need to pivot. Foreclosure bailout loans and [...]

Gelt just provided the financing and funding on 3 single family investment properties in Florida all purchased at an auction. "Jack: Hey, this is Marcy and Jack at Gelt Financial. Hopefully, [...]

In the video, Jack shares an interesting story about closing a 100% loan-to-value deal on land in Ohio. Despite not typically offering land loans, Gelt made an exception due to the [...]

Gelt Financial closes a purchase of a Gas station/ C store in Ohio. "Jack: This is Jack, and Marcy, new socially distanced closing, a gas station in Ohio—Steubenville. I've actually been [...]

Marcy and Jack talk a little bit about the increasing interest rate environment and what it means for commercial mortgage brokers and borrowers, and how to take advantage of it. "Marcy: [...]

Gelt is excited to provide first mortgage financing for an owner of a day care center in Chicago. He is an experienced operator and this is a new business for him. [...]

Chicago Office Condo Mortgage Closed, No income Verification for owners of Business. "Chicago, Chicago, that title in town, that title in town. I love it. Bet your bottom dollar that you'll [...]

Jack Miller and Marcy talk about a Mezzanine loan that just closed on a new state home in the North Shore of Long Island for a real estate investor. Mortgage broker [...]

Marcy and Jack talk about the eviction moratorium, non paying tenants and borrowing money in today's times. "Jack: Okay, we're live, Marcy. Marcy: All right, we're live. Jack: So let's continue [...]

Jack Miller gives a little explanation on why lenders charge prepayment penalties, the different types of them and some tips on how to analyze and negotiate the best one for your [...]

Gelt Financial closes a cash out, mixed use, no income verification mortgage in Indianapolis, IN. "Marcy: Hi. Jack: Hi, this is Jack and Marcy at Gelt. Marcy: How are you? Jack: [...]

We are here to help our borrowers through the financing process. When one of them was short $150,000.00 on a mixed-use property, we lent them the additional money. One of the many [...]

We just provided with a experienced investors 4.3 Million bridge Mortgage on 3 credit tenant deals as part of a 1031 Transaction. This borrower will refinance with a bank, but a [...]

Gelt has been helping commercial real estate and investment borrowers since 1989. When your bank says NO, we say YES! "Marcy: Hi. Jack: Hello, it's Marcy and Jack from Gelt Financial. [...]

Jack Miller Gelt Financial's founder talks about how to become a commercial mortgage broker. Gelt has been helping commercial real estate and investment borrowers since 1989. When your bank says NO, we [...]

In the video, Jack shares a valuable tip for investors: many people and businesses fail because they take on too much and lose focus. He advises caution, emphasizing the importance of [...]

Jack Miller answers the question: can someone be a part-time mortgage loan officer or mortgage commercial broker? "Hi, this is Jack Miller. You know, I want to answer a question that [...]

Gelt Closed a first mortgages on 7 residential Investment condo's in Orlando, FL, No appraisal and a cash out on a commercial building in Des Moine, Iowa. Both deals came from [...]

Gelt is excited to provide first mortgage financing for an owner of a business who purchased a home for his employee's to live in. The buyer owned several restaurant business with [...]

Commercial Mortgage Pawn Shop in Fort Lauderdale, FL "Marcy: Hi, Jack. Jack: Hey, Marcy. To tell people, I should, I say at the end, but I'm going to say at the [...]