In this video, Jack and Marcy discuss a commercial mortgage loan deal that did not close and the reasons behind it. The property was good and had a great location, but the borrower did not provide all the information upfront, causing a slow drip of information and partial documentation. This caused industry deal fatigue and ultimately lost confidence in the deal and the borrower. The lesson learned is that borrowers and brokers should be upfront with all information and documents, good and bad, to ensure a smoother loan process:

Jack Miller: Hey, this is Jack Miller and Marcy Berger at Gelt Financial. How are you doing Marcy?

Marcy Berger: I’m doing great today.

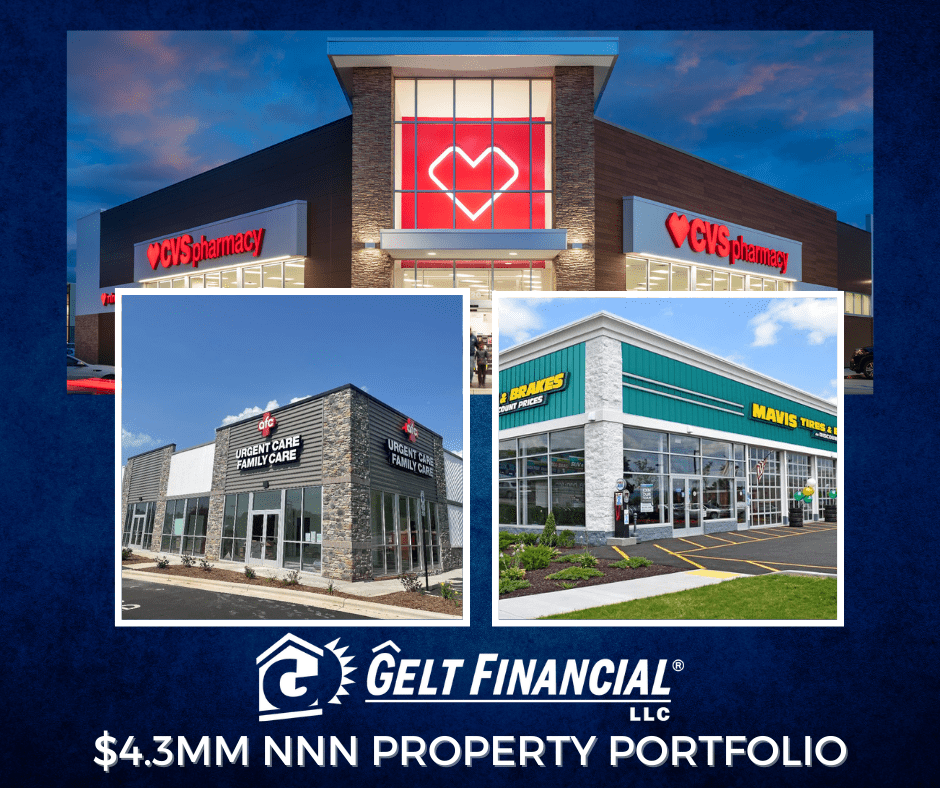

Jack Miller: So, everyone, you know what, everyone always makes videos, and they talk about all their successes. But everyone talks about the good stuff, but the truth is we had something not great happen here this week. We approved the deal I’m going to say about three, four weeks ago, maybe even longer, and the deal didn’t close. And people don’t talk about that, but that’s the reality. Anyone over two years old knows that life doesn’t always go as planned, and I want to kind of talk about it, and I’m going to put it out publicly just so other people understand. Because when a deal doesn’t close and when something goes wrong, we spend a lot of time here at Gelt, we analyze it, and we say, did we make a mistake? Did we screw up? What could we have done different? In this particular case, the property was a good property, and it was a good value.

Marcy & Jack: great location.

Jack: I personally saw this property, yeah, Marcy, superior location. But I think, and I’ll ask you, the reason it didn’t close, we kind of, and the borrower, I think was a solid guy, I really think he was a solid guy, but at least my perception of it was we did not get all the information upfront. When I think about it, we got the feeling, I don’t know if he meant it that way, and sometimes, you know, things are misunderstood in like communications causing a lot of wars and divorces and all kinds of problems. But I get the feeling, at least from our perspective, that it was kind of a slow drip of information. Instead of telling us all the stuff upfront, it was they told us a piece, then they wouldn’t give us documentation, then we found out another piece.

Marcy: Then when you put it all together like a puzzle, it didn’t make sense.

Jack: I think if they would have upfront told us everything up front, all the bad, all the problems up front, we would have closed the loan. I think we could have overcome it. But I got the perception, tell me if you’re wrong, they told us what they think they wanted us to hear.

Marcy: Absolutely, because they wanted the deal to work, and they want the numbers to work. And when we looked at everything in all different pieces, we had to ask for more information, and then the borrower didn’t really want to or didn’t provide the information.

Jack: or they provided partial information.

Marcy: It just never was the full picture.

Jack: Yeah, we got what is called the industry deal fatigue. I think if we, the borrowers, would have been 100% upfront from us, and maybe they think they were, but you know, we got the impression that they were always withholding information, and we never got the full story, and as a result, we ultimately lost confidence in the deal and the borrowers.

Marcy: Yeah, it was a pointing way, so it’s very disappointing to us, I’m sure the bar because we loved the property, we liked the borrower. My perception is, Umrah Lee, why I’m making this, I want borrowers and brokers to know that nobody comes to us that’s real clean and has perfect credit and everything’s in order. There’s always stories, I mean always stories, and we do, you’re right, we deal with rough stuff, but it’s better than we know it upfront. And when we ask for a document, don’t make a fight over either, you can give it to us, you can’t give it to us, but if everything becomes a fight and an issue, and we get, you know, partial documents, and, you know, if it all makes sense, we’re going to do the loan, and everyone’s going to be happy, and the deal’s going to go forward. In this situation, you know, it just, it was, it was disappointing because we all worked really hard at the deal

Category: Education

Tag: commercial mortgage