Gelt Financial Featured in Realtor.com’s Piece “What to Do If You Can’t Pay Your Mortgage”

Gelt Financial was recently featured in Realtor.com’s article, “What to Do If You Can’t Pay Your Mortgage”. In this piece, H. Jack Miller, President & CEO of Gelt Financial, shares valuable insights on navigating financial struggles and avoiding foreclosure.

If you’re facing challenges with your mortgage, this is a must-read! Don’t miss these expert tips—take proactive steps to secure your financial future.

Private Money Lender – Related posts

DEAL CLOSED IN LAKE WORTH, FLORIDA! Gelt Financial is excited to announce we just closed on a $900K First Mortgage on a retail strip center in South Florida. The [...]

When it comes to financing for commercial real estate investments, borrowers have two main options: traditional bank loans and private lenders, including hard money lenders. While both options have their pros and [...]

Written by Beth Mattson-Teig of WealthManagement.com contributing expert Gelt Financial The increased capital flowing to the preferred equity space far outweighs the volume of available deals. Real estate investors looking [...]

Are you wondering about what your options are for commercial mortgages? The good news is that you aren’t limited—you’ll come to discover the terminology of hard [...]

When submitting loan requests to a private lender, it is important to provide as much information as you can to get a quick response and ensure that your deal [...]

DEAL CLOSED IN PHILADELPHIA, PENNSYLVANIA! Gelt Financial just closed on a $250K First Mortgage on a retail property in Philadelphia, PA. A borrower called up Gelt and needed a [...]

JUST CLOSED IN MANHATTAN, NEW YORK! Gelt Financial is proud to announce that we just closed a $200K First Mortgage on a stunning condo on Park Avenue in Manhattan. [...]

Since 1989 we have been providing capital to real estate investors and owners of businesses, in good times and challenging ones. It was great to see that one of [...]

Gelt Financial president H. Jack Miller was recently featured as a real estate expert in the feature “What Happens to My Mortgage If My Lender Goes Bankrupt?” on U.S. News [...]

80% LTV on commercial and investment mortgages in Eastern Pennsylvania, New Jersey, New York, Delaware and Maryland. Flexible underwriting and credit

JUST CLOSED IN NORTH FORK, NEW YORK!Gelt Financial is excited to announce we just closed a beautiful Single-Family Investment Property in North Fork, NY. This home is centered in picturesque [...]

Gelt Financial just closed a $200K First Mortgage on an owner-occupied retail building in Lubbock, Texas. This borrower reached out to our expert loan originators to close the deal quickly.Gelt [...]

We were able to assist a borrower with cash-out refinance out on his 3 unit medical office building in Green Bay, WI with limited documentation. The building has 3 units [...]

When a company is going bankrupt, there are things they can sell other than its assets. For one, they can also sell their debt. What is Distressed Debt? Distressed debt [...]

Closed loan- We were able to help this borrower obtain a cash-out refinance on his mixed-use building in Philadelphia PA. The borrower was able to pay off his higher interest [...]

DEAL CLOSED IN CINCINATTI, OHIO! Gelt Financial is excited to announce we just closed on a $100K first mortgage on a Multifamily property in Cincinnati, OH. Our borrower requested [...]

Quote from mortgage Broker "Thanks for getting right back to me – you are the most responsive lender I deal with" We love working with mortgage brokers.

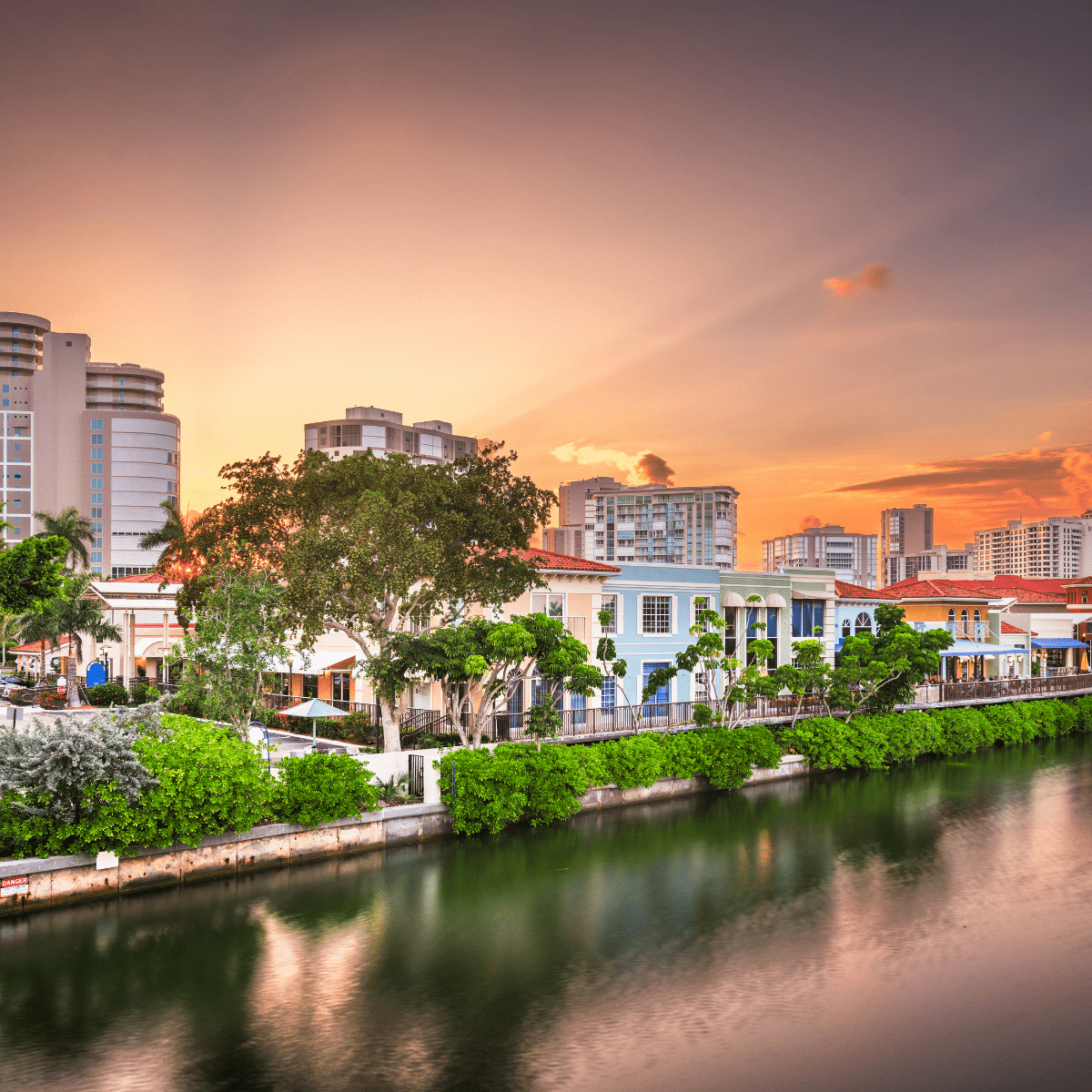

Gelt Financial just closed a $150K low-leverage cash out refinance on a renovated condo unit in Naples, Florida. The borrower inherited the unit, completed improvements, and is preparing to [...]

Chicago suburbs, the mixed-use property being purchased by an attorney at a discount price. We provided the first mortgage under our no income qualification program. Gelt Financial, is a private [...]

Gelt Financial, LLC a non-bank commercial portfolio mortgage lender who caters to commercial real estate owners and investor financing needs is pleased to launch its “Se Habla Español” campaign. According [...]

While 2019 comes to a close we reflect back on the work we have done in the area of Suicide Prevention, Mental Health awareness and education as well as recovery [...]

Deal done! Gelt Financial just funded a $240K sale leaseback for a single-family home in Port Charlotte, FL. No appraisal. No income verification. Super-fast closing. Flexible documentation. This new [...]

This borrower’s seller-financed mortgage came due to his commercial condo space. Gelt Financial, LLC was able to assist the borrower in refinancing his commercial property from which he runs his [...]

JUST CLOSED IN BROOKLYN, NEW YORK! Gelt Financial is excited to announce the closing of a $800K first mortgage in Brooklyn, NY. The investment property was a retail building [...]

Jack and Marcy share some real-life tips for commercial Mortgage Brokers: "Jack: Okay, we're starting; we're improvising here. Marcy: Yes, because we have had mechanical problems this morning. Jack: I'm embarrassed [...]

In this video, Michael discusses how Gelt Financial handles prepayment penalties on commercial mortgages. They offer a creative solution by negotiating an exit fee that allows clients to avoid paying minimum [...]

Gelt provides foreclosure bailout loans on commercial and investment real estate. "Jack: Hello, this is Jack and Marcy at Gelt Financial. Usually, we try to be bubbly, but this is like [...]

Gelt Financial closed a 1st mortgage cannabis dispensary in NJ for a cash out refinance to fix up the property, no appraisal or income verification. When your bank says NO, we [...]

Jack Miller and Marcy Berger talk about Residential Mortgage Originators and brokers getting into commercial Mortgages. How hard or easy is it? What are the differences? What do you need to know? [...]

Gelt Financial closes a rehab mortgage to finish a property in Birmingham, Alabama. "Jack: Hello, this is Jack and Marcy at Gelt. Anyway, okay, new closing property in Birmingham, Alabama. Tell [...]

Jack and Marcy of Gelt Financial are excited to announce we just closed on a $1.6MM mezzanine loan on a 60k SF office building in Houston, TX. The property was valued [...]

Gelt provides Condo and HOA Association Financing when banks won't. Typically banks wont deal with small associations, high delinquency, low reserves or high investor condensations as well as other reasons and [...]

Gelt Financial closes a first mortgages on coop investment property mortgage in a Trust. Behind the scenes with Jack Miller and Marcy Berger at Gelt Financials.

In this video, Jack discusses a closed deal in Chesapeake, Virginia. Wherein $220,000 is provided, first mortgage on a mixed-use property to a real estate investor with poor credit. The borrower [...]

Marcy Berger is Retiring from Gelt Financial. She will be greatly missed.

Jack Miller talks about what a Break up fee is and why and how it comes into play. "Hi, this is Jack Miller from Gelt Financial. I hope you're having a [...]

When a borrower ran short of capital to complete the repairs and their current lender would not lend them more money, Gelt step up and approved a second mortgage. "Jack: Hey, [...]

Gelt is now lending on Cannabis properties."Marcy: Hi, it's Marcy.Mario: It's Mario.Jack: It's Jack from Gelt Financial.Marcy: We're doing a shoutout today for cannabis.Mario: Oh, yay, cannabis. So, we're now supporting all [...]

Gelt is excited to provide first mortgage financing for an owner of a day care center in Chicago. He is an experienced operator and this is a new business for him. [...]

Marcy and Mario talked about 2 recent closings on a Mixed use property and an industrial property that we provided first mortgage debt on. "Marcy: Marcy Mario: Mario Marcy: We're here [...]

4 Day Investment Property Closing, Gelt Financial moves very fast-Commercial & Investment mortgages.

4 Day Investment Property Closing, Gelt Financial moves very fast-Commercial & Investment mortgages."Marcy: Hi Jack.Jack: Marcy, we just closed a couple of deals, but one, in particular, closed in. It came in [...]

Jack Miller and Marcy talk about how to value commercial and investment real estate. Gelt has been helping commercial real estate and investment borrowers since 1989. When your bank says NO, [...]

Jack Miller and Marcy talk about Gelt Financial providing an existing borrower a $300,000.00 when they needed more money, The property was in Brooklyn, New York and was a mixed use [...]

In every market, there is an opportunity; we lay out some ways people are taking advantage of this real estate market using financing. We want to help investors Make money using our [...]

Why do Professional athletes come to Gelt Financial to borrow money? We dive into it.....

What does the collapse and FDIC take over of Banks mean to our Borrowers and Mortgage Brokers? How will this effect us and you? "Marcy: Hello. Jack: Hey, we want to [...]

In our latest YouTube video, Michael explains what a mortgage broker or borrower should send to Gelt Financial—or any lender—for a deal to be reviewed for approval. When your bank says [...]

Gelt Financial closes a refinance on 2 auto related properties in Ohio, while the borrower was in Chapter 13. "Marcy: Hi, it's us again. Jack: It's us, this is Jack and [...]