H. Jack Miller, Was Speaking About Specially Financing at Crittenden Financing Conference in Miami, Fl September of 2018

Jack attended the Crittenden Financing Conference in Miami, Fl September of 2018 and was there meeting with industry leaders, people speaking about the latest trends, challenges, and opportunities with his peers. They exchanged ideas on ways to help and solve the needs of commercial real estate investors and business owners, Force new alliance and partnerships.

Jack, has been in the lending and real estate investment field for over 30 years and focuses on Preferred Equity, Mezzanine, Equity, Seconds and Subordinated Debt as well as First mortgage, bridge debt, and DIP Financing on Stabilized commercial real estate nationwide.

Crittenden Financing Conference is a place where industry leaders come to learn, meet, and discuss the latest in industry standards.

Private Money Lender – Related posts

JUST CLOSED IN ENGLEWOOD, FLORIDA! Gelt just closed a $235K First Mortgage purchase for a father and son team who operates outside of Florida. The duo wanted to expand [...]

Gelt is pleased to have relocated its offices to 5300 Atlantic Ave, Suite 205, Delray Beach, Fl 33484, We are very excited about this move it will give us the [...]

Gelt Financial just closed a $200K First Mortgage on an owner-occupied retail building in Lubbock, Texas. This borrower reached out to our expert loan originators to close the deal quickly.Gelt [...]

If your bank can't help you, we can. We specialize in mortgages that banks won't do. We use commonsense underwriting and offer flexible terms. Quick approvals and closing. [...]

Gelt Financial, LLC was pleased to provide a $1,800,000.00 non-recourse first mortgage financing to a local non-profit owner of a retail shopping center in Philadelphia. The property is a neighborhood [...]

JUST CLOSED IN BROOKLYN, NEW YORK! Gelt Financial is proud to announce we just closed a $450K First Mortgage on a mixed-use property in Brooklyn, NY. The building was [...]

DEAL CLOSED IN PHILADELPHIA, PENNSYLVANIA! Gelt Financial just closed on a $250K First Mortgage on a retail property in Philadelphia, PA. A borrower called up Gelt and needed a [...]

Gelt Financial has closed a First Mortgage Refinance on a convenience store in Charleston, SC. The property has been owned by a successful operator and they needed to refinance out [...]

Gelt Financial was recently featured in BadCredit.org's article, "Private Lending That Produces Money-Making Wins," highlighting our commitment to delivering swift and reliable financing solutions. In the article, H. Jack [...]

Gelt Financial president H. Jack Miller was recently featured as a real estate expert in the Benzinga article "How Many Months of Bank Statements for a Mortgage Are Needed?" [...]

Gelt Financial Announces Funding of $200,000.00 Office Building in Ohio Gelt Financial, a leading commercial real estate direct lender, today announced the closing of a $200,000 first purchase money [...]

Gelt Financial just closed a $150K low-leverage cash out refinance on a renovated condo unit in Naples, Florida. The borrower inherited the unit, completed improvements, and is preparing to [...]

You are debating receiving your real estate loans from either a bank or a private lender. There’s been a lot of talks lately about private lenders like us here [...]

H. Jack Miller recently said how proud he was of the entire Gelt Financial, LLC team for their hard work. We are lucky to have a team of very [...]

Gelt Financial president H. Jack Miller was recently featured as a real estate expert in the feature “This Private Commercial Real Estate Lender Cuts Through the Clutter To Produce [...]

JUST CLOSED IN NEW YORK CITY, NEW YORK! Gelt Financial is proud to announce we just closed a $500K second mortgage on a 40+ unit apartment building in New [...]

Debtor-in-possession financing, commonly referred to as DIP financing, is a type of financing central to companies in bankruptcy, specifically those who have filed for Chapter 11 bankruptcy protection within [...]

Gelt Financial is a leading provider of DIP loans, also known as debtor-in-possession loans. We offer DIP loans between $100,000 and $3,000,000 to help businesses continue operations and achieve financial stability [...]

Loan amounts $50,000,00 and above Commercial Properties or Investment Real Estate Commonsense Underwriting- Deal with decision-makers Customized terms to meet the borrower’s needs (we can be flexible) Purchase, refinance, storied [...]

Gelt Financial president H. Jack Miller was recently featured as a real estate expert in the Bankrate article "What Is A Private Mortgage Lender?" What Is A Private Mortgage [...]

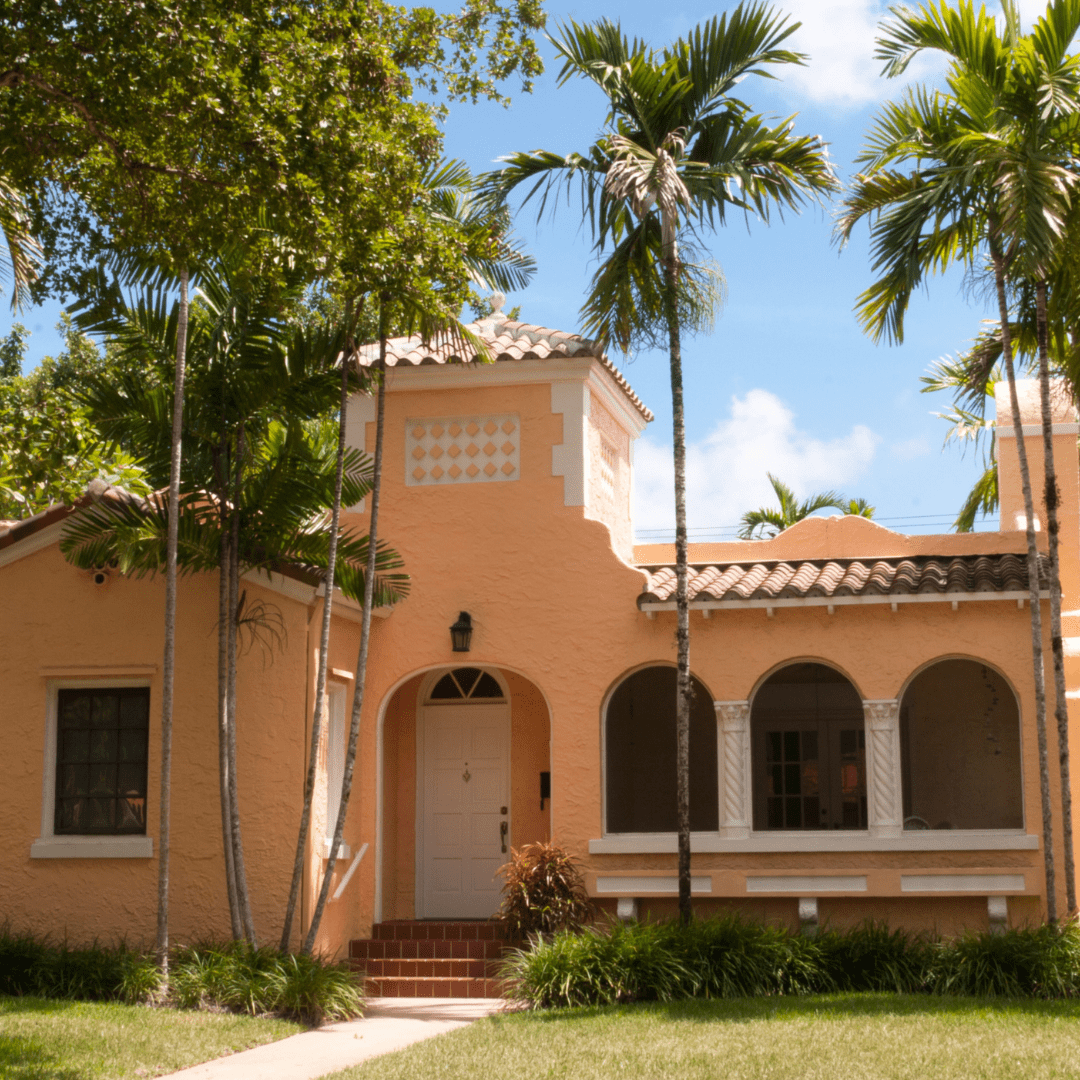

Gelt Financial, was pleased to provide 100% of the financing to a new investor who found a great deal on a single-family property in Coral Gables, Florida, in need of [...]

There’s been a trend in real estate, and it has been in how buyers and moguls finance their investments. There is an increasing amount [...]

Gelt Financial, LLC is pleased to sponsor and support SafeTALK a three-hour suicide alertness and prevention training, developed by Livingworks, which is an innovative workshop that provides participants with tools, [...]

If you own a commercial or investment property and want to borrow less than $150,000.00, you have limited choices. Most go to costly merchant cash advance loans that charge 60% [...]

Everyone has challenges at some point or another in their life; each of our challenges is different, but in today's times, a lot of people are falling behind on their mortgages [...]

In C Store Commercial Mortgage Closed, Atlanta Georgia it discusses about a commercial mortgage deal for a convenience store (c-store) located near Atlanta, Georgia. It features the c-store owned by a [...]

Borrower tip if you own and LLC and are borrowing money. Remember, when your bank says NO, we say YES! Jack: Hey Jack and Marcy at Gelt Financial. Marcy: Hi! How’s [...]

Gelt was pleased to provide the financing to purchase of a Gas Station- C-Store for the manager who purchased the property and business. "Jack: This is Jack and Marcy at Gelt [...]

Why do Professional athletes come to Gelt Financial to borrow money? We dive into it.....

In some situations, Gelt Financial does not require a credit report on residential investment property financing and small commercial Mortgage Financing. Gelt has been helping commercial real estate and investment borrowers [...]

Gelt Financial closes a purchase of a Gas station/ C store in Ohio. "Jack: This is Jack, and Marcy, new socially distanced closing, a gas station in Ohio—Steubenville. I've actually been [...]

Marcy and Jack talk about the eviction moratorium, non paying tenants and borrowing money in today's times. "Jack: Okay, we're live, Marcy. Marcy: All right, we're live. Jack: So let's continue [...]

Gelt Financial closes a refinance on a new construction investment property in Texas. "Jack: This is Jack, this is Marcy at Gelt Financial. We just closed the loan in Manville, Texas, [...]

Gelt just closed on a Debtor in Possession for a nonprofit in Chapter 11 Bankruptcy in Boca Raton, Florida. Hear how it all went down from our expert team! "Marcy: Hi, [...]

Gelt has been helping commercial real estate and investment borrowers since 1989. When your bank says NO, we say YES! "Marcy: Hi, it's Marcy and Jack. Jack: Hey, we're Gelt Financial, [...]

Marcy and Jack talk a little bit about the increasing interest rate environment and what it means for commercial mortgage brokers and borrowers, and how to take advantage of it. "Marcy: [...]

Gelt just closed on a Bridge to Agency short term mortgage solution on Multi Family in Chicago, we were called to private quick financing when it was clear the the permeant [...]

Gelt is excited to provide first mortgage financing for an owner of a business who purchased a home for his employee's to live in. The buyer owned several restaurant business with [...]

The video titled "Pro Guide To Commercial Mortgage Rates with Some Key Factors" by Gelt Financial, LLC discusses the factors involved in pricing a loan in the private lending space. It [...]

Gelt Financial, LLC is pleased to announce and start to offer a second mortgage program on some income producing properties where we are offering a first mortgage on of 5% of [...]

Jack Miller and Marcy talk about a Mezzanine loan that just closed on a new state home in the North Shore of Long Island for a real estate investor. Mortgage broker [...]

Jack Miller gives a little background on what a Loan Loss reserve or an Allowance for a loan loss reserve is in lending. "Hi, this is Jack Miller. I want to [...]

Jack, discusses his experience in providing fix and flip and rehab loans for real estate investors. He shares a story about a challenging time during a market crash in 1991 when [...]

Jack Miller and Marcy talk a little about marketing basics for commercial mortgage brokers.

Gelt Financial closes a cash out, mixed use, no income verification mortgage in Indianapolis, IN. "Marcy: Hi. Jack: Hi, this is Jack and Marcy at Gelt. Marcy: How are you? Jack: [...]

Gelt Financial is lending and busy, while the secondary market is almost shut down and a lot of other lenders are not lending. We are busy providing commercial and investment mortgages [...]

Jack Miller goes into detail on why real estate investing is the best inflation hedge and investment. He goes over it step by step. "Hello, this is Jack Miller. I hope [...]

Foreclosure Bailouts: Blanket Loan on 2 Mixed-Use Properties in New Jersey — Property-Only Qualification. Gelt Financial. No personal income, no credit, no appraisal. Same-day approval and fast closing. [...]