Closed: $240K Cash-Out Refinance for Two Homes

Just Closed! We just funded a $240K cash-out refinance for two single-family homes in Marmora and Westville, New Jersey!

This deal was a blanket mortgage with a 43% LTV — a solid, low-leverage, collateral-based loan. No income verification, no appraisal, and even with low credit scores, we made it happen.

The borrower plans to do some light rehab and sell — another win for a real estate investor who knows how to make deals work. When your bank says NO, we say YES!

About Gelt Financial

Gelt Financial is a non-bank commercial real estate lender. We closed more than 10,000 loans totaling over $1 billion since 1989. Gelt focuses on providing debt to non-bank borrowers on all types of commercial real estate, including but not limited to multifamily, office, retail, warehouse, industrial, self-storage, and mixed-use.

For more info on how Gelt can help you with an investment property or on any of our other various products and services, look at what President Jack Miller does on Gelt’s YouTube channel, and for more info on our completed deals, check our Deals Done.

Private Money Lender – Related posts

Another successful deal was closed by Gelt Financial! We’re excited to announce the closing of a $300K cash-out refinance for a medical office in Baton Rouge, LA. This property, [...]

About 18 months ago we received a referral from a workout attorney, he had a client who owned a multi-location small business. Their current lender a local bank had [...]

JUST CLOSED! Gelt Financial is thrilled to announce the closing of a $500K Cash-Out Refinance for an owner-occupied office condominium in Orlando, FL. With a 41% LTV, this non-recourse [...]

JUST CLOSED IN NEW JERSEY! Gelt Financial just closed an $800K First Mortgage on a cannabis dispensary in New Jersey. We provided cash-out refinancing to fund the borrower's rehab [...]

Jack Miller of Gelt Financial, LLC announces its “Better than Bank Commercial Mortgages without the aggravation new loan programs” Gelt recognizes that commercial real estate owners and investors are increasingly [...]

Gelt Financial is pleased to announce we just closed a $4.3MM First Mortgage on a NNN Portfolio. The 1031 transaction included three properties in Chattanooga, TN, Macon, GA and [...]

TL;DR: What Insurance Do I Need for a Hard Money Loan? • Property insurance (hazard): Covers the physical structure against fire, wind, theft, and damage • Liability coverage: Protects [...]

Chicago Retail Mortgage Loan: Gelt Financial has provided a First Mortgage loan on a 15,000 SF former Aldi Supermarket in Chicago, IL This loan was brought to Gelt by a [...]

Gelt Financial just closed a $280K Mortgage for a daycare property located in the heart of Philadelphia, PA. Our dedicated team closed the deal in less than 10 days. [...]

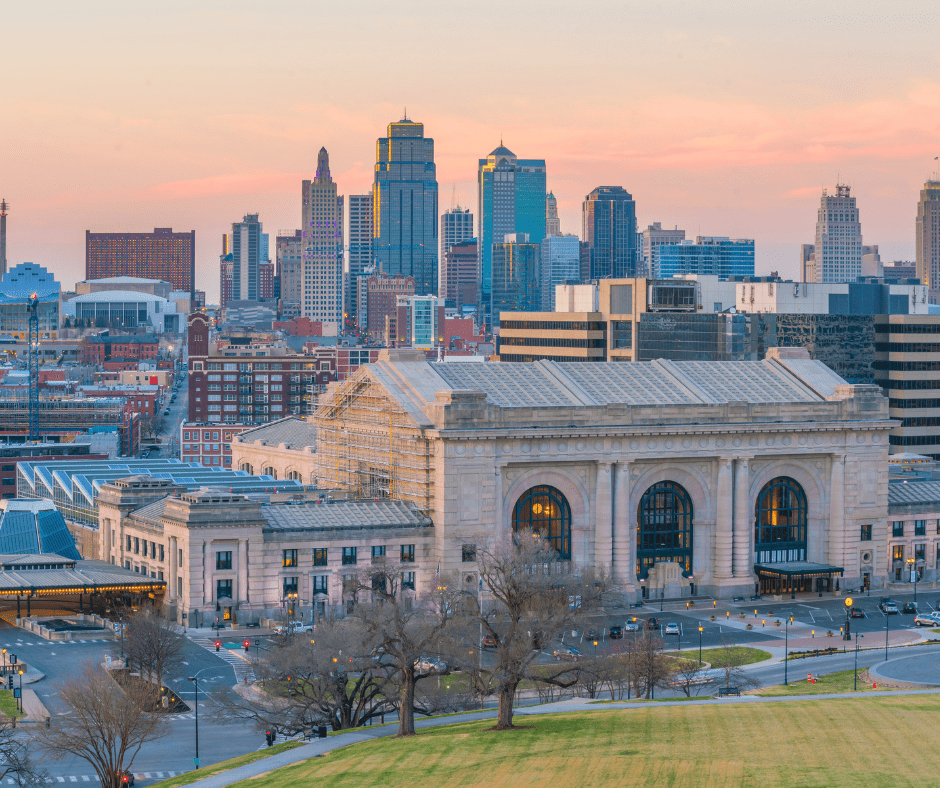

Gelt Financial is thrilled to announce the successful closing of a $200K deal on a Retail/Warehouse Portfolio in Kansas City. We are proud to have provided the financing for [...]

Cash-out Refinance, No Income verification, Out of country borrower, partial recourse, Property had city violations on it that need to be corrected. They tried their bank and when their bank [...]

A closed first mortgage in Atlantic City, New Jersey, Mixed-use, no income verification mortgage. Self-employed business owner. When your bank says No, we say Yes. Contact us on 561-221-0900 or [...]

Gelt Financial has closed a First Mortgage Refinance on a convenience store in Charleston, SC. The property has been owned by a successful operator and they needed to refinance out [...]

Gelt Financial providing private lending for office buildings nationwide between $100,000 and $5,000,000 Gelt Financial is a leading provider of private lending for office buildings nationwide. We offer loans between $100,000 [...]

Gelt Financial president H. Jack Miller was recently featured as a real estate expert in the feature “This Private Commercial Real Estate Lender Cuts Through the Clutter To Produce [...]

Gelt Financial just funded a $450,000 refinance loan for a single-family home in beautiful Charleston, SC. The borrower plans to renovate the property and turn it into a rental. With a 64% LTV and no income verification required, this deal highlights the flexibility we bring to real estate investors. Looking for creative financing? We can help. When your bank says NO, we say YES! About Gelt Financial Gelt Financial is a [...]

Gelt Financial has provided a First Mortgage on a multifamily investment property in Brooklyn, NY. "Gelt is flexible with how we structure deals, giving us a real edge in providing [...]

JUST CLOSED! Gelt Financial is excited to announce the closing of a $1,500,000 loan for a Miami, FL Condominium Association with over 160 units. Built in the 1970s, the [...]

Gelt Financial, LLC was pleased to close on a Blanket Mortgage, two auto-related properties in Ohio for a borrower in Chapter 13.

DEAL CLOSED IN CHICAGO, ILLINOIS! Gelt Financial just closed on a $900k Bridge-to-Agency Loan in Chicago, IL. This professional investor could not close with traditional financing from Fannie/Freddie due [...]

Some Reasons To Deal with Gelt Financial For Your Commercial or Real Estate Investment Mortgage We have a long history and were founded on February 1, 1989 Experience: We [...]

Gelt Financial is excited to announce we just closed on a $225k first mortgage on a condo in Miami, FL. Talk about a breathtaking property! Discover more closed commercial [...]

Noah Miller, Vice President of Gelt Financial LLC, was featured on Bloomberg Radio with host Matt Miller and Paul Sweeney. Miller discussed the health of the real estate market and [...]

JUST CLOSED IN TOLEDO, OHIO! Gelt Financial is excited to announce the closing of a $1.7MM First Mortgage in Toledo, OH. This stunning 80k square-foot office/retail building was highly [...]

Super Rush Closing to save the day. "Jack: Okay, Michael Kelman, tell everyone exactly what happened. Don't spare anything in the last 10 minutes. Michael: We have a broker who has [...]

Gelt Financial provided a Condominium association with the financing they needed, after being turned down by banks for capital improvements in order to comply with the new laws in Florida. [...]

Gelt Financial closes a refinance on investment condominium in Jersey City, NJ. "Jack: Hello, this is Jack and Marcy again, here to tell you about a loan. A loan we just [...]

Gelt Financial closes a purchase of a Gas station/ C store in Ohio. "Jack: This is Jack, and Marcy, new socially distanced closing, a gas station in Ohio—Steubenville. I've actually been [...]

Another deal closed! Gelt Financial discusses their recent closed loan on a 400k second mortgage in Tampa, FL. No appraisal, 85% debt. Interest only, short term, six month deal. We focused [...]

Chicago Office Condo Mortgage Closed, No income Verification for owners of Business. "Chicago, Chicago, that title in town, that title in town. I love it. Bet your bottom dollar that you'll [...]

Marcy Berger of Gelt Financial Message to Mortgage Brokers. Call us at | 561-221-0900. Gelt has been helping commercial real estate and investment borrowers since 1989. When your bank says NO, [...]

A Mortgage broker emailed us and asked us about marketing to banks for turndowns. Lots of opportunities out there for those willing to work at it. Watch the video to learn [...]

Jack Miller gives a little explanation on why lenders charge prepayment penalties, the different types of them and some tips on how to analyze and negotiate the best one for your [...]

Jack Miller gives a explanation on what an exit fee is. "Hello, this is Jack Miller at Gelt Financial. Hope you're having a fantastic day. We get a question a lot, and [...]

Gelt Financial is lending and busy, while the secondary market is almost shut down and a lot of other lenders are not lending. We are busy providing commercial and investment mortgages [...]

Jack discusses how "fix and flip”, and rehab loans works. He highlights his extensive experience, having done thousands of loans for investors. Gelt Financial offers loans up to 65% of the [...]

We are here to help our borrowers through the financing process. When one of them was short $150,000.00 on a mixed-use property, we lent them the additional money. One of the many [...]

Marcy Berger is Retiring from Gelt Financial. She will be greatly missed.

In our latest YouTube video, Michael explains what a mortgage broker or borrower should send to Gelt Financial—or any lender—for a deal to be reviewed for approval. When your bank says [...]

Jack Miller gives his opinion on if its wise to pay down a home mortgages faster then the term calls for? Its all comes down to the person you are. "Hi, [...]

Jack and Marcy talk about a 50k first mortgage Gelt Financial just closed on a Multi family property, There is almost no where for borrowers who want to borrower small amount [...]

We completed a mixed-use property first mortgage refinance for a non-U.S. resident who is a foreign national and lives and works overseas. He has no credit or no personal income. We did [...]

Jack Miller talks about 4 easy and tried and true ways to get 100% financing on commercial and or investment real estate. "Hi, this is Jack Miller from Gelt Financial. I [...]

Gelt Financial closes a refinance on a new construction investment property in Texas. "Jack: This is Jack, this is Marcy at Gelt Financial. We just closed the loan in Manville, Texas, [...]

We just provided an experienced real estate investor 100% financing on a new purchase by talking an additional property as collateral, our mortgages were on two single-family properties in two cities, Orlando [...]

Gelt Financial provided a new first mortgage foreclosure bailout loan on a mixed use property ion Brooklyn, NY. The mortgage broker called us and we approved and close the loan without [...]

Jack Miller and Marcy closed a very quick closing in Florida for a real estate investor on a single family investment property."Marcy: Hi Jack.Jack: Hey Marcy, how you doing? Our first video [...]

Gelt Financial provided a purchase mortgage first mortgage on Mixed Use Property in Brooklyn New York. No income qualification When your bank says No, we say Yes. "Marcy: Hi, all right. [...]