Closed: $300K cash-out refi for a Medical Office in Baton Rouge, LA

Another successful deal was closed by Gelt Financial! We’re excited to announce the closing of a $300K cash-out refinance for a medical office in Baton Rouge, LA. This property, featuring multiple rooms, two bathrooms, and a large parking lot, is leased to a long-term tenant.

Our client, a dedicated medical professional and real estate investor who built the property themselves, needed cash to pay off debt. Despite a 590 FICO score, we were able to provide financing with a 60% loan-to-value ratio.

At Gelt Financial, we specialize in hassle-free financing solutions tailored to your needs. When your bank says NO, we say YES!

About Gelt Financial

Gelt Financial is a non-bank commercial real estate lender. We closed more than 10,000 loans totaling over $1 billion since 1989. Gelt focuses on providing debt to non-bank borrowers on all types of commercial real estate, including but not limited to multifamily, office, retail, warehouse, industrial, self-storage, and mixed-use.

For more info on how Gelt can help you with an investment property or on any of our other various products and services, look at what President Jack Miller does on Gelt’s YouTube channel, and for more info on our completed deals, check our Deals Done.

Private Money Lender – Related posts

JUST CLOSED! Gelt Financial is pleased to announce we just closed a $65k loan for a single-family investment property in Augusta, Georgia. With our streamlined process, there was no [...]

JUST CLOSED IN FORT LAUDERDALE, FLORIDA! Gelt Financial is excited to announce we just closed a $1.4MM non-performing note purchase on an office building in Fort Lauderdale, FL. The [...]

JUST CLOSED IN MIAMI, FLORIDA! Gelt Financial is happy to announce we just closed on a $250,000 Land Loan in Miami, FL. This piece of land is zoned for [...]

Gelt Financial just closed a $400K refinance loan for a medical office building in Odessa, TX. The property sits in a fantastic location with excellent parking, and the borrower came to us with strong business financials. With a low 49% LTV, this deal was a great fit for our flexible lending approach. When traditional lenders say NO, we say YES! About Gelt Financial Gelt Financial is a non-bank commercial [...]

We just provided an experienced real estate investor 100% financing on a new purchase by talking an additional property as collateral, our mortgages were on two single-family properties in [...]

Chicago Retail Mortgage Loan: Gelt Financial has provided a First Mortgage loan on a 15,000 SF former Aldi Supermarket in Chicago, IL This loan was brought to Gelt by a [...]

JUST CLOSED IN MANHATTAN, NEW YORK! Gelt Financial is proud to announce that we just closed a $200K First Mortgage on a stunning condo on Park Avenue in Manhattan. [...]

Gelt Financial is excited to announce we just closed on a $225k first mortgage on a condo in Miami, FL. Talk about a breathtaking property! Discover more closed commercial [...]

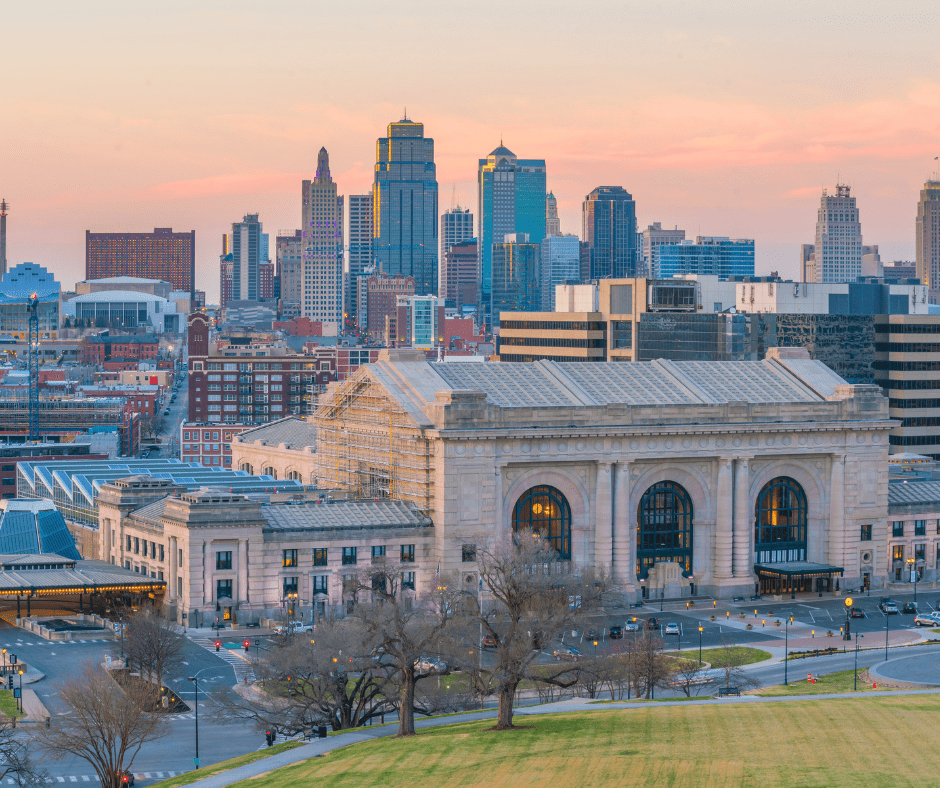

Deal Closed! Gelt Financial helped secure a $60K First Mortgage on an Office Building in the bustling and vibrant city of Kansas City, MO! At Gelt Financial, we take [...]

Chicago suburbs, the mixed-use property being purchased by an attorney at a discount price. We provided the first mortgage under our no income qualification program. Gelt Financial, is a private [...]

Gelt Financial just funded a $450,000 refinance loan for a single-family home in beautiful Charleston, SC. The borrower plans to renovate the property and turn it into a rental. With a 64% LTV and no income verification required, this deal highlights the flexibility we bring to real estate investors. Looking for creative financing? We can help. When your bank says NO, we say YES! About Gelt Financial Gelt Financial is a [...]

JUST CLOSED IN THE HAMPTONS, NEW YORK! Gelt Financial is excited to announce we just closed on a $1.25MM Mezzanine Loan on a stunning property in The Hamptons, NY. [...]

JUST CLOSED! Gelt Financial is proud to have assisted a condo association in Hialeah, FL with securing $200K in financing for essential improvements. The 40-unit condo association needed immediate [...]

We are pleased to provide first Mortgage Bridge financing on a Single tenant Humana Health Care deal in Dayton, OH. The borrower came to us who owed a free standing [...]

Gelt Financial has successfully closed a $400K purchase loan for a beautiful one-bedroom, one-bathroom condominium unit in Miami, FL. This property, valued at $665K, is primed to become a [...]

Gelt Financial is thrilled to announce the successful closing of a $200K deal on a Retail/Warehouse Portfolio in Kansas City. We are proud to have provided the financing for [...]

Miami Preferred Equity MultiFamily: Gelt Financial, a leading commercial real estate lender, announced the closing of a preferred equity investment on a 16-unit Multifamily property in Miami, FL. Gelt [...]

JUST CLOSED IN FORT LAUDERDALE, FLORIDA! Gelt Financial just closed a $600K First Mortgage on a retail building in Fort Lauderdale, FL. The borrower was having trouble finding a [...]

JUST CLOSED IN ATLANTA, GEORGIA! Gelt Financial is excited to announce we just closed a First Mortgage on a gas station in Atlanta, GA. Our repeat borrower is a [...]

JUST CLOSED! Gelt Financial is pleased to announce we just closed a $325K First Mortgage on an Industrial Property in Pueblo, CO. This was structured as a cash-out refinance [...]

A closed first mortgage in Atlantic City, New Jersey, Mixed-use, no income verification mortgage. Self-employed business owner. When your bank says No, we say Yes. Contact us on 561-221-0900 or [...]

CLOSED! 👊 Gelt Financial just closed on a $100k first mortgage on an office building in Greensboro, NC. To learn more about Gelt Financial’s lending capabilities and its advantages to [...]

Rehab Fix and Hold Gelt is pleased to have closed a mortgage to a local real estate investors in Haverstraw, Part of Rockland County, New York. We provided the investor [...]

Gelt Financial just provided a first mortgage cash-out refinance on a commercial property in Des Moine, Iowa. The property was recently converted from a church to multi-unit commercial. In providing [...]

Gelt Financial provides first mortgage financing on an owner occupied business under our no income verification program. No appraisal, no credit and no income verification. "Jack: Hello, this is Jack and [...]

Gelt Financial provided $500,000 as a first mortgage on an office Condominium in Orlando Florida, No appraisal, No income, No Credit, No Recourse financing. fast approval and closing. Gelt has been [...]

Jack Miller and Marcy talk about a fast closing on a mixed use property in New Jersey that a residential mortgage broker brought to us when no one else could close [...]

Gelt Financial just closed two fix and hold JV equity Mortgages, were we provided 100% Financing to our partner.

Jack and Marcy of Gelt Financial are back with another success story. We helped a client in Vineland, New Jersey with a joint venture equity loan and provided 100% of the [...]

Gelt just closed on a Bridge to Agency short term mortgage solution on Multi Family in Chicago, we were called to private quick financing when it was clear the the permeant [...]

The video discusses how a small loan payoff of $65,000 made to an ethnic family who owned a bodega in Atlantic City. Despite not making much profit on the deal, Gelt [...]

Just closed! Gelt Financial successfully secured a private loan for an auto body shop, a new commercial mortgage deal. No appraisal or income verification required. Watch the video to hear how [...]

Construction First Mortgage closed on investment property spec home in Boca Raton, Fl. "Marcy: Hey Jack. Jack: Hey Marcy, let's tell everyone we just closed something. We normally don't do a [...]

Jack Miller talks about what he leaned by making Toast? How good things take time and effort before you see the results. "Hey, this is Jack Miller. I hope you're having [...]

Gelt Financial provides a First Mortgage on a Fire damaged Investment property in Baton Rough, LA.

Jack Miller gives a little explanation on why lenders charge prepayment penalties, the different types of them and some tips on how to analyze and negotiate the best one for your [...]

Gelt Financial provided a new first mortgage foreclosure bailout loan on a mixed use property ion Brooklyn, NY. The mortgage broker called us and we approved and close the loan without [...]

Jack Miller answers the question: can someone be a part-time mortgage loan officer or mortgage commercial broker? "Hi, this is Jack Miller. You know, I want to answer a question that [...]

Jack Miller goes over the Mortgage Brokers' Commissions, Mortgage Broker Fee Income, and more

Marcy Berger of Gelt Financial Message to Mortgage Brokers. Call us at | 561-221-0900. Gelt has been helping commercial real estate and investment borrowers since 1989. When your bank says NO, [...]

In Bridge Mortgage Loan Paid Us Off | Bridge Loans the video discusses a successful payoff of a bridge mortgage loan from Gelt Financial. The borrower owned three properties but had [...]

In the video, Jack explains the secondary mortgage market, where loans are bought and sold as assets. He discusses how loans, including mortgages, can be sold by originators and owners in [...]

Gelt Financial provided a purchase mortgage first mortgage on Mixed Use Property in Brooklyn New York. No income qualification When your bank says No, we say Yes. "Marcy: Hi, all right. [...]

Jack Miller gives a explanation on what an exit fee is. "Hello, this is Jack Miller at Gelt Financial. Hope you're having a fantastic day. We get a question a lot, and [...]

Gelt is excited to provide first mortgage financing for an owner of a business who purchased a home for his employee's to live in. The buyer owned several restaurant business with [...]

Term sheet signed Black Friday, deal ready to close Wednesday. Broker contacted us when bank did not close and needed a very quick close. We did it! "Jack: Hi, Jack and [...]

Gelt Financial loves Chicago! We love to do business in Chicago. When your bank says no, we say YES! #privatelending #commercialrealestate #Chicago "Marcy: hi. Jack: hey, it's Jack and Marcy at Gelt [...]

When a borrower ran short of capital to complete the repairs and their current lender would not lend them more money, Gelt step up and approved a second mortgage. "Jack: Hey, [...]