First Mortgage Rehab Closed Birmingham, Alabama

Gelt is pleased to provide a first mortgage rehab mortgage to an investor in Birmingham, Alabama. We have a very long history of providing rehab fix and flip and fix and hold mortgage financing to real estate investors and have closed on thousands of deals. In this case the borrower ran short on the financing to complete the project. When the real estate investor ran short on the capital to fix up the property Gelt stepped in and provided the real estate investor with the financing to complete the rehab of the property.

Gelt focuses on the deal and property and works with borrowers and investors with credit challenges.

When your bank says No, we say Yes.

Private Money Lender – Related posts

Gelt Financial assisted the owner of a 35 unit apartment building in North Huntingdon, PA in arranging a cash-out refinance using the Freddie Mac Small Balance Loan program. The Borrower [...]

JUST CLOSED IN DOTHAN, ALABAMA! Gelt Financial closed a $600K First Mortgage on a NNN Property in Dothan, AL. A PopShelf, a credit-rated tenant with a corporate guarantee, secured [...]

An experienced investor was able to put under agreement of sale an Industrial building with a large amount of ground at a very good price. The property was lost to [...]

Commercial Mortgage Loan Closed Gelt Financial helped close a deal on a car wash in Lintoia, GA, the owner-operator chose Gelt Financial, LLC. We focus on providing financing to [...]

JUST CLOSED IN BOCA RATON, FLORIDA! Gelt Financial is proud to announce we just closed a $400k single-family construction loan in Boca Raton, FL. A mortgage broker sought a [...]

Just Closed in Shawnee, KS! We just wrapped up a $210K refinance on a single-family rental—and we moved fast. The borrower had low credit, the loan was nearing maturity, [...]

Detroit Cash Out Refinance: Gelt Financial provided a cash out refinance to an experienced real estate investor on a retail strip center in Detroit, MI. Gelt was able to focus [...]

Gelt Financial, LLC was pleased to close on a Blanket Mortgage, two auto-related properties in Ohio for a borrower in Chapter 13.

We are excited to once again step in and help those who banks won’t. In this case, it was owners of a mixed use property in New Jersey which we [...]

Gelt Financial, LLC is pleased to have closed two small multi-family mortgages for a real estate investor who needed the cash out to use on another property.

JUST CLOSED! Gelt Financial is thrilled to announce the closing of a $500K Cash-Out Refinance for an owner-occupied office condominium in Orlando, FL. With a 41% LTV, this non-recourse [...]

CLOSED! 👊 Gelt Financial just closed on a $100k first mortgage on an office building in Greensboro, NC. To learn more about Gelt Financial’s lending capabilities and its advantages to [...]

JUST CLOSED! Gelt Financial is pleased to announce we just closed a $65k loan for a single-family investment property in Augusta, Georgia. With our streamlined process, there was no [...]

Just closed! Another win for an experienced investor. Gelt Financial closed a $300K cash out refinance on a single-family home in Charlotte where the borrower needed funds for light [...]

Another successful deal was closed by Gelt Financial! We’re excited to announce the closing of a $300K cash-out refinance for a medical office in Baton Rouge, LA. This property, [...]

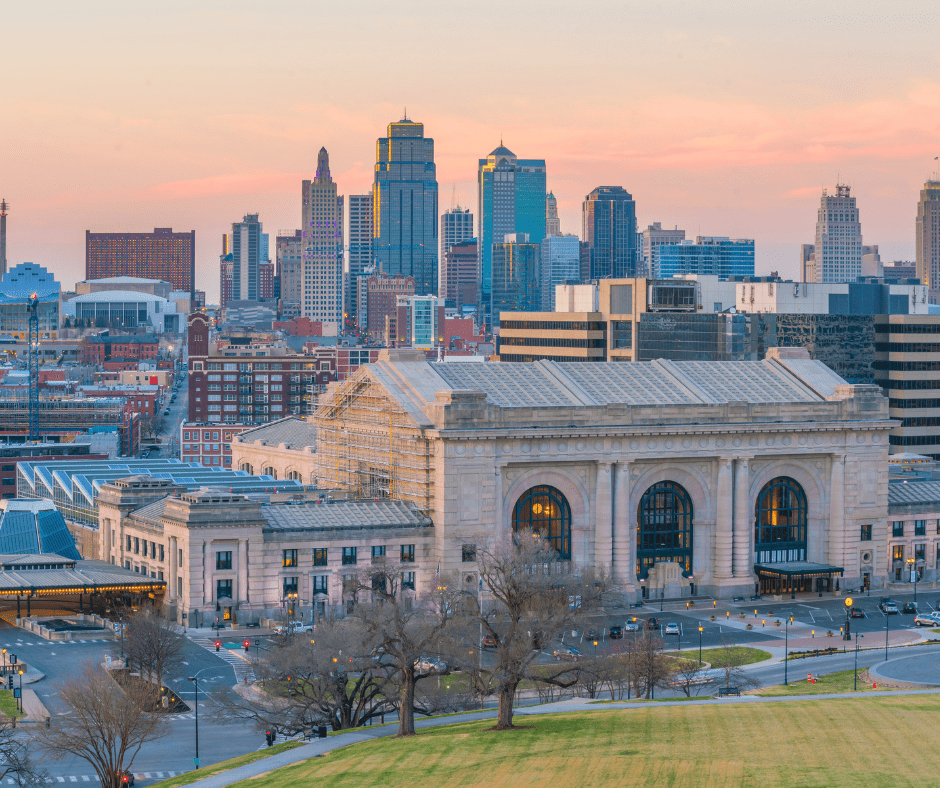

Gelt Financial is thrilled to announce the successful closing of a $200K deal on a Retail/Warehouse Portfolio in Kansas City. We are proud to have provided the financing for [...]

New York Bridge Loan: Gelt Financial Announces Funding of $1.4MM Manufactured Housing Bridge Loan in New York DELRAY BEACH, FL (Nov. 12, 2020) – Gelt Financial, a leading commercial real [...]

Gelt Financial LLC is pleased to have closed on a investment first mortgage single family home in Darian, IL. The Buyer is a real estate investor and purchased the property [...]

Gelt Financial just closed a $125K refinance on a single-family home in Richmond, Virginia. The borrower wanted to do some light rehab before putting the property back on the [...]

DEAL CLOSED IN MIAMI, FLORIDA! Gelt Financial just closed on a $300K First Mortgage on a single-family, investment property in Miami, FL. The non-owner-occupied home was bought vacant and [...]

Deal Closed! Gelt Financial funded a $122K First Mortgage on an investment home in McAllen, Texas. Texas real estate investors: Skip bank delays & unlock profits! Gelt Financial's private [...]

Gelt Financial just closed and funded a first mortgage on a 7-unit condo Portfolio in Orlando, Florida. The buyer was a first-time investor who could not obtain financing through a [...]

Deal done! Gelt Financial just funded a $240K sale leaseback for a single-family home in Port Charlotte, FL. No appraisal. No income verification. Super-fast closing. Flexible documentation. This new [...]

JUST CLOSED IN WASHINGTON, D.C.! Gelt Financial just closed a $480K First Mortgage on a daycare center in Washington, D.C. metro area. This deal closed in just two weeks. [...]

Jack Miller gives his opinion on leaving your job and becoming a full time real estate investor. What has he seen over the years: "How you doing? This is Jack Miller. [...]

Paul talks about a first mortage Gelt provided for a Jack in the Box in Texas. A CRE investor secured this deal with a credit tenant, NNN lease, and 1031 financing [...]

Marcy and Jack talk a little bit about the increasing interest rate environment and what it means for commercial mortgage brokers and borrowers, and how to take advantage of it. "Marcy: [...]

Jack Miller talks about surviving a down term. How he survived numerous downturns and reinvested the company. What he learned along the way. "Well, this is Jack Miller. I hope this [...]

Jack Miller gives some tips for mortgage brokers. Gelt has been helping commercial real estate and investment borrowers since 1989. When your bank says NO, we say YES! "Hey, hope you're [...]

Gelt Financial just closed two fix and hold JV equity Mortgages, were we provided 100% Financing to our partner. Gelt has been helping commercial real estate and investment borrowers since 1989. [...]

Gelt Financial provided a new first mortgage foreclosure bailout loan on a mixed use property ion Brooklyn, NY. The mortgage broker called us and we approved and close the loan without [...]

Gelt Financial loves providing Real Estate Investors and Small Business owners the small balance mortgage financing they need. Gelt has been helping commercial real estate and investment borrowers since 1989. When [...]

The video titled "Pro Guide To Commercial Mortgage Rates with Some Key Factors" by Gelt Financial, LLC discusses the factors involved in pricing a loan in the private lending space. It [...]

In this video, H. Jack Miller shares common mistakes he has seen people make in real estate investing, especially with fix-and-flip projects. To succeed, you need to excel in three key [...]

Gelt Financial is lending and busy, while the secondary market is almost shut down and a lot of other lenders are not lending. We are busy providing commercial and investment mortgages [...]

Gelt Financial provided a Professional real estate Investors a first mortgage to payoff their existing debt and fix up a 5 unit property in Lake Worth Florida. "Jack: I love working [...]

Mobile Home Park closes, in Long Island, NY Gelt has been helping commercial real estate and investment borrowers since 1989. When your bank says NO, we say YES! "Jack: This is [...]

Jack Miller goes over the Mortgage Brokers' Commissions, Mortgage Broker Fee Income, and more

Marcy and Jack at Gelt Financial, LLC, nonbank commercial portfolio lenders, talk about the best way for a mortgage broker to submit and close a deal. Gelt offers financing to real estate [...]

Jack and Marcy talk and debunk 5 common myths in hard money and private mortgage. Maybe people would be surprised at how useful hard money lenders are to real estate investors. [...]

Everyone has challenges at some point or another in their life; each of our challenges is different, but in today's times, a lot of people are falling behind on their mortgages [...]

Jack and Marcy go into details and talk about Whats needed to have a 4 day closing on a investment or commercial mortgage. It happens all of the time, but all [...]

In the video, Jack explains the concept of value add in commercial real estate. Value add refers to purchasing a property and making improvements or changes to increase its value. He [...]

Gelt Financial provided $500,000 as a first mortgage on an office Condominium in Orlando Florida, No appraisal, No income, No Credit, No Recourse financing. fast approval and closing. Gelt has been [...]

In the video, Jack discusses JV equity in real estate investment, where partners provide the down payment and others find and manage the property. Gelt Financial offers JV equity to investors [...]

In Bridge Loans by Gelt Financial | Commercial Bridge Loans - Explained the video discusses bridge financing, which is a short-term loan used for two purposes: to make money, such as [...]

Closed First Mortgage on a Restaurant Bar in Philadelphia. Gelt has been helping commercial real estate and investment borrowers since 1989. When your bank says NO, we say YES! "Jack: Hey, [...]

Jack Miller gives a little background on what a Loan Loss reserve or an Allowance for a loan loss reserve is in lending. "Hi, this is Jack Miller. I want to [...]