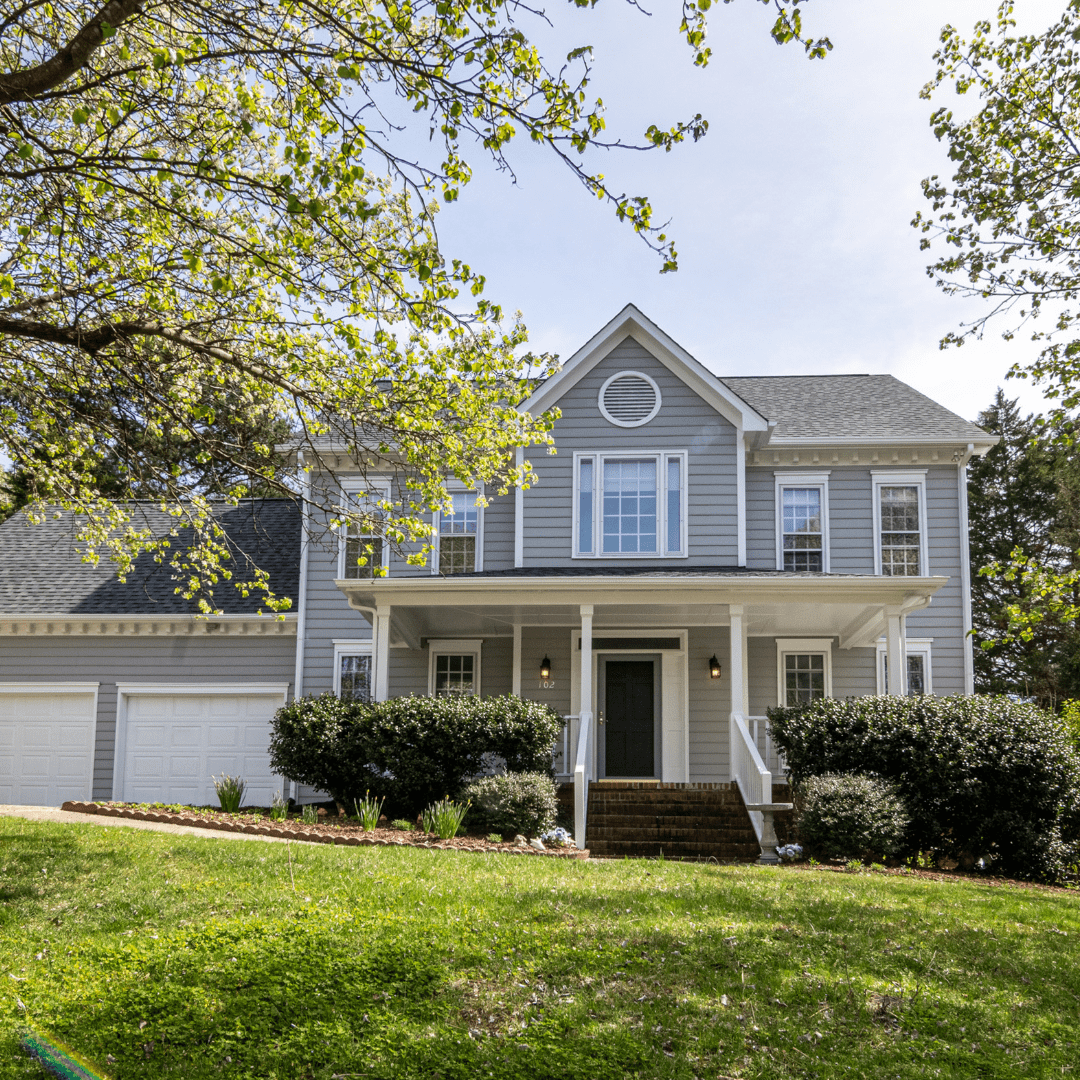

Closed: $135K Cash-Out Refinance Home in Baton Rouge

Just Closed! Gelt Financial just funded a $135K cash-out refinance for a single-family home in Baton Rouge, Louisiana!

This deal came in at a 49% LTV — a strong, low-leverage, collateral-based loan with no income verification and no appraisal required.

The borrower plans to do a light rehab and sell — and we helped make it happen quickly and seamlessly.

Fast, flexible, and investor-focused — that’s the Gelt way. When your bank says NO, we say YES!

About Gelt Financial

Gelt Financial is a non-bank commercial real estate lender. We closed more than 10,000 loans totaling over $1 billion since 1989. Gelt focuses on providing debt to non-bank borrowers on all types of commercial real estate, including but not limited to multifamily, office, retail, warehouse, industrial, self-storage, and mixed-use.

For more info on how Gelt can help you with an investment property or on any of our other various products and services, look at what President Jack Miller does on Gelt’s YouTube channel, and for more info on our completed deals, check our Deals Done.

Private Money Lender – Related posts

Deal Closed! Gelt Financial funded a $122K First Mortgage on an investment home in McAllen, Texas. Texas real estate investors: Skip bank delays & unlock profits! Gelt Financial's private [...]

Gelt Financial has provided a First Mortgage on a multifamily investment property in Brooklyn, NY. "Gelt is flexible with how we structure deals, giving us a real edge in providing [...]

Gelt Financial closed a first mortgage on a mobile home Park in Clio, Michigan. It has 70 units, is not stabilized and we provided financing to clean up, expand and [...]

We are pleased to provide financing for a real estate investor on a cash-out refinance on an investment property in Pennsylvania. The borrower cashed out to pay tax liens as [...]

We're excited to share our latest successful partnership at Gelt Financial! We recently provided $330K in financing for a Condominium Association in South Florida. This capital will be used [...]

Karen Huller of Epic Career tales interviews H. Jack Miller about his 30-year long career and some of the ups and downs that came along with it. How he overcame [...]

Just closed commercial mortgage, Purchase of a owners occupied day care in Florida, credit below 630, 25 year term, no balloon……….. We are always here to help our clients.

DEAL CLOSED IN ATLANTA, GEORGIA IN FOUR BUSINESS DAYS! Gelt Financial closed on a $1.2MM First Mortgage in Atlanta, GA. This office building was in a highly desired location, [...]

JUST CLOSED IN BOCA RATON, FLORIDA! Gelt Financial is proud to announce we just closed a $400k single-family construction loan in Boca Raton, FL. A mortgage broker sought a [...]

Borrower cashed out $230k on a 2-bedroom luxury condominium in the heart of downtown Miami, FL. We paid off his first mortgage and gave them a new mortgage of $603k, [...]

Virginia First Retail Mortgage: Gelt Financial, LLC is pleased to have provided a 1st mortgage and a Line of credit 2nd mortgage on an auto repair and sales center in [...]

DEAL CLOSED IN MIAMI, FLORIDA! Gelt Financial just closed on a $300K First Mortgage on a single-family, investment property in Miami, FL. The non-owner-occupied home was bought vacant and [...]

JUST CLOSED IN BRADENTON, FLORIDA! Gelt Financial closed a $220K First Mortgage on a single-family investment property in Bradenton, FL. Our client needed a fix-and-flip loan with short-term financing [...]

JUST CLOSED IN CHATTANOOGA, TENNESSEE + MACON, GEORGIA + DANVILLE, ILLINOIS! Gelt Financial is pleased to announce that they recently closed a $4.3MM First Mortgage on a NNN Portfolio [...]

JUST CLOSED IN MIAMI, FLORIDA! We are pleased to announce we just closed a $242,500 First Mortgage on an investment property collateralized by a condo in Brickell, the heart [...]

Who is your lender, is as important as what deal you get... Since 1989. In the past week some examples of how we work with our borrowers. 1. One of [...]

We are pleased to provide first Mortgage Bridge financing on a Single tenant Humana Health Care deal in Dayton, OH. The borrower came to us who owed a free standing [...]

Gelt Financial, LLC is pleased to be back in Scotsman Guide. Gelt and its management have been lending to small commercial property owners and investors since 1989. Gelt offers commercial [...]

DEAL CLOSED IN SANTA FE, NEW MEXICO! Gelt Financial is excited to announce we just closed on a $1MM first mortgage on an office building in Santa Fe, NM. [...]

Gelt Financial is thrilled to announce that we have successfully closed a $230K first mortgage on a car wash purchase in Charleston, SC. This incredible deal was completed in [...]

Detroit Cash Out Refinance: Gelt Financial provided a cash out refinance to an experienced real estate investor on a retail strip center in Detroit, MI. Gelt was able to focus [...]

As the world faces an unpredictable crisis we on the Gelt Financial team are preparing for the worst and hoping and praying for the best. We are reaching out to [...]

Gelt Financial has successfully closed a $400K purchase loan for a beautiful one-bedroom, one-bathroom condominium unit in Miami, FL. This property, valued at $665K, is primed to become a [...]

Gelt Financial just closed a $125K refinance on a single-family home in Richmond, Virginia. The borrower wanted to do some light rehab before putting the property back on the [...]

Real estate investors, DON'T depend on anyone else when doing your background or due diligence for your real estate projects. This can backfire on you or cause complications. "Hey, this is [...]

Jack and Marcy talk and debunk 5 common myths in hard money and private mortgage. Maybe people would be surprised at how useful hard money lenders are to real estate investors. [...]

Gelt Financial is lending and busy, while the secondary market is almost shut down and a lot of other lenders are not lending. We are busy providing commercial and investment mortgages [...]

Jack Miller speaks to mortgage brokers and talks about doing business together and some things to know.

The video explains the definition of Note on Note Financing. It is the practice of buying and selling notes, typically related to mortgages and debts. Investors look for discounts and consider [...]

Michael Kelman goes into detail and lays out the business purposes and commerical mortgage that are in the stick zone of Gelt Financial and how we can get create to meet [...]

Gelt is excited to partner with a local real estate investor. We provided 100% debt and equity in a deal where we purchased an office building and leased it out to [...]

Marcy and Mario talked about 2 recent closings on a Mixed use property and an industrial property that we provided first mortgage debt on. "Marcy: Marcy Mario: Mario Marcy: We're here [...]

What is a Mezzanine loan. Gelt lends up and down the cap stack, debt and Equity. "Marcy: Hi. Jack: Hello, Jack and Marcy, making a socially distanced video on what a [...]

Jack Miller and Marcy Berger talk about Residential Mortgage Originators and brokers getting into commercial Mortgages. How hard or easy is it? What are the differences? What do you need to know? [...]

What is a LTV Loan to Value and how do we calculate it? This is not a cut and dry question. "Marcy: Hey Jack Jack: Hey Marcy, let's talk today about [...]

Gelt Financial closes a refinance on 2 small multi family properties in CT. "Jack: Hello, this is Jack and Marcy at Gelt Financial again, super excited. We're always excited here, but [...]

Gelt Financial closed a 1st mortgage rehab loan in Virginia for a cash out refinance to fix up the property, no appraisal or income verification.

In this video, H. Jack Miller shares common mistakes he has seen people make in real estate investing, especially with fix-and-flip projects. To succeed, you need to excel in three key [...]

In this video, Jack discusses a closed deal in Chesapeake, Virginia. Wherein $220,000 is provided, first mortgage on a mixed-use property to a real estate investor with poor credit. The borrower [...]

We just provided with a experienced investors 4.3 Million bridge Mortgage on 3 credit tenant deals as part of a 1031 Transaction. This borrower will refinance with a bank, but a [...]

Jack Miller talks about what a Break up fee is and why and how it comes into play. "Hi, this is Jack Miller from Gelt Financial. I hope you're having a [...]

Gelt closed another Mobile Home Park Mortgage Closed in Indiana. Remember, when your bank says NO, we say YES! "Jack: Okay, Marcy Berger, we're here. Marcy: We're here. Hi, guess what? [...]

Gelt is excited to provide first mortgage financing for an owner of a business who purchased a home for his employee's to live in. The buyer owned several restaurant business with [...]

In the video, Jack explains the concept of a blanket or cross-collateralization mortgage. It involves combining multiple properties into one mortgage, allowing borrowers to tap into equity in one property to [...]

Term sheet signed Black Friday, deal ready to close Wednesday. Broker contacted us when bank did not close and needed a very quick close. We did it! "Jack: Hi, Jack and [...]

Marcy and Jack talk about the eviction moratorium, non paying tenants and borrowing money in today's times. "Jack: Okay, we're live, Marcy. Marcy: All right, we're live. Jack: So let's continue [...]

Gelt has been helping commercial real estate and investment borrowers since 1989. When your bank says NO, we say YES. "Jack: So, what— a little interview. Marcy: Sure. Jack: A little [...]

What’s needed for a fast and smooth mortage closing at Gelt Financial? And what can cause delays? Go behind the scenes with Jack Miller and Marcy Berger at Gelt Financial to [...]